Should Investors Choose Precious Metals Or Crypto In 2023?

It is a matter of time until markets will stabilize. We can clearly see the long-term bullish reversal structure that is developing in 2022. Consequently, we expect 2022 to be a ‘reset’ year and 2023 will come with new trends. We are writing our annual forecasts and it’s clear that 2023 will come with opportunities in silver and in crypto. Our silver forecast outlines that the drivers are in place for a great opportunity in silver in 2023 and beyond. We concluded that silver is the precious metal to buy. Interestingly, while we think that the 2nd half of 2023 will be great for crypto, we believe that XRP is one of ‘the juicy’ opportunities as outlined in our latest XRP forecast.

2022 is going to be a year for history books with once-in-a-century type of events. In our premium services, we jokingly say that we should enjoy the last 10 weeks of 2022 because investors will never again, in their lifetimes, experience similar market events.

Think concurrently falling stock and bond prices, think the extremely tight period of 3 weeks in which commodities went ballistic, think the volume of hedging that occurred in September, think many more highly unusual events.

Market trend in 2023

2023 is going to be different, very different, compared with 2022.

Here is the driver that is going to make change the direction of markets, metals and crypto much more constructive: TIP ETF.

We expect that inflation expectations have found a bottom in the context of their long-term channel. We believe that an epic bottom has been set in TIP ETF, like in 2008 and 2020.

A rise in inflation expectations should come with relief in markets and the start of a new uptrend, even though it might feel like a very slow process.

While monetary policies will continue to be tight, bond yields are also close to achieving the target that policy makers have in mind. The upside in bond yields is limited, in relative terms, which means that inflation expectations are forming a bottom.

History shows that precious metals tend to rise along with stocks when TIP ETF is on the rise.

Precious metals in 2023

Gold and silver have a few drivers. No, it’s not supply/demand, unfortunately. As explained in great detail by silver expert Theodore Butler, it is the COMEX futures market that determines price.

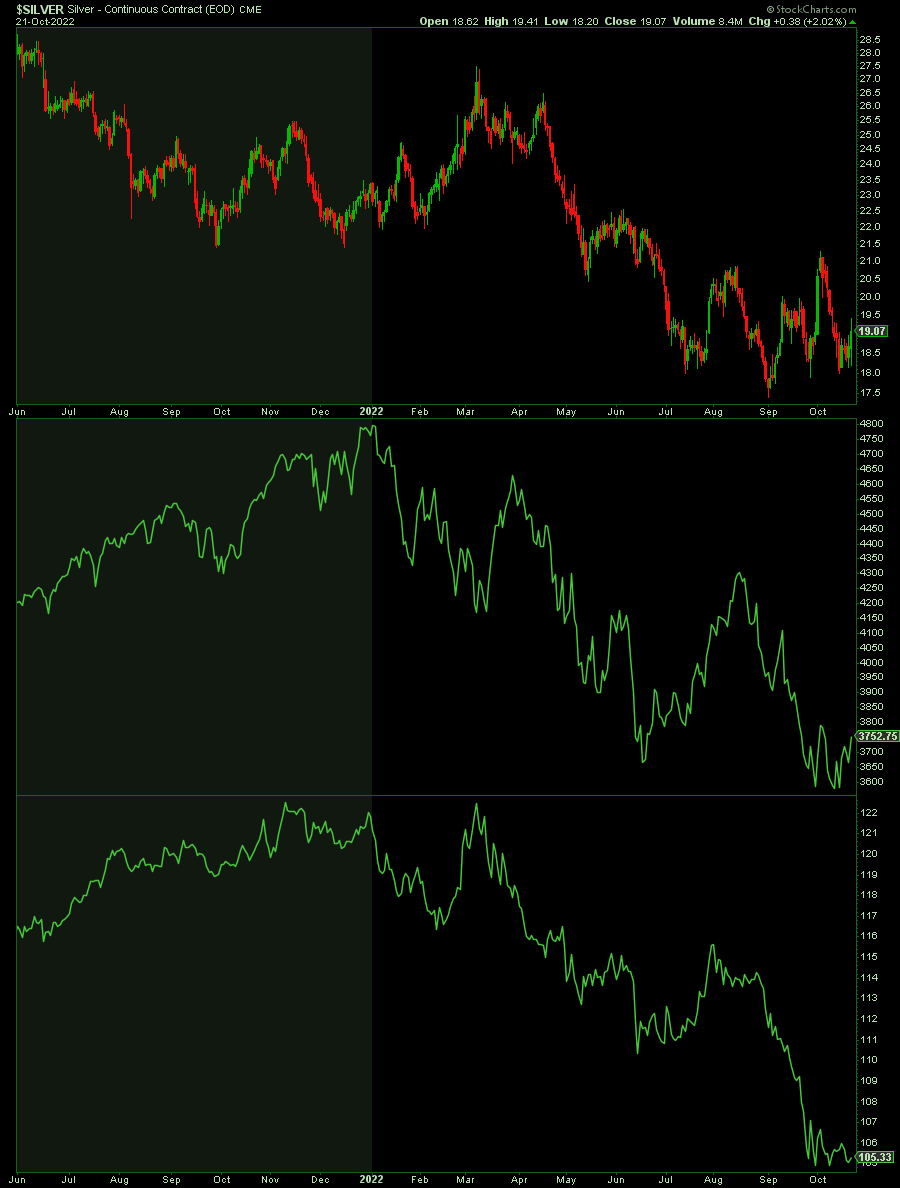

The correlations between precious metals prices are most outspoken with the U.S. Dollar and TIP ETF (inflation expectations).

We explained how outlook on inflation expectations before: we expect a bounce in the context of its long-term structure.

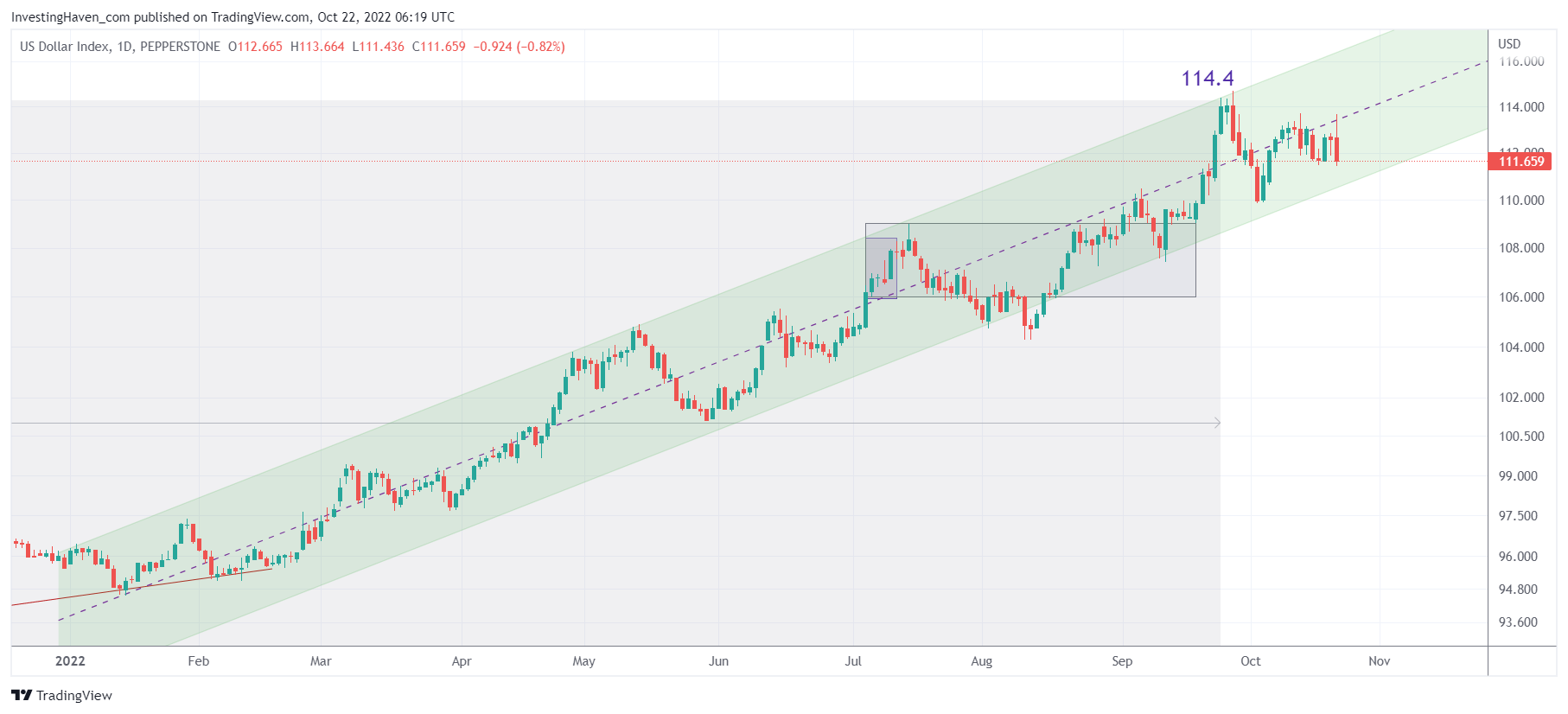

The U.S. Dollar is the other driver. As seen on the next chart, 2022 came with a solid trend for the USD. This rise is not sustainable, we expect that the USD will set a top either around November 30, 2022 or throughout January of 2023. Ultimately, the USD index might move to 118-119, we don’t see it move higher.

Because of this we expect that silver is the precious metal that will provide its investors with attractive leverage. Once the USD tops, either in 4 or 12 weeks from now, we expect inflation expectations to confirm a bottom. That’s when markets and metals will start a new uptrend.

The correlation between silver, TIP and the S&P 500 is clear from this one chart:

We believe long term oriented investors can accumulate silver around current levels, for the long term.

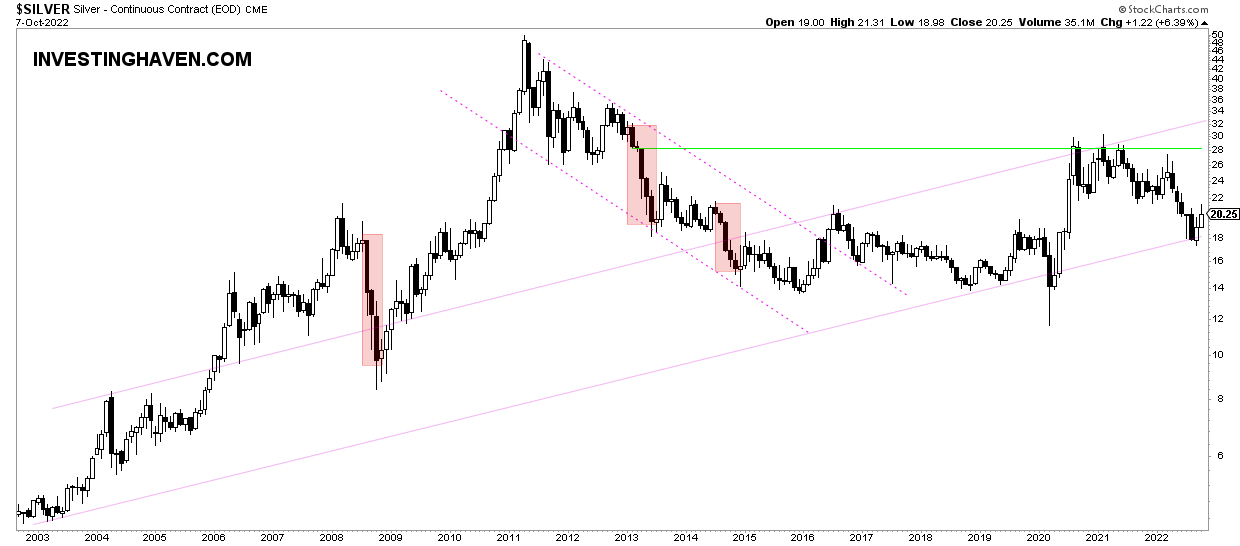

The long-term silver chart is an absolute beauty. We want the 2022 lows to hold on a 5 day closing basis as a pre-requisite to confirm our bullish 2023 silver outlook. As outlined in our silver forecast:

“We can reasonably expect silver to move to the top of this formation (between 32 and 36 USD) in the 2nd half of 2023.”

Crypto in 2023

Precious metals and crypto have similar drivers: inflation expectations, inversely correlated with the USD.

In a way, betting on precious metals or crypto is very similar, at least directionally. Both go up in an inflationary environment (expected in 2023) which implies both will struggle in a disinflationary environment (2022).

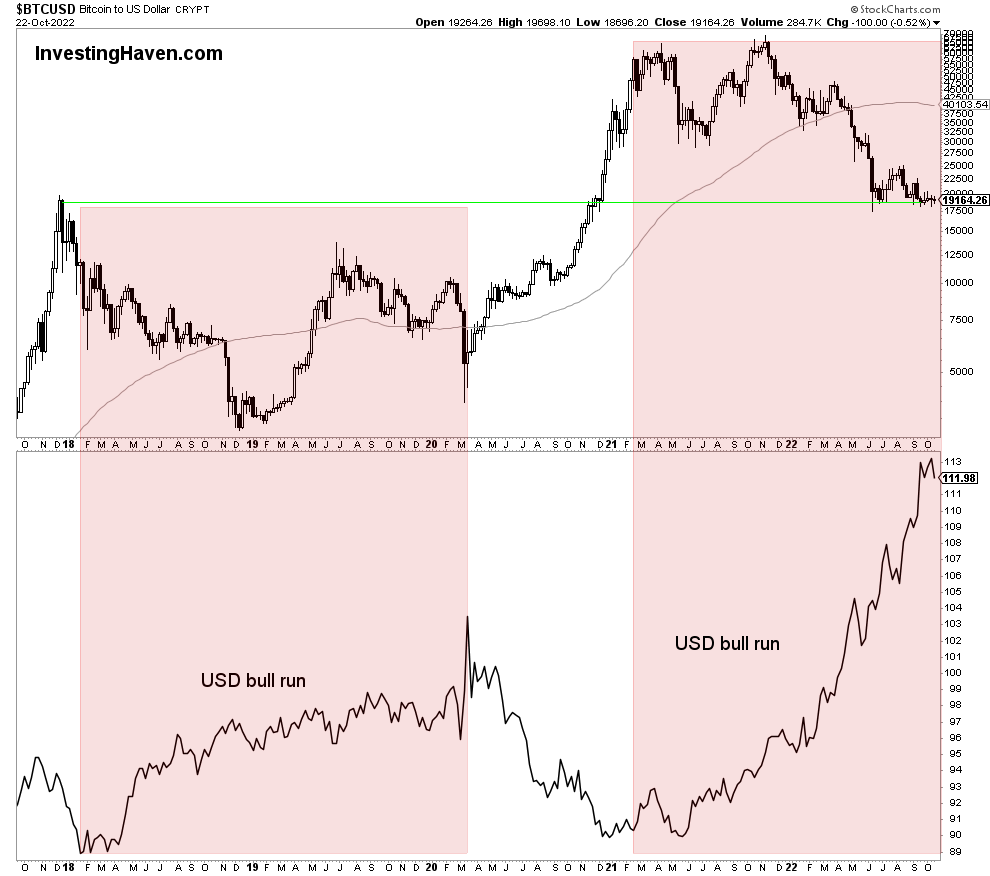

The correlation between BTC and the USD is indisputable:

Crypto will need a stabilization in the USD, ideally a downtrend, in order to do ‘its magic’. While we don’t expect a downtrend in the USD in 2022, we can reasonably expect that 2023 will come with lower USD readings. This will be the ultimate trigger for BTC and crypto markets to move higher.

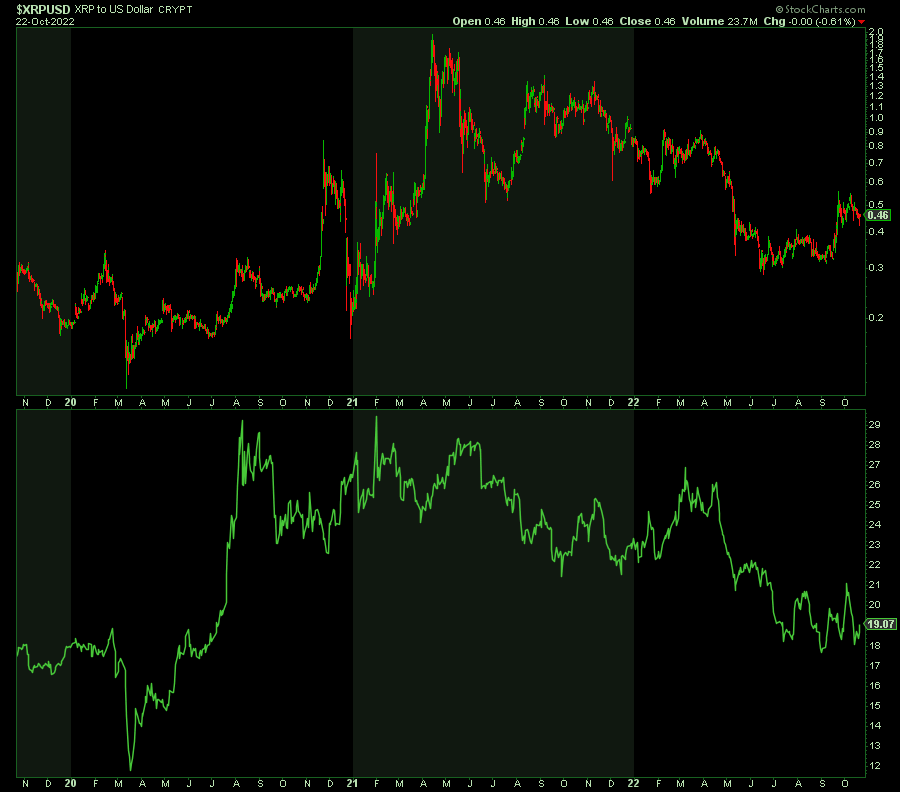

Within the crypto space we prefer a select few altcoins. One of them, surprisingly maybe, is XRP. As the SEC saga that confronted a few Ripple executives is about to conclude we see a really encouraging development: increased adoption in terms of XRP usage.

In our XRP forecast we highlighted this one really important quote that illustrates how XRP is developing:

“Q2 2022 was a record quarter for On-Demand Liquidity as volume grew considerably with over 9x YoY growth. Customers continued to expand the use of ODL for use cases beyond traditional remittances or individual payments, with treasury flows and bulk payments accounting for more volume on the network.”

ODL is the ultimate proof that XRP is actively being used on the Ripple blockchain, to support transactions like cross border payments.

We are bullish XRP in 2023, we believe accumulating XRP on the drops in 2022 is justified.

Interestingly, XRP and silver are strongly correlated.

In a way, betting on silver or XRP is somehow similar, directionally. Maybe it’s a good idea to accumulate a bit of both before 2022 concludes.

More By This Author:

Lithium Price Breaking Out Aggressively, Lithium Miners Will Follow Suit

Silver: Wild Swings In A Wide Range, Long Term Still Bullish

The Market Will Not Move 50% Lower Contrary To What The Gurus Are Telling You

Disclaimer: InvestingHaven.com makes every effort to ensure that the information provided is complete, correct, accurate and ...

more

Definitely play it safe and buy both!

That's a tough call and won I've been thinking about myself. But precious metals are a great safe haven asset and crypto will always be highly volatile.