S&P 500 Intrinsic Value Index Update - Friday, Jan. 31

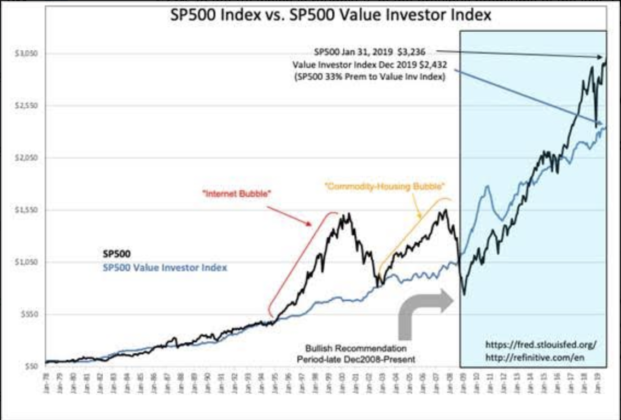

Simply put, the S&P would have to hit 5,100 for it to be valued at the previous two market peaks.

“Davidson” submits:

Value Investor Update:

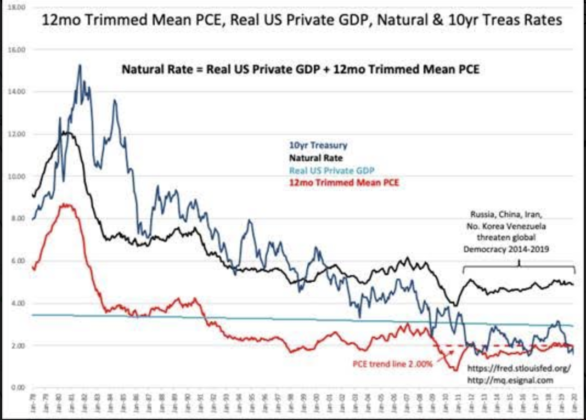

The Dallas Fed reported the 12mo Trimmed Mean PCE which is used in the calculation of the Value Investor Index for the SP500. 12mo inflation dipped slightly to 1.96% which keeps it close to a trend line of 2.00% the past 10yrs. The Value Investor Index(VII) is $2,432 using 70yr trends for Real GDP and SP500 median earnings. The SP500 sits at a premium of ~33% to the VII which is roughly ½ of the previous premiums of the last 2 market cycle peaks. There are no signs of this economic cycle ending even with current pessimism. Should the SP500 repeat past premium levels in 2024, the potential for $5,100 is possible.

(Click on image to enlarge)

(Click on image to enlarge)

REAL GDP, Government Spending, M2 and Inflation:

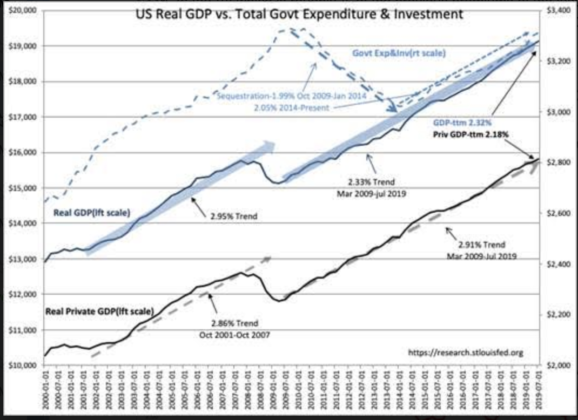

The chart from Jan 2000 shows US Real GDP reported this week with a trailing twelve months of 2.32%. The Real Private GDP which subtracts out Govt Exp&Inv was 2.18%. Both values are coming off a surge in GDP 2017-2018 as a result of tax and regulation reductions. Real Govt Exp&Inv which continues to under-pace Real GDP at 2.09% reflects an uptick with recent military spending.

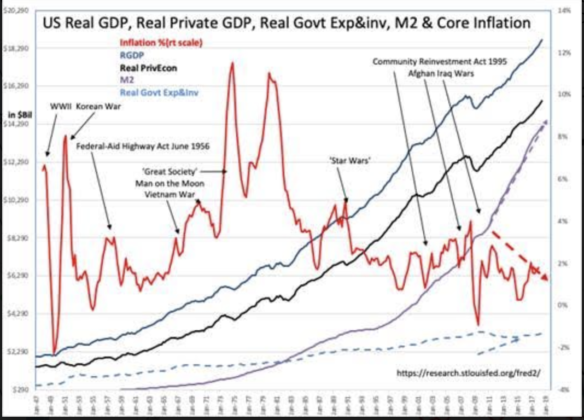

The chart from Jan 1947 provides a perspective on GDP, Money Supply, Inflation and key events thought connected with Inflation. Note that Money Supply(M2) has soared as Inflation has plummeted. Also, note that key government spending initiatives sometimes do and do not correlate with Inflation. Wars do correlate as both expensive and inflationary.

The lack of a specifically identifiable causation for Inflation has left economists scratching their heads for hundreds of years. There has been a long-held concept apparently first observed in print by Aristophanes in“The Frogs”, 405BC today spoken of as Gresham’s Law or Copernicus’s Law that “bad money drives out good”. Governments that simply print currency to support spending, over time do not create economic value. The net result is that a currency expansion without the same real expansion of GDP is inflationary. Germany of the 1930s and Argentina and Venezuela have done this today. The same was feared in the US with the rapid expansion of M2 2009-Present. To many, that the pace of Inflation remains unchanged overturns well-held tenets.

That government spending is inflationary especially during wartime, can be found in the correlation of Govt Exp&Inv to Inflation. Real Govt Exp&Inv fell at a ~2% annual rate 2009 to 2014 while M2 soared(and continues to soar). Oil prices, which are not shown, rose sharply beginning in 2009 and nearly tripled by 2011 held well over $100BBL till late in 2014 only to plummet 80%+ when Russia invaded Ukraine. Inflation over the whole period continued lower without noticeable impact. While Govt Exp&Inv has some correlation to inflation, M2 and commodity prices not so much.

This forces one to look elsewhere for another inflationary input. It looks like it has been discovered.

(Click on image to enlarge)

(Click on image to enlarge)

The Mystery of Inflation Solved?

Inflation has multiple causes but likely all come from one source, government policy. Wars and excessive government spending without adding economic value in the form of an increased and long-lasting improvement in society’s standard of living expands the amount of currency spread over the same level of sustainable GDP. Only peacetime additions through innovations that better the standard of living by adding non-inflated value to one’s GDP. In a Free Market like the US as compared to anywhere else, especially China, Russia, Venezuela, Argentina and etc., innovation enters the economy via entrepreneurs who often receive bank loans. Lending creates temporary currency. When the loan is paid back by successful businesses making profits selling innovations to consumers, the currency created through the earlier loan is now made permanent. Innovation by this process is turned into equity for society. The most important part of the process is individual freedom to choose to buy or not depending on how well a new product advances one’s standard of living. The spending choice always involves deciding if one is getting more value for one’s earnings vs.not spending at all. The companies that offer the greatest level of innovation at the most attractive valuation succeed because they attract consumers. It is a constant process of offering faster, better and cheaper alternatives to consumers to maintain business success which drives the entire production/consumption system. Every individual transaction is a decision to improve one’s standard of living. Simple reasoning leads one to the conclusion that innovation is deflationary and that the most creative of societies should have the lowest inflation.

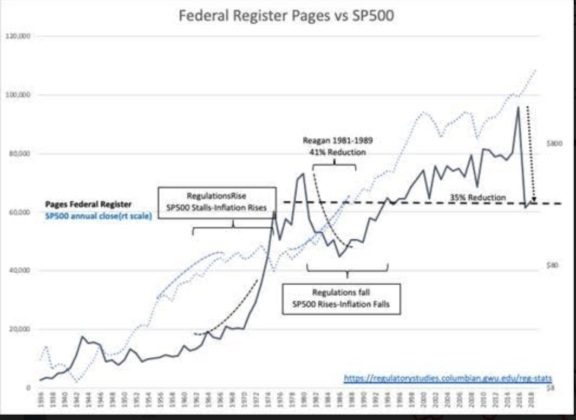

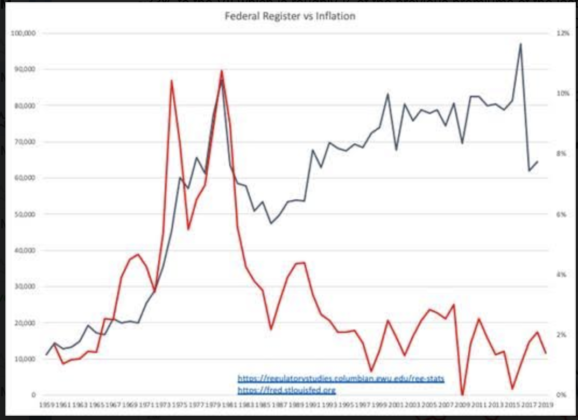

But society is not that simple. Society at any point in time has a breadth of perspectives and there have been multiple instances when some believed it correct to even out the benefits society has but have been distributed unequally. It is when the governing group decides to regulate for a specific policy outcome that costs are added to goods and services. There is a fine line between regulating a society for opportunity or for outcome. The power of the State vs the freedoms of its citizens has been argued since the time of Socrates. Aristophanes and Socrates were contemporaries.“The Clouds”, 423BC,is a Greek comedy play written by the playwright Aristophanes lampooning of intellectual fashions. Such a period occurred in the 1970s. This surge in regulatory activity is seen in the rise in the number of pages in the Federal Register. The inflation spiraled higher in near lockstep with the pages in the Federal Register. The Federal Register more than tripled from 20,000 in 1970 to more than 73,000 by the end of 1980 while inflation also more than tripled from 3.4% to nearly 11%. The US had shifted markedly towards an economy regulated by government. This shift was much towards forms of socialism we see failing globally today.

The next Presidential election brought Ronald Reagan into the Oval Office. Recognizing that regulations were stifling the US economy, he proceeded to deregulate. Over his two terms regulations fell by 41%. Not recognized in the process was the impact that deregulation had on lowering costs to consumers. Inflation fellfrom 11% back to ~3%-4% range and actually reached as low as 2% at one point during his tenure. Even today, many observers continue to be amazed and confused about the origins of Reagan’s “Miracle Economy”. The decline in the number of pages in the Federal Register and inflation are again nearly in lockstep.

(Click on image to enlarge)

(Click on image to enlarge)

Now we have it! Inflation comes from the adverse impact of government on converting entrepreneurial innovation into currency. Government is necessary as the only organized force to protect society in times of outside threats, natural disasters and to ensure that members of society treat each other fairly. The cost of government adds costs to society and the reason behind inflation. Some costs like self-defense are visible. Other costs such as regulations tend to go unnoticed but can be even more impactful than any visible costs. When government regulates excessively, costs rise, and inflation is the outcome.

The current economy is in the early stages of Reagan’s “Miracle Economy”. Federal Register pages spiked just under 100,000 in 2016 with a sizable rise since 1986 level of 47,000. The inflation normally associated with this rise was held in check by Congressional disagreements leading to a decline in Real Govt Exp&Inv under “Sequestration”. Since 2017, the number of pages has dropped to ~61,000. Businesses and individuals received tax reductions. The US economy accelerated. Some of this economic strength is being used to negotiate new trade agreements, lower tariffs globally and counter anti-Democratic forces with economic sanctions. Further reductions in the Federal Register page count are anticipated.

The current level of market pessimism is wholly unjustified. Economic activity is strong and should continue to rise with inflation remaining tepid. Investors should treat any decline in market prices as a buying opportunity. Once we have passed through this period, equity prices should rise for several years.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more