S&P Downgrades WeWork To 'B-' Due To "Liquidity Strains"

WeWork bonds were already plunging, due to the massive cash burn and dwindling cash pile, and tonight S&P downgraded the company's issuer credit rating to 'B-'.

We warned just a few hours ago that WeWork is rapidly running out of cash, as Bloomberg warns, WeWork’s very business model is now at stake.

WeWork has raised more than $12 billion to rent office space that it renovates and then leases to companies. But that strategy has left it in a precarious position. It has some $47 billion of future rent payments due. On average it leases its buildings for 15 years. Yet its tenants are committed to paying only $4 billion, and on average have leases for 15 months.

Those long-term leases “may become an albatross in an economic downturn,” Bloomberg Intelligence analyst Jeffrey Langbaum wrote in a report Wednesday, adding that WeWork needs to find a “clear path to profitability.”

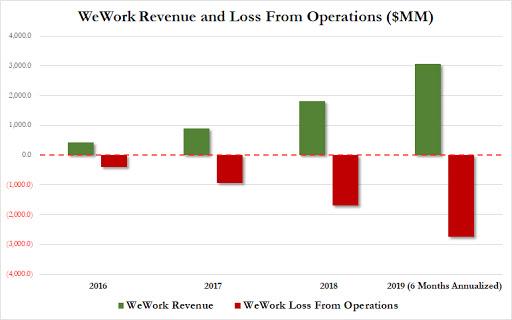

And, as a reminder, for every dollar WeWork earned in revenue last year, it lost roughly two.

(Click on image to enlarge)

As S&P details:

The downgrade reflects heightened uncertainty around The We Company's ability to raise capital to support aggressive growth and the pressure this places on liquidity.

These uncertainties stem from the weak reception of The We Company's IPO, partly related to what we view as subpar governance practices. Governance-linked questions and a series of changes in the week following the S-1 filing have weakened the prospects for a successful IPO by year-end, creating uncertainty about access to alternative capital resources.

Despite some improvements in governance practices subsequent to the initial filing, it is unclear whether the changes will lift investor sentiment. We also believe the company may struggle to meet its capital investment funding needs and liquidity covenant over the next 12 months.

At this point, we have not factored in any potential additional capital inflows from SoftBank other than the $1.7 billion due in 2020 ($1.5 billion due in April and $200 million due in the second half of 2020). Underpinning these uncertainties are challenging market conditions including a heightened risk of recession in the U.S., Brexit worries, and a slowdown of the Chinese economy (both London and China are major markets for The We Company).

The negative outlook is indicative of the uncertainty tied to The We Company's weakening liquidity position and access to capital, following poor reception to its IPO related to scrutiny of corporate leadership and governance practices. It also reflects the risk the company will struggle to fund its capital spending needs absent additional financing, the pivot in corporate leadership, and increased uncertainty about its future direction.

And the bonds are signaling trouble ahead...

(Click on image to enlarge)

Very helpful S&P... downgrading AFTER the company crashed and burned? $WE