Stalled Real Estate Market In The US, Gold Rush In India

The flow of economic news remains intense, even in the middle of summer.

Markets seem to be focusing their expectations on the Fed's next rate cut. If Jerome Powell fails to act within a reasonable timeframe, he could be criticized for taking too long to cut rates.

The yield on 2-year US Treasuries fell to 4.408%, its lowest level since February 7. The market is clearly anticipating a change in Fed policy. The US 2-year note is breaking through its bearish resistance, signalling that the rebound is well and truly underway:

(Click on image to enlarge)

It's high time rates eased in the United States.

The US real estate market remains stalled.

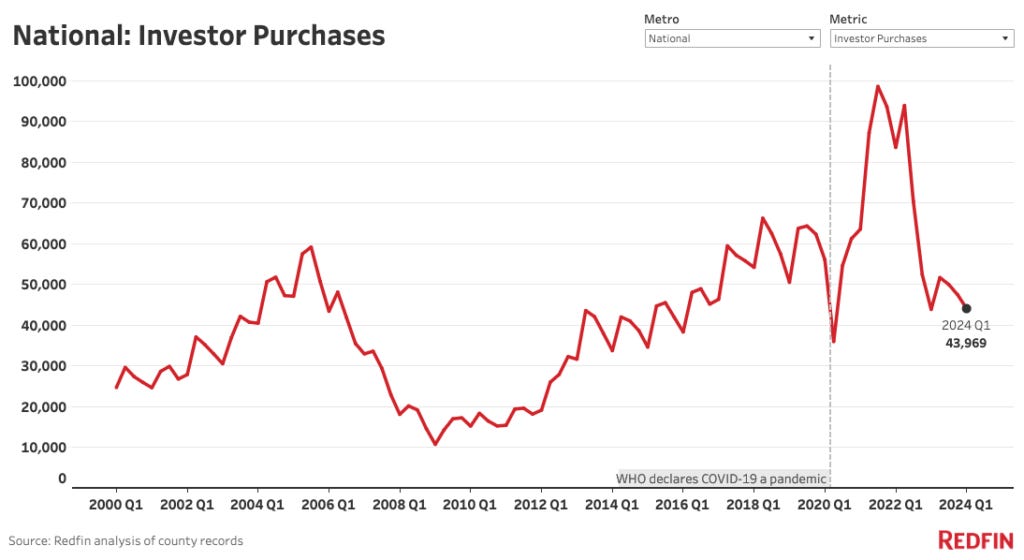

Real estate purchases by investors rose by 0.5% in the first quarter of 2024 compared with the previous year, marking the first increase since mid-2022. California recorded the strongest increases, notably in San Jose and Oakland, with rises of over 20%. Investors benefited greatly, with the average selling price of homes up 55% on their purchase price. In the first quarter, investors acquired 19% of homes sold, the highest share in almost two years.

They are concentrating mainly on single-family homes and high-end homes, but are also buying a record number of affordable homes, accounting for 26% of low-cost home sales.

This rise in sales masks a phenomenon that continues to give cause for concern: transaction volumes are still stuck at too low a level. Real estate turnover is still largely stuck in the United States:

Investor activity is stabilizing after years of marked fluctuations, having doubled during the pandemic in 2021 and then fallen by almost 50% in early 2023. With house prices and rents rising, and mortgage rates stabilizing, investors seem to be returning to the market, albeit very timidly.

Investors prefer single-family homes, which accounted for 68.9% of their purchases in the first quarter, up 3.9% year-on-year. By contrast, purchases of terraced houses, condominiums and multi-family properties fell. This preference can be explained by rising rents and the stability of tenants in single-family homes. Properties that can be rented at higher rates are not selling. Homeowners who bought at much lower rates have no incentive to move, as they would face much higher repayments. The market remains paralyzed until the Fed cuts interest rates. The entire US real estate sector is waiting for a rate cut like the messiah!

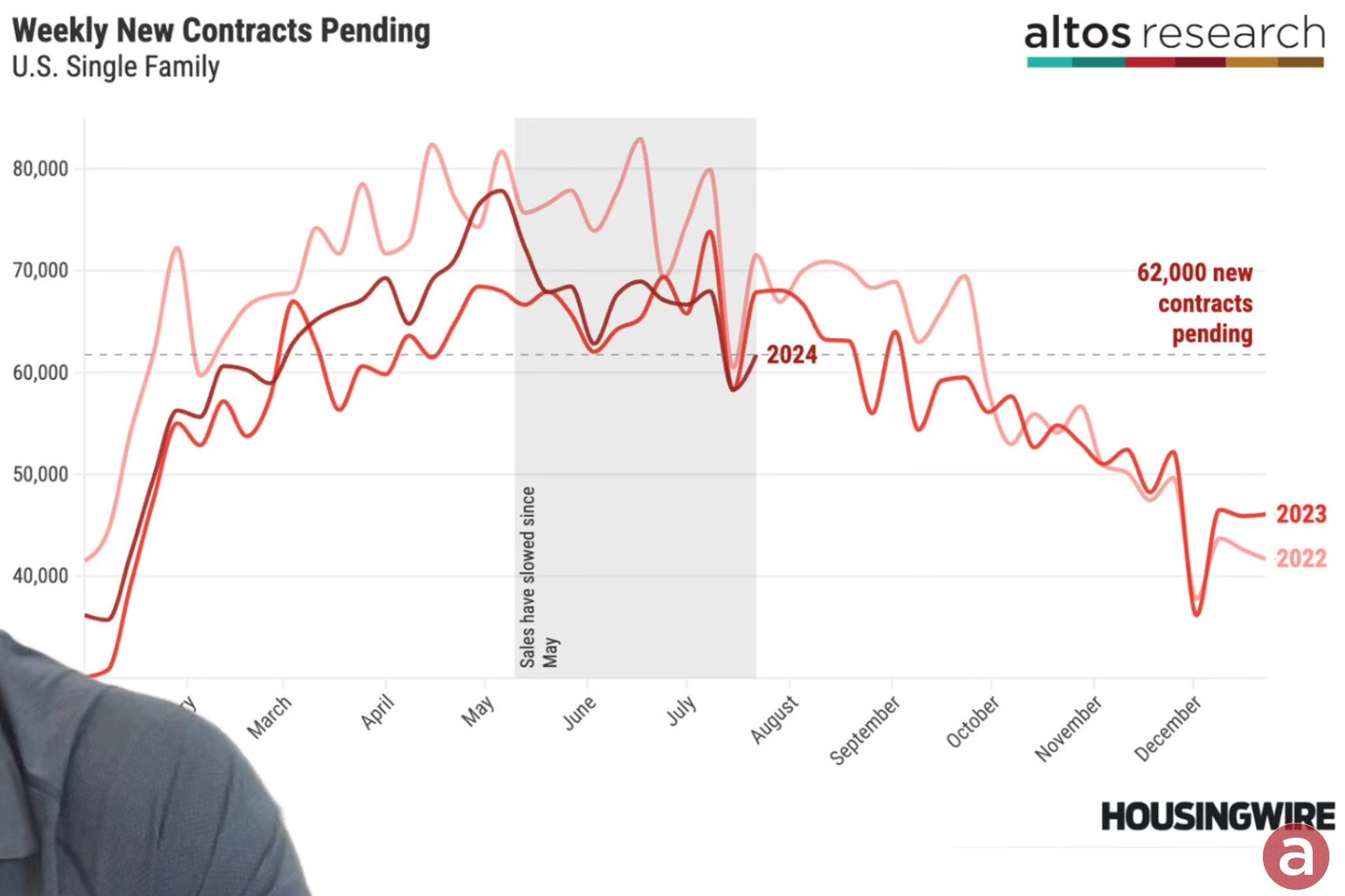

Home sales are at an even lower level than in the last two years at the same time:

Sales in 2023 were already at their lowest level since 1995. If this figure does not recover by the end of the year, we could set a new record low.

This drop in transactions particularly concerns international buyers.

International buyers purchased fewer homes in the U.S. this year, but paid record prices. Between April 2023 and March 2024, they invested $42 billion in residential real estate, down 21.2% on the previous year. Some 54,300 homes were sold to international buyers, the lowest level recorded since the National Association of Realtors (NAR) began tracking these transactions.

The average and median prices of homes purchased by foreigners peaked at $783,300 and $475,000 respectively. The decline in purchases is attributable to the strength of the US dollar, as well as to the same problems encountered by local buyers: high prices and low property availability. International buyers include both non-citizens with permanent residences abroad and those residing in the U.S. for more than six months.

Despite their low overall impact (2% of the market), international buyers exert a significant influence in certain markets, such as Florida and Texas, where they are particularly active. Mexican buyers dominate in Texas, while Florida remains the preferred destination for international buyers overall.

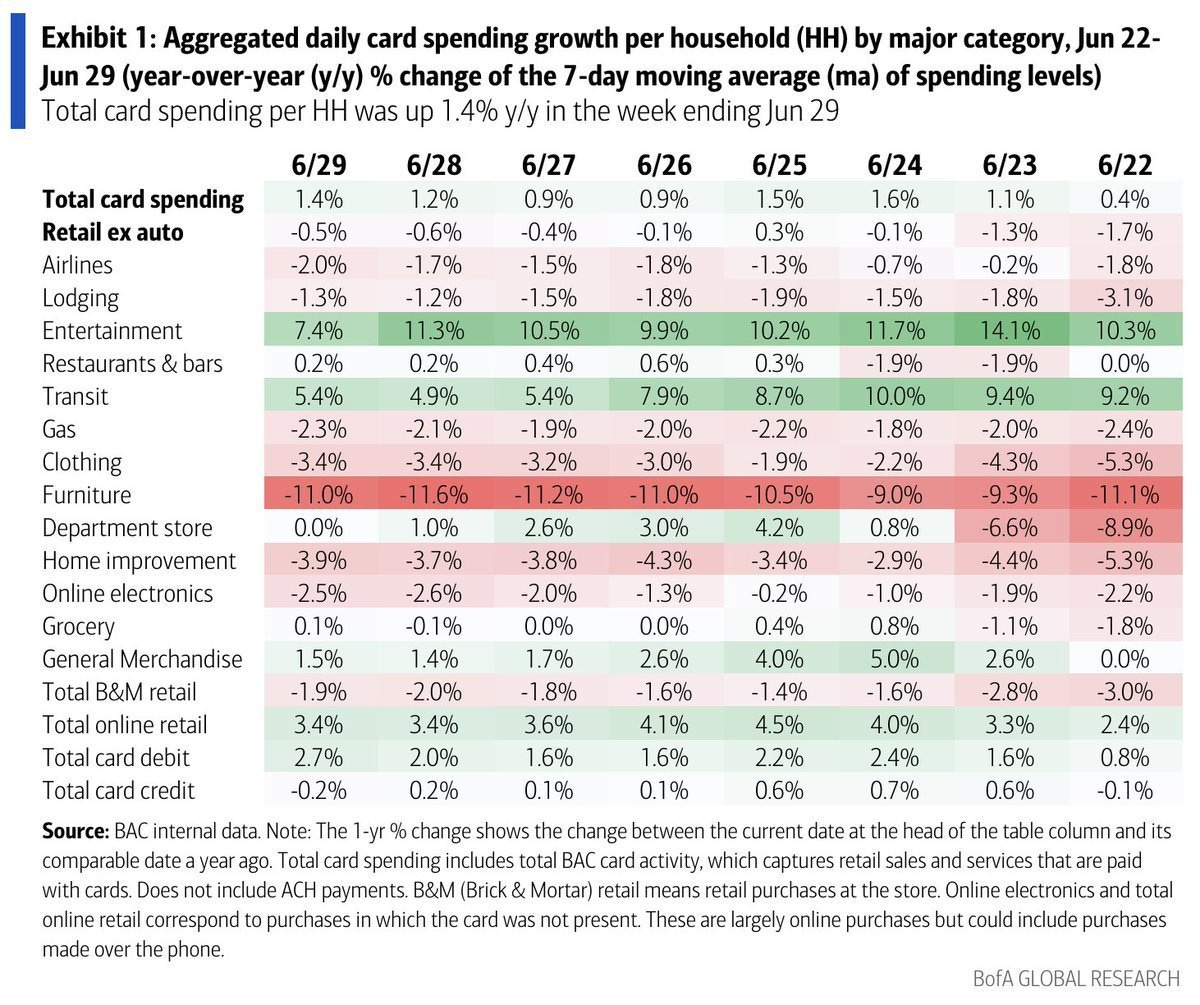

This drop in transactions has a direct impact on sales figures for furniture products.

Fewer transactions mean fewer kitchens, less furniture and fewer interior fittings.

The latest retail sales figures underline the sharp decline in this pillar of American retailing:

The decline in sales in this sector in favor of much more fragile sectors, such as leisure activities, weakens the overall US consumer figures.

The decline in real estate transactions is also having an impact on consumption, as American spending is now much less fundamental and therefore much more sensitive to a marked slowdown.

With the daily increase in the risk of recession in the United States, gold is regaining its role as a safe-haven asset in this context of economic slowdown.

We have seen this in China over the last two quarters: gold has become the preferred investment of Chinese savers in the face of an economic slowdown, the risk of depreciation of the Chinese currency, and the risks associated with the Chinese banking system.

In recent months, these savers have become increasingly keen on physical gold.

This physical demand from the Chinese could now move West, to another high-consumption country of physical gold and silver.

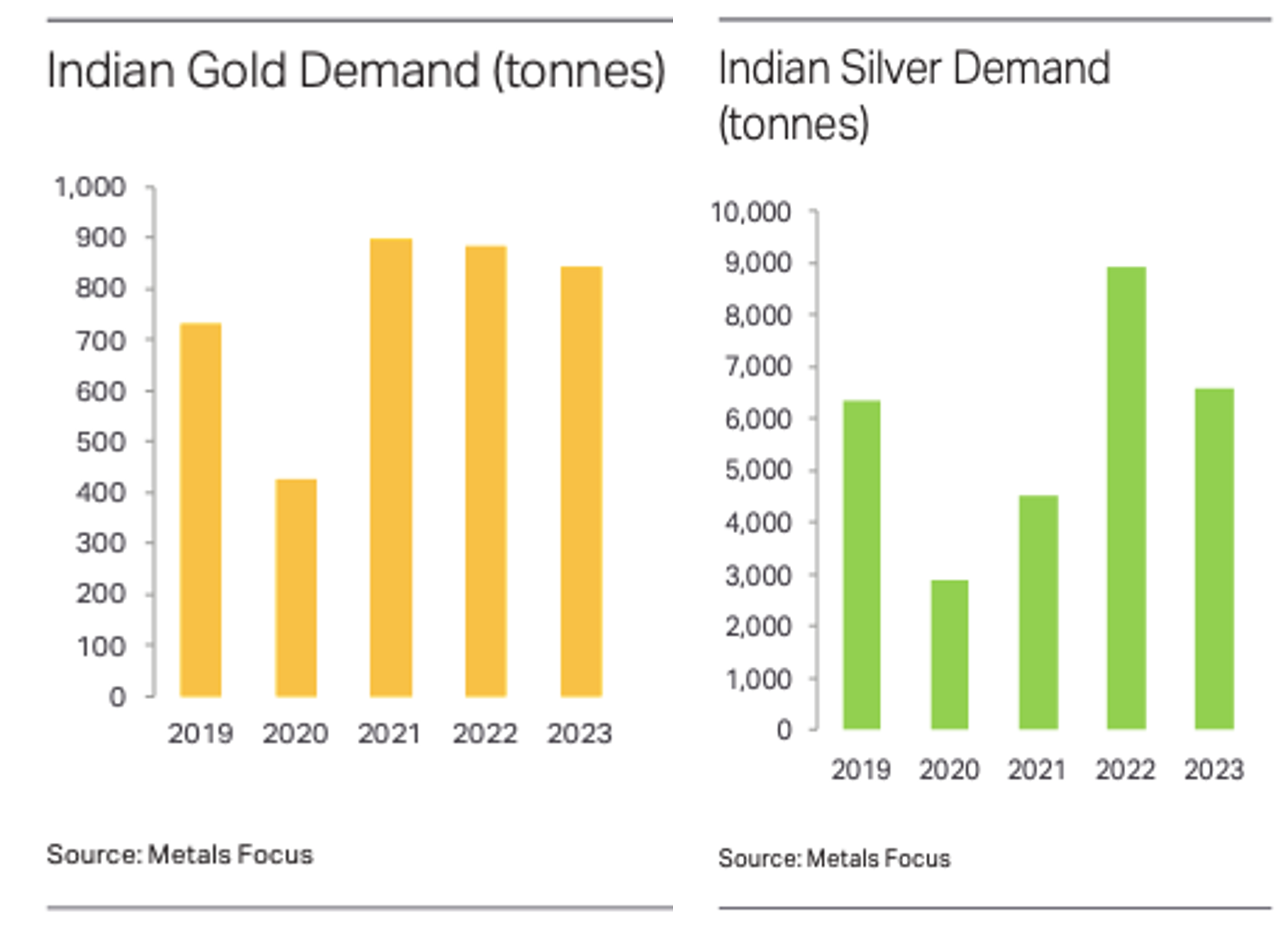

This week, India reduced import duties on gold and silver from 15% to 6%, a move designed to stimulate demand and reduce smuggling. Lower local prices have already led to an increase in demand for jewelry, and shares in jewelry manufacturers climbed as much as 10% after the announcement.

This surprise decision effectively reduces the price of an ounce of gold by almost $300 in India.

Under these conditions, demand for precious metals in India could pick up again after a slowdown in 2023:

This new physical demand is, of course, very bad news for paper gold sellers on the COMEX, who have just significantly increased their naked shorts contracts. For these participants, it will be necessary to print a lot more paper, create even more contracts, and further increase leverage on the futures markets to counter this new surge in demand for physical gold and silver.

More By This Author:

Gold Mining Stocks Suggest Higher Prices for GoldGold, A Safe Haven In The Face Of The Dual Debt/Deficit Problem In France And The US

Investment In The Gold Sector On The Rise Again

Disclosure: GoldBroker.com, all rights reserved.