Solid 3Y Treasury Auction Stops Through As Short Covering Boosts Demand

After last month's ugly, tailing 3Y Treasury auction (which preceded a borderline disastrous 30Y Treasury sale) investors were cautiously eyeing how today's 3Y sales would go especially with another roof-raising CPI print on deck this coming Friday. Countering this, we said that the auction would likely stop through because as we showed earlier, the 3Y note was trading super special in repo, suggesting we would get another big squeeze into the auction.

*U.S. 3-YEAR YIELD RISES 5 BASIS POINTS WITH AUCTION AHEAD

— zerohedge (@zerohedge) December 7, 2021

Actually, auction will be stellar with huge covering on deck as 3Y trades super special in repo. Expect stop through of at least 0.5bps pic.twitter.com/LnxtGUxcLh

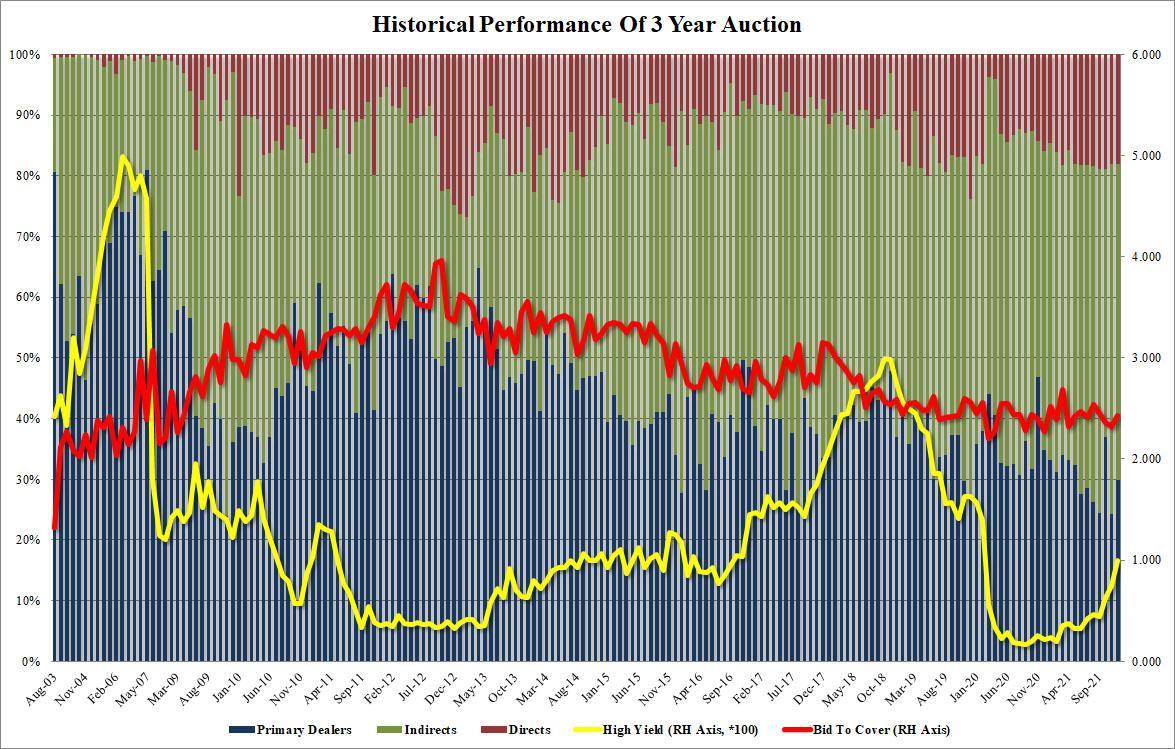

Sure enough, moments ago our forecast was confirmed when the 3Y priced at exactly 1.000%, which while the highest high yield in the tenor since February 2020, stopped through the When Issued 1.003% by 0.3 basis points.

The strength continued to the Bid to Cover which printed at 2.432, the highest since September and well above both November's 2.326 and the six-auction average of 2.425.

The internals were a touch softer, with Indirects taking down 52.2%, just below the recent average of 53.5, and with Directs taking 18.0% or the same as last month, means Dealers were left holding to 29.8%, in line with recent auctions and slightly above the average of 28.0%.

(Click on image to enlarge)

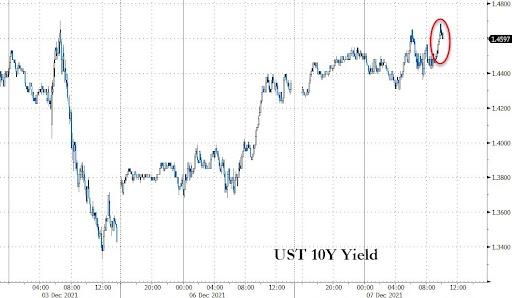

And with yields across the curve hitting session highs just ahead of the auction, seemingly amid fears of another bond auction rout, yields have reversed modestly with the 10Y dipping 1 basis point and the 3Y trading just north of 0.95%, below the session high of 0.96%.

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

moreComments

No Thumbs up yet!

No Thumbs up yet!