Spending Splurge Bill Coming Due

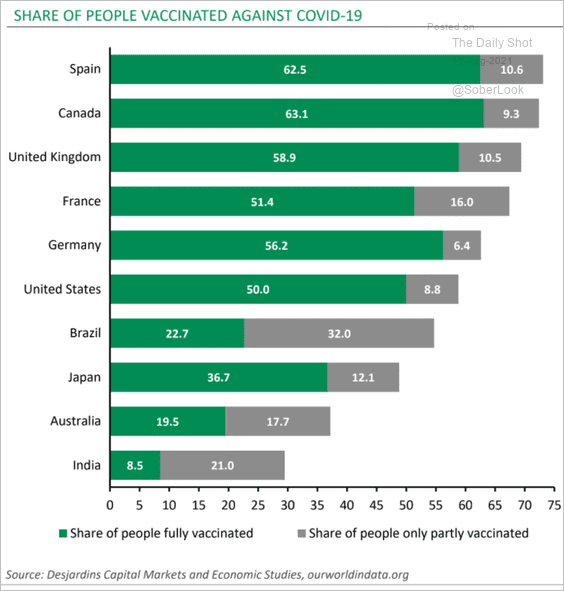

The good news, as shown below, is that Spain, Canada, and the UK are on track to have 70% of their populations fully vaccinated against COVID-19 within weeks (green shows the percentage with both shots and grey those with the first). On the other hand, most of the global population remains possibly years (?) from reaching herd immunity.

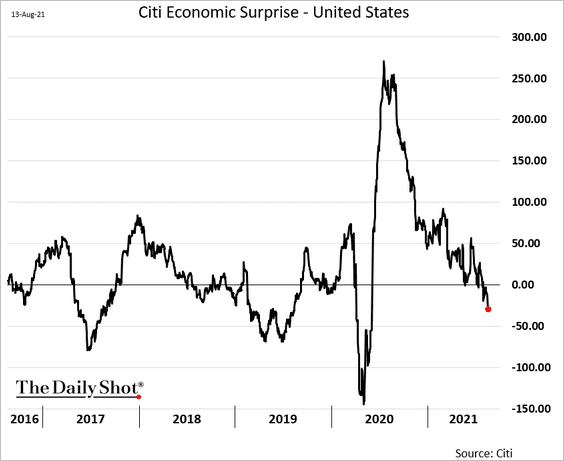

Meanwhile, frenzied consumption buying in the west has been coming off the boil since last winter, with leading economic data disappointing consensus expectations (below zero) since May (US Citi Economic Surprise Index below since 2016).

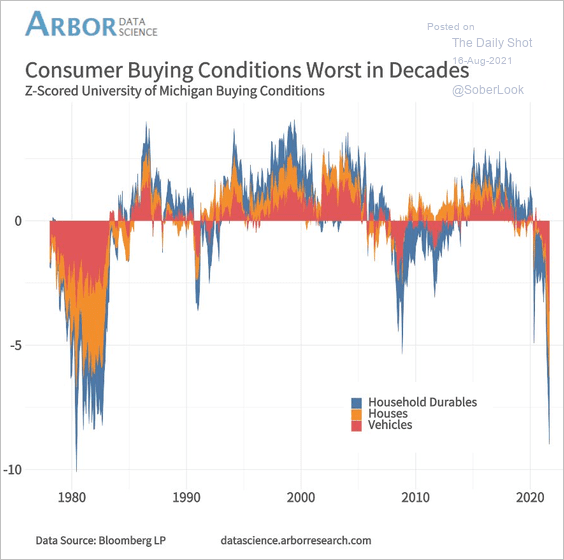

Amid record-low interest rates, prices have become so elevated relative to incomes that consumer buying conditions for big-ticket items (vehicles, housing, and durable goods) are now the worst in decades (shown here since 1975).

After the pandemic’s initial spending splurge, the bill is due, and global growth is mean-reverting again. Commodity prices have been signaling this for months: lumber (-71%), iron ore (-31%), steel rebar (-16%), copper (-16%), oil (WTIC -25%), and silver (-20%) are just a few of the recent standouts.

On the other end of the teeter-totter, the US dollar index is trading above 93.48 for the first time since November 2020. It has today moved above 1.28 against the commodity-centric Canadian loonie. As shown in my partner Cory Venable’s chart below, since the fall of 2020, if the 1.28 level holds, 1.34 becomes the next upside target for the USD/CAD.

(Click on image to enlarge)

Treasury yields are confirming the disinflationary ride as we thought that they should. Cory’s chart below from July showed the US 10-year Treasury yield’s relapse from the end of March (green arrow). At 1.245 today, the 1% range remains our base case retest ahead (green band) as growth and inflation rates slow.

(Click on image to enlarge)

Similar trends are unfolding in the great hot north, with Canadian government bond prices rising and the Canadian 10-year yield back at the 1.13% level of last February.

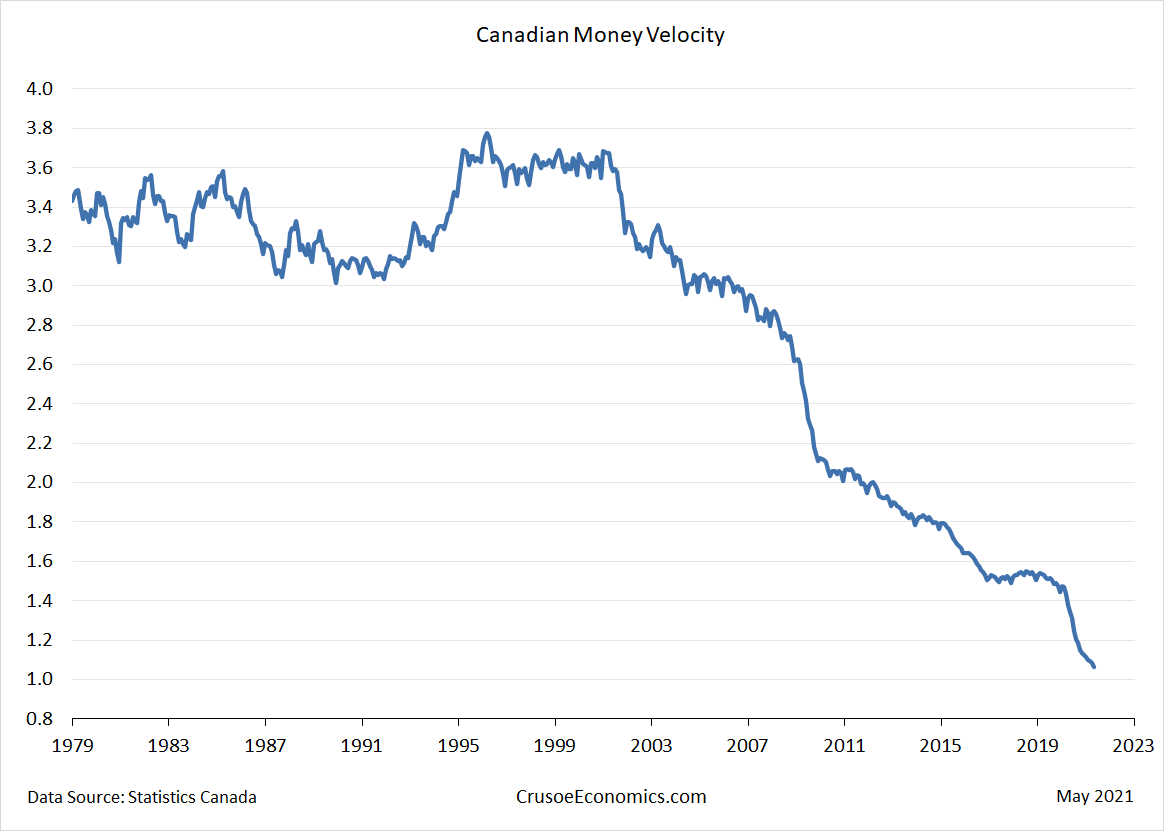

This chart of Canadian money velocity (movement of capital through the real economy since 1979) speaks volumes. Low-interest rates have run to the end of their stimulative course, and the payback period should be lengthy.

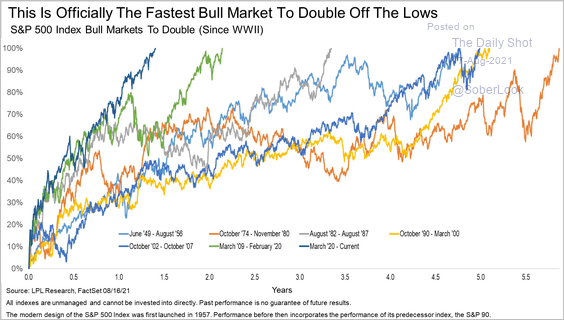

After the sharpest market rebound ever (2020-21 shown on far left below relative to other cycles since WWII), stock prices have been trading in a world of their own dreaming. Wake-up calls are overdue.

Disclosure: None.