S&P 500: Looking Positive

Image Source: Pexels

7:45 am

NDX futures are retesting Intermediate-term resistance at 12732.89 after reaching for the Lip of the Cup with Handle formation on Friday. Friday’s reversal from the Lip may be the triggering event for the new decline over the next two weeks. It has the same expectation as the SPX, with an anticipated 38.2% decline from the Lip. It may go deeper.

In today’s expiring options, Max Pain is at 12560.00 and calls dominate starting at 12600.00. Puts dominate beneath 12350.00 and short gamma starts at 12250.00. Should NDX not bounce at the Cycle Bottom at 12192.40, the race for the target is on.

ZeroHedge comments, “Yesterday we shared the bullish view from Goldman’s trading desk courtesy of flow trader, Scott Rubner. Today, we take a look at the other side of the trade by way of Tony Pasquariello, Goldman’s head of hedge fund sales, who has been turning increasingly more bearish over the past three months. We excerpt the below from Tony’s latest note available to professional subs in the usual place.”

SPX futures are looking positive this morning, challenging Intermediate-term support/resistance at 4126.11. Traders may go short with confidence beneath that level, and especially beneath the Lip of the Cup with Handle at 4120.00 which is the triggering event for the Cup with Handle formation.

Today’s expiring options show Max Pain at 4110.00. Options favor calls at 4150.00, while puts dominate beneath 4075.00 with short gamma lurking at 4000.00.

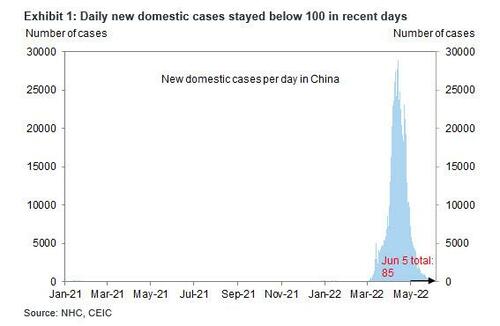

ZeroHedge reports, “Global markets and US equity futures pushed sharply higher to start the new week (at least until some Fed speakers opens their mouth and threatens a 100bps emergency rate hike) as Beijing’s latest move to ease Covid restrictions injected a note of optimism into markets rattled by inflation and rate-hike concerns. Nasdaq 100 futures climbed 1.4% at 7:15 a.m. in New York after the underlying index erased more than $400 billion in market value on Friday amid renewed concerns about tightening monetary policy, as Beijing rolled back Covid-19 restrictions, boosting global risk appetite after reporting zero local covid cases on Monday while also finding no community cases for three straight days…

… while a Wall Street Journal report that China is preparing to conclude its probe on Didi Global boosted sentiment further, with Didi shares surging 50% and sending the Hang Seng Tech index soaring. S&P 500 futures also climbed, rising about 1% and trading near session highs. Treasuries and the dollar slipped.”

(Click on image to enlarge)

VIX futures reached a weekend high of 25.42, still short of the 50-day Moving Average at 26.04. The 50-day is the go-ahead for VIX longs. While the SPX shows a possible “crash low” in two weeks, the VIX does not show its next Master Cycle high until mid-August. That agrees with the thesis that equities are caught in a complex decline that may not end until the Fall. The Cycles Model shows the VIX may not peak in Intermediate Wave (5) of Primary Wave [3] until mid-October.

The NYSE Hi-Lo Index has been hovering above its “zero” trigger since making its Master Cycle high on May 31. I may be monitoring it to see when it declines into negative territory.

TNX is rising, but not yet above Friday’s high. A breakout above the Cycle Top resistance at 30.72 will confirm the rally. The next proposed Master Cycle high may be anticipated in mid-July.

ZeroHedge comments, “Since central bankers are enacting monetary policy by acting as market participants, let’s analyze them like investors,” said Lindsay Politi, PM for One River’s inflation strategy.

“Central banks are the biggest whale in financial market history. And we’ve all seen what happens when a whale needs to exit. The catalyst is always an unaccounted risk, a surprise event, or an incorrect assumption,” said Lindsay. “Whether it’s a margin call that can’t be met, a risk officer shutting it down, or client redemptions; there’s a point where every ordinary investor is forced to liquidate.”

If the position is big enough, a bubble bursts and risks shift from being idiosyncratic to systemic.”

Nothing in this email or article should be construed as a personal recommendation to buy, hold or sell short any security. The Practical Investor, LLC (TPI) may provide a status report of ...

more