Retail Apocalypse: Gold And Silver Bottoms

Fundamentals

Inflation is hurting retail sales. For the past couple of months, inflation has been hurting the economy. Facebook (FB), Amazon (AMZN), Apple (AAPL), Walmart (WMT), Target (TGT), and a slew of others have all fallen in stock value. Headlines are talking about a “Retail Apocalypse,” as inflation is hammering the retail business. Interest rates have risen so fast that it is beginning to hurt the economy. The sentiment of the market, as a result, is very bearish. Talk of recession is growing. Many are saying that we may already be in a recession.

10 Yr T Note (Investing.com)

The 10-Year Note is at 2.736, down 12.3 basis points. The 10-Year Note measures the interest rate environment we are in for the short term. Interest rates appear to have topped out. The market is telling us that the rates have made almost a head-and-shoulder top, with the peak at about 3.16 or 3.14. We are now at 2.76, so stocks and the E-mini S&P are, therefore, very undervalued. The cost of money is starting to price the stock market as going into undervalued territory. This situation is taken bullishly by the metals, with gold and silver moving up. This indicates that the cost of money and interest rates are going to decline. If we break below 2.75, then we are looking at the mid-2.5 rate on the 10-Year Note, which would take the pressure off the Fed to do anything else. The market has already discounted two half-a-point increases in the next two meetings, and it appears unlikely that the Fed will deviate from that plan.

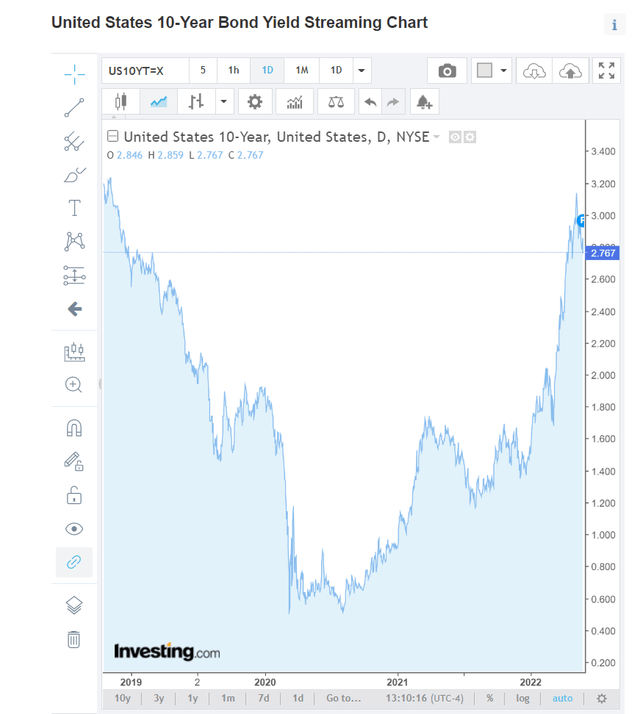

The cost of money is affecting the US dollar, which has regained a lot of strength recently as rates have risen since March. The chart for the 10-Year Note is almost straight up the past few months. Rates affect every sector of the economy that uses debt, especially those who are over-leveraged and in debt. The Note rose from about .33 in 2020 to the recent highs. If we break the 3.20 area on the 10-Year Note, it would confirm that the recession is underway. We are seeing pure margin call liquidation today by those affected by the rise in interest rates.

10 Yr T Note (investing.com)

Precious Metals

Gold and silver appear to be putting in a major floor as the economic situation appears to be getting grimmer.

Gold is at $1,867, up about $19. Silver is at $22.20, up about 48 cents. NUGT is up 1.45 at 50.06. Precious metals are gaining momentum as gold trades close to $1,900. Gold appears to be headed for about $1,874, which the Variable Changing Price Momentum Indicator (VC PMI) standard deviation daily target for May 24, 2022. Silver has a target of $22.29 for today.

Robo-Advisor Gold Weekly Standard Deviation Report

Niki the Robot, our artificial intelligence (AI) advisor, for the weekly gold report, says that the weekly trend momentum of $1,909 is bearish. The weekly VC PMI of $1,826 indicates a bullish price momentum. A close below $1,826 stop, would negate the bullishness to neutral. If short, take profits at $1,804 to $1,763. If long, take profits at $1,867 to $1,889. The levels the AI forecasts can serve as a GPS for your trading, using standard deviation and mean reversion. A contrarian signal, the VC PMI often goes against what the media sentiment and many analysts are recommending.

Robo-Advisor Silver Weekly Standard Deviation Report

For silver, Niki the Robot said in the weekly report that the weekly trend momentum of $23.73 is bearish. The weekly VC PMI of $21.56 indicates a bullish price momentum or standard deviation. A close below $21.56 stop would negate the price momentum to neutral. If short, take profits at $21.04 and $20.33, and go long. If long, take profits at $22.29 to $22.81.

Mean Reversion And Standard Deviation

The AI gave us the weekly trend momentum, which was bearish. That is the bigger trend. The weekly VC PMI of $21.56 indicates a bullish price momentum and standard deviation, which means that the market is bullish within that bigger bearish trend. The VC PMI tells you when the bullishness would be neutralized, as well as when to exit your trades. The market today came close to the $22.29 level, when longs should have taken some profits off the table. At that level, sellers start coming into the market and supply comes into the market, which causes the market to start coming back down again.

Strategy

We have a long-term core position in gold and silver, which we are adding to on short-term corrections. In the long-term, we believe, and the VC PMI and standard deviation predicts, that precious metals will move much higher.

Disclosure: I/we have a beneficial long position in the shares of GDX either through stock ownership, options, or other derivatives.

To learn more about how the VC PMI works and receive weekly ...

more