Russia Claims “Drills” Over. Can Gold Resume Bearish Path?

While the Russia-Ukraine conflict remains a wild card as the news fluctuates, the hype died down on Feb. 15. For example, with Russia calling some of its troops back after completing their “drills,” the geopolitical risks fizzled. With that, the PMs’ rallies fizzled. Moreover, as cooler heads prevailed, the U.S. 10-Year Treasury yield closed at a new 2022 high.

Please see below:

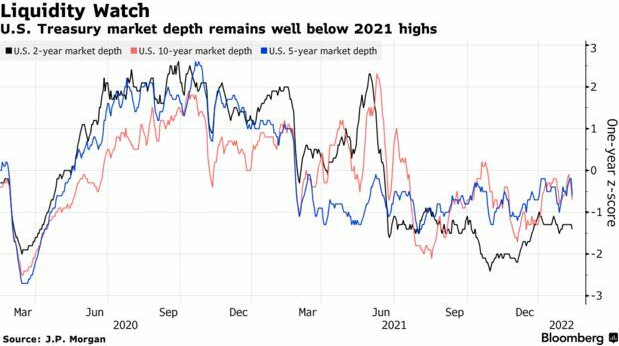

In addition, with bond market liquidity stuck in a downtrend, the rapid moves in interest rates that we witnessed in 2022 could cause more fundamental problems for precious metals. For example, Bloomberg’s U.S. Government Securities Liquidity Index – which gauges bond yields’ deviations from a fair-value model – is at levels that coincide with large daily swings. Moreover, market breadth – which is calculated by analyzing the size of bids and offers for U.S. Treasuries – has also fallen materially.

Please see below:

To explain, the black, blue, and pink lines above track the market breadth for the U.S. 2-Year, 5-Year, and 10-Year Treasuries. If you analyze the downtrend, you can see that the size of bids and offers has shrunk over the last several months. As a result, when sell orders hit the market and buyers are nowhere to be found, the prices of U.S. Treasuries plummet and yields increase. Thus, if the activity continues when surging inflation has investors extremely skittish, more mini taper tantrums could erupt in the coming weeks.

As further evidence, the Cboe Interest Rate Volatility Index (SRVIX) – which uses options on swaps to gauge risk – has rallied hard in 2022. Moreover, the index has surpassed its 2020 highs and only remains below the spike we witnessed in August 2021. As a result, there is plenty of anxiety in the bond market right now.

Please see below:

Headlining the recent uncertainty, the Fed’s next monetary policy meeting is only one month away (Mar. 15/16). Moreover, the date also coincides with a new release of the Fed’s Summary of Economic Projections (SEP). As a result, with inflation’s inability to settle down rattling the Fed and investors, the hawkish policy is needed to calm the pricing pressures.

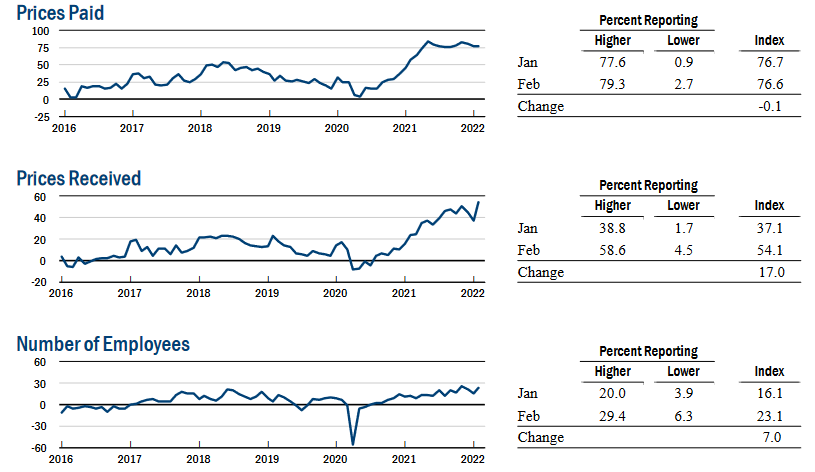

To that point, the New York Fed released its Empire State Manufacturing Index on Feb. 15. While the headline index increased from -0.70 in January to 3.10 in February, the report revealed:

“The index for the number of employees climbed seven points to 23.1, indicating solid gains in employment levels, and the average workweek index held steady at 10.9. The prices paid index was little changed at 76.6, while the prices received index rose a steep seventeen points to a record high of 54.1, signaling ongoing substantial increases in both input prices and selling prices.”

As a result, the Fed’s dual mandate (employment and inflation) has been achieved in New York State, and the data support a hawkish response from the central bank in March.

Please see below:

Source: New York Fed

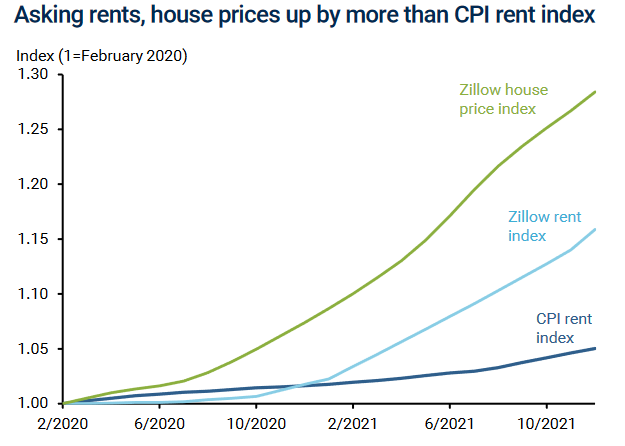

Likewise, the San Francisco Fed released an Economic Letter on rent inflation on Feb. 14. The report revealed:

“Current CPI rent inflation is positively correlated with 1-year lagged Zillow house price inflation, indicating that MSAs with higher Zillow house price inflation in one year are more likely to have higher rent inflation over the following year.”

As a result, the researchers concluded:

“The extraordinarily large increases in two leading indicators of future rent inflation – asking rent inflation and house price inflation – point to significant upside risks to the overall inflation outlook. The potential increases are particularly significant for CPI inflation, which places a larger weight on shelter costs. Still, the potential additions to PCE inflation of about 0.5pp for both 2022 and 2023 are important to consider in light of the Federal Reserve’s 2% inflation target.”

Please see below:

Source: San Francisco Fed

To explain, the green and light blue lines above track Zillow’s house price and rent indexes, while the dark blue line above tracks the CPI rent index. As you can see, Zillow’s data has materially outperformed the U.S. government’s data since the pandemic struck. As a result, with historical Zillow data often predicting future government data, rent inflation is likely far from its peak, and the headline CPI should remain elevated, putting more pressure on the Fed.

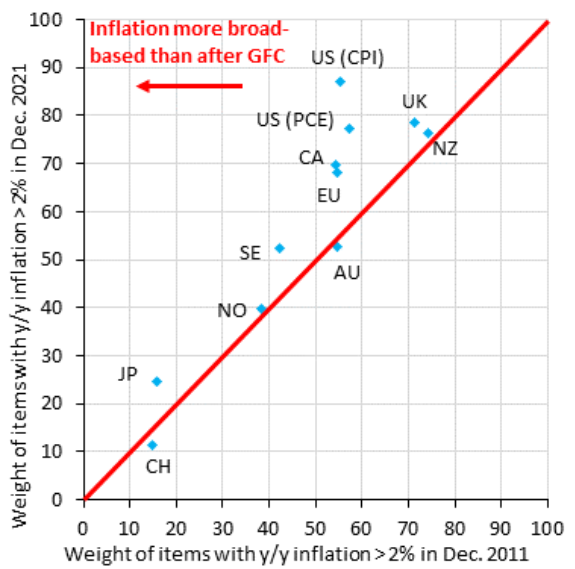

To that point, while the “transitory” camp initially blamed used cars, airfares, and hotel accommodations for the inflationary surge, the reality is that pricing pressures have broadened in recent months. Along the way, the percentage of CPI constituents tracking above the Fed’s 2% annual target continues to expand.

Please see below:

Source: Institute of International Finance (IIF)/Robin Brooks

To explain, the blue diamonds above track the regions and the percentage of their components tracking inflation above 2%. For context, the post-global financial crisis (GFC) data are plotted on the x-axis, the current data is plotted on the y-axis, and the upward-sloping red line depicts the linear trend.

If you analyze the blue diamond at the top half of the middle of the chart labeled “US (CPI),” you can see that nearly 90% of CPI components are tracking above 2%. Conversely, in December 2011 (post-GFC), the figure was closer to 55%. As a result, not only is U.S. inflation outperforming the rest of the world, but it’s also outperforming the precedent set following the GFC. Thus, the Fed has little reason not to raise interest rates in March.

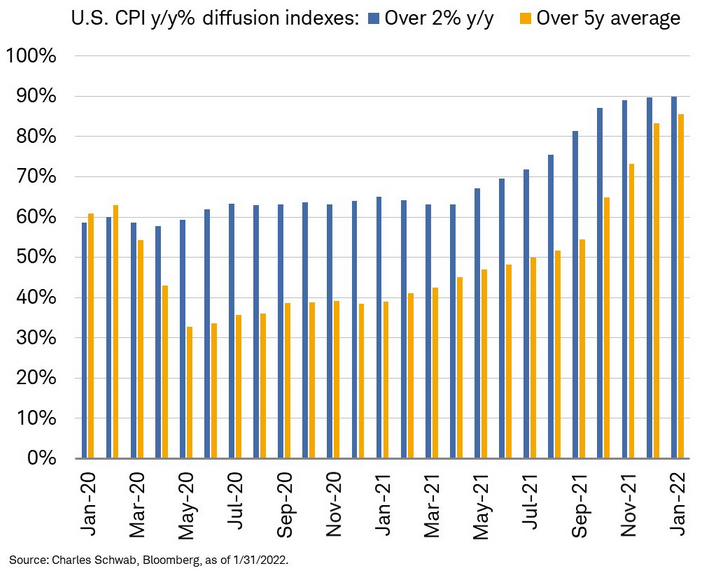

Also noteworthy, Charles Schwab presents the same data for the U.S. chronologically. If you analyze the chart below, you can see that the percentage of components that are tracking inflation above 2% (the blue bars) and the percentage of components above their five-year averages (the orange bars) have been increasing for the last several months. Moreover, with both metrics at or approaching 90% in January 2022, it’s a far cry from the roughly 60% we witnessed in January 2020.

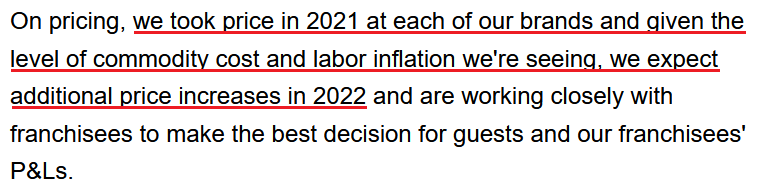

Finally, while the data above presents a bird’s eye view of the inflation story, the merry-go-round continues to circulate on the ground. For example, Restaurant Brands International (RBI) released its fourth-quarter earnings on Feb. 15. For context, RBI is the parent company of Burger King, Tim Hortons, Popeyes, and Firehouse Subs. Despite beating estimates on both the top and bottom lines, CFO Matthew Dunnigan said during the conference call:

“Similar to what others across the industry have noted, we saw a significant increase in commodity volatility as we progress through the quarter, leading to elevated levels of inflation that have similar pass-through effects on both our revenue and expense lines.”

Moreover, CEO Jose Cil added:

“In Canada as well as in the U.S., we've tended to price in line with CPI, and CPI in Canada is – has been probably in '21, about half or even slightly below half of what we've seen in the U.S.”

However, with Cil not waiting for the Fed to solve the problem, he said:

Source: RBI/Seeking Alpha

The bottom line? While the Russia-Ukraine conflict will likely weigh on markets until there is a definitive resolution, the PMs’ fundamental outlooks continue to worsen as the “peak concern” seems to be behind us. With inflation and employment holding firm, there is little stopping the Fed from raising interest rates. With U.S. Treasury nominal and real yields poised to move higher, history shows that the PMs often move in the opposite direction. As a result, while they remain uplifted, for the time being, sentiment should shift over the medium term.

In conclusion, the PMs declined on Feb. 15, as they gave back some of their geopolitical-risk-induced gains. While the USD Index also suffered, the fundamentals hurting the PMs (a hawkish Fed and higher U.S. Treasury yields) support a stronger greenback. As such, once the Russia-Ukraine conflict is no longer the main driver of the financial markets, the PMs and the USD Index will likely go their separate ways.

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more