Solid 7Y Auction Sees Jump In Foreign Demand, Sends Yields Lower

Image Source: Pixabay

After yesterday's catastrophic 5Y auction, there were concerns that today's traditionally weaker 7Y "belly" auction would send yields into the stratosphere. And despite a modest tail, that did not happen because today's sale of $41BN in 7Y notes went off without a hitch.

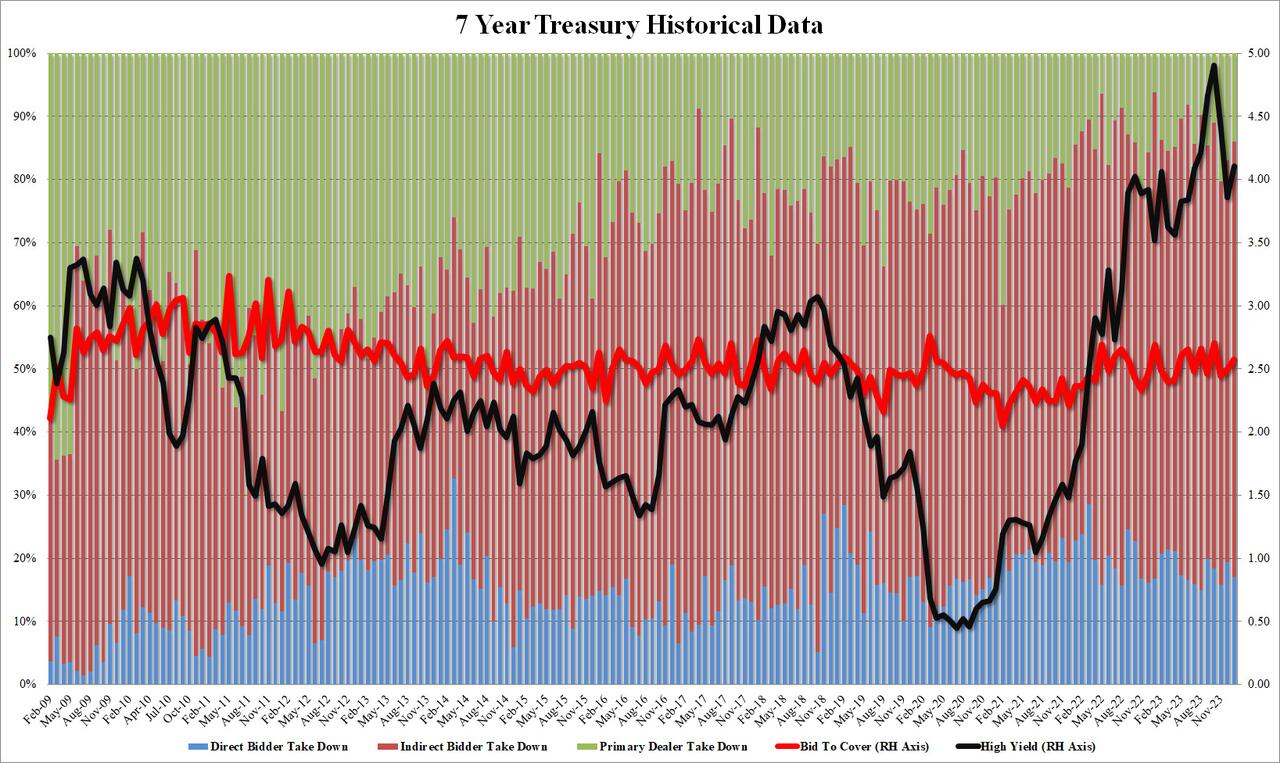

The high yield of 4.109% was higher than December's 3.859% and tailed the 4.106% by 0.3bps, the third tail in a row.

While the headline print was subpar, the rest of the auction was solid, with the bid to cover rising from 2.498 to 2.574, the highest since October.

The internals were even stronger, with Indirects awarded 69.1% of the auction, the highest since October, and above the 68.1% recent average; and with Directs taking down 17.0%, Dealers were left holding 13.94%, the lowest since October.

(Click on image to enlarge)

Overall, this was a solid, if hardly stellar, auction and certain strong enough to reverse the very bitter taste that yesterday's catastrophic 5Y sale left in the market's mouth. Sure enough, yields dropped, with the 10Y down from 4.15% before the auction to 4.13% after.

More By This Author:

Q4 GDP Unexpectedly Soars, Driven By Lack Of Destocking And An RV Spending Spree

Big-Tech Bid, Bonds & Bullion Battered As 'Better' Data Made Doves Cry

Tesla Misses On Top, Bottom Line But Margin Beats

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more