Stellar 20Y Auction Thanks To Record Stop Through, Record High Directs, Record Low Dealers

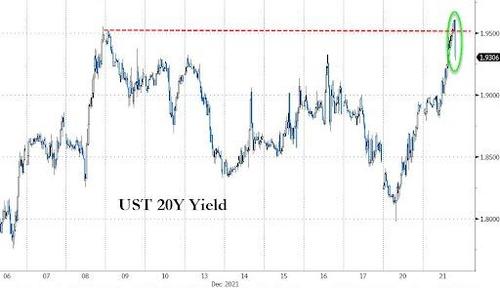

Amid expectations that today's $20BN auction will tail due to holiday-thinned markets, the massive concession derived from the recent steepening in the curve and today's 8bps push higher in 10Y yields, proved to be too tempting, and instead the results to the 1 pm auction were nothing short of stellar, with the auction pricing at 1.942%, well below November's 2.065% (in fact, the lowest since September's 1.795%). This stopped through the When Issued 1.965% by 2.3bps, the biggest on record since the auction launched in May 2020.

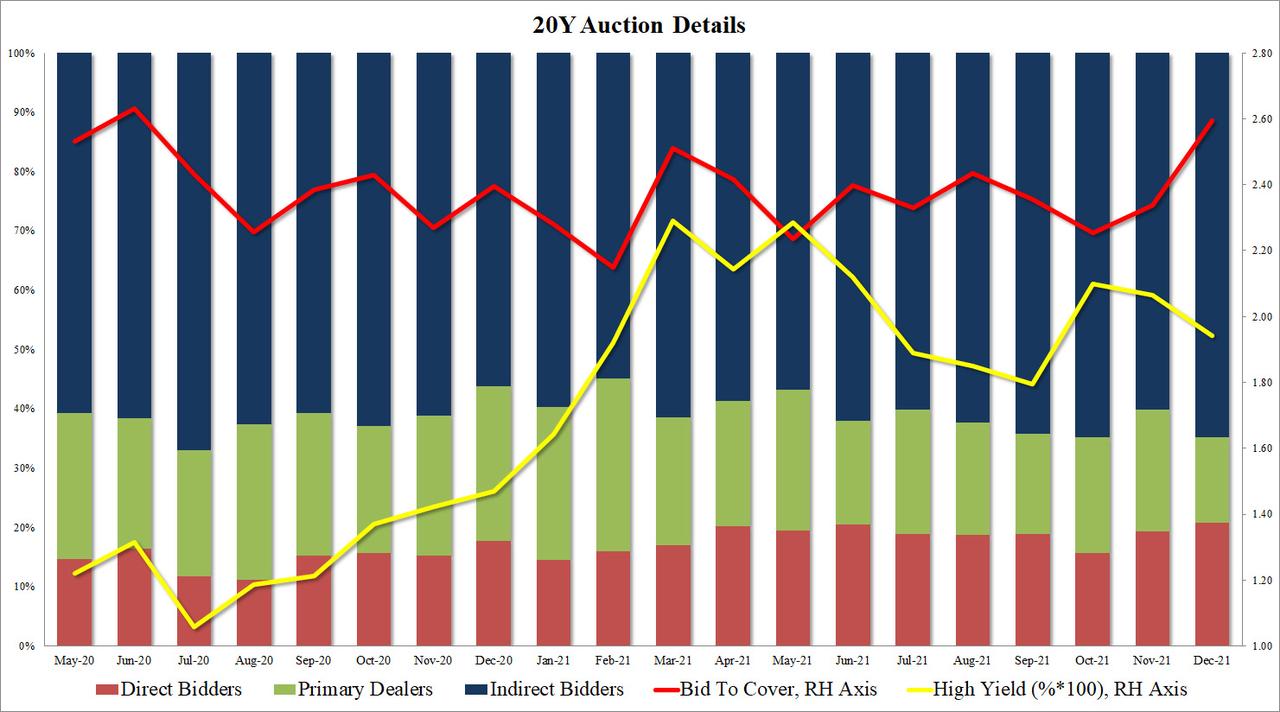

The bid to cover was just as solid, rising to 2.59 from 2.34 last month, this was well above the 2.35 six-auction average, and the second-highest on record with just June of 2020 at 2.63 higher.

The internals were also solid, with Indirects taking down 64.8%, well above both last month's 60.2% and the recent average 62.3%. And with Directs taking down 20.8%, also the highest on record, Dealers were left with just 14.3% - also a record low.

(Click on image to enlarge)

The market was pleasantly surprised, with 10Y yields sliding from session highs just ahead of the auction.

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more