Signs Of Inflationary Reflation Running Low On Gas

The summer (inflation) cooldown continues…

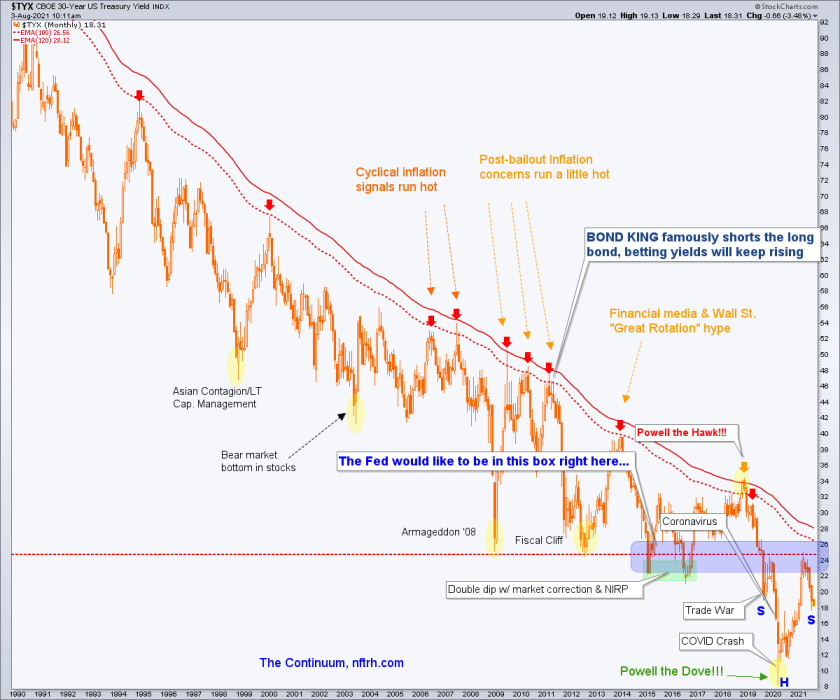

We anticipated it in NFTRH well ahead of time using the (monthly 30yr yield) Continuum as a visual guide. The idea was that the inflation uproar of Q1…

…needed to be tamped down, preferably to a roughly symmetrical right side shoulder to the one on the left side of a would-be inverted H&S.

(Click on image to enlarge)

While the macro is still in that process, other macro signals are also in decline along with the right side shoulder above. Let’s dial in and look at a few using daily charts. We took a look at Copper/Gold in the previous post. Let’s look at some other signals flashing during the summer cool down.

The yield curve had been steepening under inflationary pressure and now it is flattening due to dis-inflation or at least a moderation of that pressure. When it steepens again folks, there is no assurance whatsoever that the steepener will be inflation-driven as before. It’s important to remember that inflation or deflation can drive a curve steepener (with very different implications, obviously).

(Click on image to enlarge)

Credit spreads (e.g. junk/investment grade shown here) are bailing out of the speculative mindset driven by… oh yeah, the Fed’s inflationary operations of 2020.

(Click on image to enlarge)

Inflation expectations are certainly not inspiring at the moment.

(Click on image to enlarge)

My personal Canadian credit spread (of sorts), the speculative TSX-V vs. the senior TSX abdicated the inflationary view about the same time the yield curve (above) did. It is and has been a negative macro warning on the fly.

(Click on image to enlarge)

Finally, the daddy of all indicators (well, along with the Continuum) in my world, the Gold/Silver ratio has been flashing a potential base from which it could turn up. Let’s flip it over to its Silver/Gold ratio version and see a picture that could turn nasty. If it does and the US dollar regains its composure after the roads & bridges (etc.) bailout last week the macro could abort not only the cyclical inflation, it could get flat out nasty.

(Click on image to enlarge)

I am not presenting this stuff to be some kind of doom-saying blogger. I am presenting it because at important junctures like this, I think it is appropriate to have the site be of value to those who are not one-way casino patrons trying to always make coin.

The above danger signals may also act as levers. After all, when beginning the summer cool down a thesis, we presented it as just that, a cool down, a temporary way station from the inflationary hysteria. These levers could jerk the Fed out of its stance of fretting audibly about inflation (that was soooo July) and into a new inflationary production mode. We just don’t know.

The Fed needs permission, after all. The Vampire needs to be invited into your (macro) house. There’s nothing like a deflating macro to do that trick. Then the question becomes, will they be effective at renewing the inflation in any sort of an orderly way if the massive thing they built in 2020 starts cascading down?

Subscribe to NFTRH Premium for your 40-55 page weekly report, interim updates and NFTRH+ chart and ...

more