Recessions Are Not Forecastable

I’m seeing too many people assuming that a recession will occur within the next year or so. That’s certainly possible, but let’s not lose sight of the fact that recessions are not forecastable.

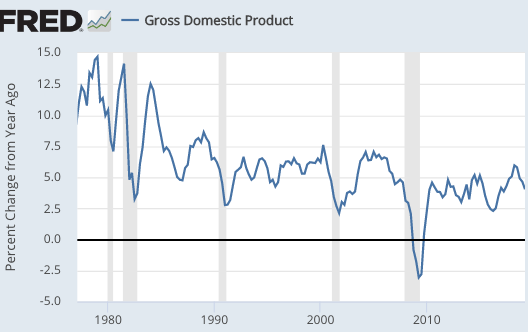

This looks like a trend, doesn’t it?

(Click on image to enlarge)

I’ve argued that long term interest rates reflect NGDP growth. That’s presumably still true, but the linkage seems to be weakening in recent years.NGDP growth since the mid-1990s has not slowed anywhere near as much as the decline in 30-year bond yields:

(Click on image to enlarge)

For most of the 1990s, 30-year bond yields were in the 6% to 8% range, despite NGDP growth running only about 6%. Now the yields have fallen to 2%, despite NGDP growth of roughly 4%.

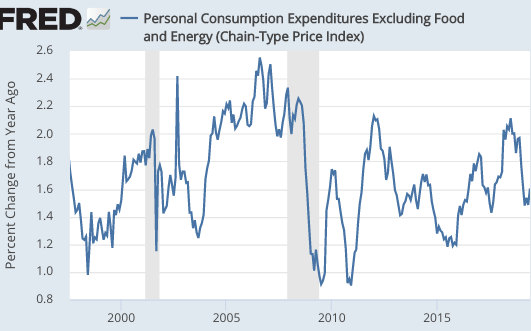

The inflation trends are even more startling. Core PCE inflation hasn’t slowed at all in the past 20 years (which surprised me), and thus real interest rates have fallen especially sharply. Here’s 12-month core PCE inflation:

The 5-year TIPS spread is running about 1.35%, which implies about 1.1% PCE inflation (as PCE inflation is at least 0.25% below the CPI inflation used to adjust TIPS.) That just seems weird. Obviously, the TIPS spread is not measuring inflation expectations, as it seems very unlikely that PCE inflation will average only 1.1% over the next 5 years. (I’d guess about 1.8%.) I’m told by people who work on Wall Street that investors simply don’t like TIPS. Thus I believe that real interest rates on conventional bonds have probably fallen by even more than the decline in 30-year yield TIPS yields

The interest rate situation is certainly weird, but that doesn’t tell us much about whether there’ll be a recession. In a month or so there’ll be a new NGDP prediction market, which will add a useful forecasting tool.

PS. I used core PCE inflation, as most economists believe that core inflation is a better predictor of future headline inflation than is headline inflation itself.

Great article. I think the linkage is weakening because of the massive demand for longer bonds as collateral. However, the feared collateral margin calls that spur buying could be tied to fear of recessions. So there still is a connection.