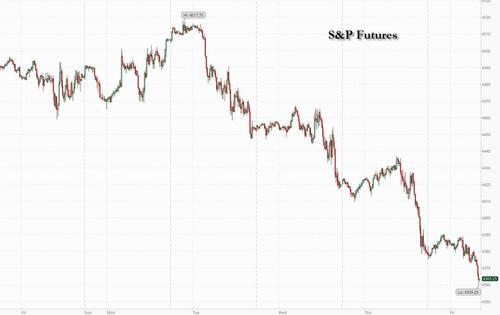

SPX Futures Decline

(Click on image to enlarge)

SPX futures declined to a morning low of 4345.70 and are hovering near their lows. The nearest known support is the Minor Wave 4 low at 4335.00. Should it bounce there it may set up a waterfall decline to 4060.00 next week.

Today’s op-ex shows Maximum investor Pain is at 4450.00 with over 30,000 puts and 30,000 calls. There are walls of puts at 4300 and 4350 that may be defended today. If so, look for a bounce to 4400.00 or higher.

ZeroHedge reports, “After another very weak session in the US which saw the S&P500 and Nasdaq close lower by -1.2% and -1.1% respectively, with the S&P dropping below 4,400 for the first time since June, today’s $2.2 trillion option expiration session has started on the back foot as stocks slumped putting MSCI’s global benchmark on track for the biggest weekly loss since the March bank crisis, as worries about China and higher global interest rates sapped sentiment.

Europe is red across the board and Asia was down again this morning heading for its 6th consecutive daily decline, with S&P futures trading near session lows down more than 0.5% at 7:45 am ET, although there is some respite compared to yesterday’s losses as 10Y Treasury yields retreat mildly from their near 15Y highs this am (yields are modestly lower across the rest of the curve currently too); Nasdaq futures are down more than 0.7%. Treasuries are slightly higher, in line with bonds in Europe, as their declines in recent days take a pause. Iron ore prices are bouncing, oil is marginally lower, while bitcoin is nursing losses from the $2000 flash crash that came out of nowhere late on Thursday afternoon.”

(Click on image to enlarge)

(Click on image to enlarge)

VIX futures have rallied to a morning high of 18.87 and are continuing to hover near their highs. VIX may be approaching a probable Master Cycle high in the next few days. A probable target may be the Cycle Top at 24.75.

Wednesday’s op-ex shows Max Pain rising to 18.00. There is some short gamma below 16.00, but dwindling. Long gamma begins at 20.00 and rises to 33.00.

(Click on image to enlarge)

TNX futures pulled back this morning to a low of 42.17, while the cash low came in at 42.43. This suggests TNX may be finished with its correction and may run even higher. The Cycles Model supports that thesis by showing trending strength over the next few days.

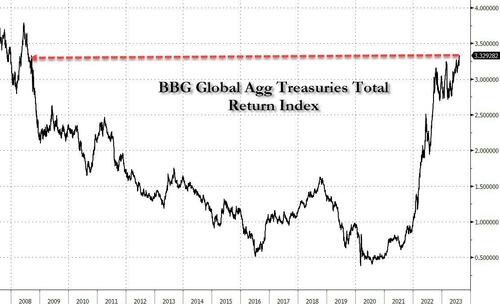

ZeroHedge remarks, “Global yields are heading towards a 15-year high as inflation concerns remain persistent and signs of economic downturns are still elusive.

(Click on image to enlarge)

The latest push higher was partly driven by the minutes of the July FOMC meeting, which revealed that the Committee members’ opinions are diverging. A large majority of the FOMC still saw upside risks to the inflation outlook, which would require further tightening after July. However, a couple of participants had actually preferred to leave the policy rate on hold. A gradual slowdown in economic activity appeared to be in progress, and that increases the risk of ‘overtightening’. The San Francisco Fed argues that Americans have depleted their excess savings from the pandemic, which has so far helped to prop up consumption throughout the hiking cycle.”

(Click on image to enlarge)

USD futures challenged the 200-day Moving Average at 103.36, rising to 103.58. Trending Strength is rising into the probable Master Cycle high due next week. A likely target may be the Cycle Top resistance at 105.90. However, it may go higher, given the circumstances.

Investing.com observes, “We start with the bigger picture monthly chart for the U.S. Dollar Index (DXY) as the longer-term price patterns can influence the shorter time frames. Let’s review the history briefly to provide some context for the current environment. DXY rallied into the 88.6 Fibonacci retracement in September, peaking at a trend high of 114.78.

The beginning of that uptrend began around February 2021 as the index flirted with support around the 200-month exponential moving average (EMA). That was the second successful test of the 200-month line as support and price eventually reversed higher. Being above the 200-month EMA is bullish and supportive of a continuation higher.”

More By This Author:

SPX Futures Rose After A 6-Day DeclineSPX Futures Have Challenged The Rising Trendline

SPX Futures: Small Gain

Nothing in this email or article should be construed as a personal recommendation to buy, hold or sell short any security. The Practical Investor, LLC (TPI) may provide a status report of ...

more