Sharp Selloffs Ahead; Plan On It

Image Source: Unsplash

Everyone's asking the same question as the calendar flips. Where's the opportunity in 2026?

Here's what they're not ready to hear. The opportunity doesn't exist yet. You have to wait for the market to create it.

That’s because we didn’t really have a bull market in 2025. It was more like a market full of bull– well, you get the idea!

The S&P rallied nearly 1,000 points in 2025. Up 20%. Every talking head called it a bull market.

They missed something critical. Measured against gold, the market went nowhere. Your gains evaporated when priced in real terms. Dollar destruction created the illusion of wealth while purchasing power stagnated.

That's not a bull market. That's nominal accounting masking real losses.

Now we head into 2026 with valuations stretched, corporate borrowing costs rising, and institutions hedging aggressively. Smart money sees what's coming.

The market needs to correct before an opportunity emerges. Sharp selloffs reset valuations. Volatility clears out weak positioning. Pain creates buying opportunities for those positioned correctly.

Why First Quarter Weakness Creates Opportunity

Markets don't normalize by grinding sideways. They normalize through selling pressure. Through volatility spikes. Through forced de-leveraging that makes everyone uncomfortable.

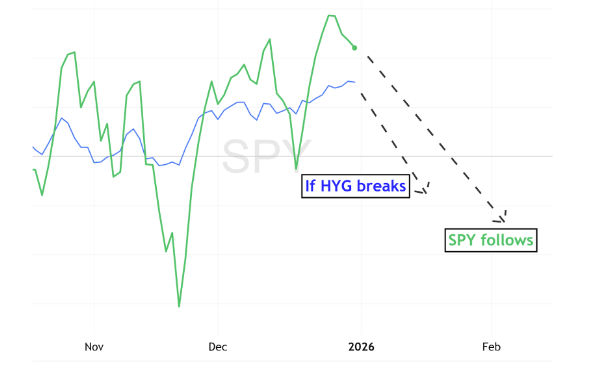

Corporate credit spreads need to widen. Junk bonds (HYG) and investment-grade corporates (LQD) need to sell off.

That pain forces companies with poor balance sheets to face reality. It separates businesses built on leverage from businesses built on fundamentals.

The VIX needs to spike. Institutional hedging signals that major players expect volatility. When the VIX is pricing in 18% to 25% swings, that's not paranoia. That's preparation.

If you're bullish on 2026, you should be hoping for first-quarter weakness. A sharp correction creates the lower entry points that make value investing profitable. Without that reset, the market just bleeds higher on continued dollar weakness until gravity eventually wins.

The Magic Formula for Finding Survivors

Value becomes the critical factor when growth names carrying massive debt face rising costs. This is where the Magic Formula approach becomes essential.

The formula ranks companies on two metrics. Return on Capital (ROC) measures how effectively management generates returns on invested capital. Earnings Yield (EBIT/Enterprise Value) captures valuation relative to actual business performance.

Companies scoring high on both metrics offer downside protection and upside opportunity. When the market corrects, these businesses survive. When borrowing costs spike, clean balance sheets win.

I've modified the traditional formula with additional filters for 2026. I'm hunting for companies with 15% ROC or higher, cash-to-debt ratios of 1.0 or better, debt-to-equity under 0.5, and price-to-book under 3.0.

These aren't sexy momentum names. They're fortress balance sheet companies that generate real profits without depending on cheap capital. When corporate credit markets seize up, these businesses keep performing.

The Systematic Approach to Buying Weakness

The Magic Formula strategy is simple. Generate a list of 30 top-ranked stocks that meet the criteria. Buy 2-3 stocks per month from that list. Hold each position for one year.

The monthly purchasing discipline forces you to buy during selloffs. When the market corrects in Q1, you're deploying capital systematically into names that other investors are panicking out of.

The one-year holding period captures mean reversion. Value stocks underperform during momentum rallies. They outperform during corrections and recovery periods. Holding through both cycles captures the full return.

Tax efficiency matters too. Sell losers just before the one-year mark to harvest losses. Sell winners just after the one-year threshold to capture long-term capital gains treatment.

What Institutions Already Know

The absence of a Santa Claus rally wasn't random. Smart money isn't chasing year-end performance. They're preparing for volatility.

Not retail traders panicking. Institutions protecting portfolios with serious capital deployed in size.

Most investors will stay long and hope. They'll chase the narrative that markets only go up. They'll ignore credit spreads widening and volatility building until it's too late.

The opportunity in 2026 comes from doing the opposite. Prepare for the correction. Build your watchlist of fortress balance sheet names. Deploy capital systematically when fear peaks.

The Two Paths to the Same Destination

Two scenarios play out from here. Neither is bullish short-term.

Path One: Sharp Q1 correction. Markets sell off fast. VIX spikes. Value stocks become attractive at deeply discounted prices. The pain creates a clear opportunity.

Path Two: Extended malaise. The market grinds sideways or bleeds marginally higher throughout the year. Dollar destruction continues. Real returns remain elusive. Eventually, gravity win,s and the correction materializes later.

Both paths require the same positioning. Build your Magic Formula watchlist now. Wait for the selloff. Deploy capital systematically during the panic.

The opportunity in 2026 doesn't exist yet. But when sharp selloffs create it, you'll know exactly where to look.

More By This Author:

Your 2025 Gains Are FakeThe Big Short Just Blinked

Markets Have One Week Left