Rates Spark: The Nudge Higher In Market Yields To Continue

The 10yr now finds itself nudging the key 4.33% for the third time in the past week or so. We've spoken of the 4.25% to 4.5% area as a range within which to fade the up move in yields, and favouring a turn at closer to 4.5%. This remains our view. The ugly, badly-tailed 20yr auction, points in the same direction. A 0.4% MoM for core PCE next week adds to the pressure.

Image Source: Pexels

FOMC minutes and 20yr auction solidify the trend edge higher in yields

Two things stand out from the January FOMC minutes. First, the Federal Reserve is in no mood to chop rates just yet. Second, the Federal Reserve is prepared to talk above a tapering of the Quantitative Tightening (QT) programme, but there is absolutely no panic on ending it too soon. Both of these are placing upward pressure on yields. The ugly, badly-tailed 20yr auction, albeit not determinative, points in the same direction. A 0.4% month-on-month for core PCE next week won't help the mood either.

Let's take the second point first. It does not surprise us that the Fed remains very much in QT mode. On our calculations there is comfortably another US$1tn of bond roll-offs to come. We base that off the US$500bn still going back to the Fed on the reverse repo facility, which is a part of the excess liquidity calculation. And second, we'd argue that bank reserves at US$3.5tn are on the high side and can comfortably get down to US$3tn. That's still practically double the level we bottomed at pre-pandemic. It was arguably a tad too low at the time, but fast forward and US$3tn should be quite comfortable.

If we assume a further US$1tn of balance sheet roll-off, that's at least another 11 months of QT ahead of us, which comfortably takes us to year-end. Bear in mind too that the actual roll-off in many months has been less than the US$95bn planned. In some months it has been as low as US$75bn, in part reflecting less pre-payments on mortgage-backed bonds. So even if the Fed announces a slowing in the pace of QT to the US$65bn area as has been mooted, remember that that's not dramatically below what has actually been happening.

Now to the first point – the Fed's "hold your horses" stance. This chimes with a 353k payrolls report, a 0.4% MoM core CPI number and a 0.6% MoM core PPI reading. Acknowledged these are selected data that ignore some of the weaker readings, but bottom line the Fed can't feel comfortable cutting with MoM rates that annualise to scary levels. It's why the number of 25bp rate cuts discounted has been chopped from 7 to 4 since the beginning of the year.

And in turn, it's why the 10yr now finds itself nudging the key 4.33% for the third time in the past week or so. A break above that level would confirm a conviction mood for the 10yr yield to continue to edge higher. We've spoken of the 4.25% to 4.5% area as a range within which to fade the up move in yields, and favouring a turn at closer to 4.5%. This remains our view.

PMIs are likely to continue to recover but not enough for a jump in yields

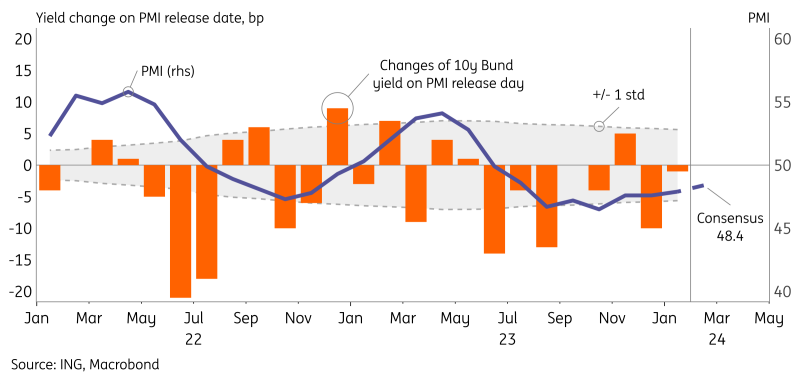

PMIs are released on Thursday and should reflect a slow but steady recovery of growth in the eurozone. The consensus call for the eurozone composite is 48.4, still below the threshold of 50, but a tick above the prior 47.9. Our economists expect PMIs to recover too, but nothing stellar and thus a significant upside surprise seems unlikely.

The last time PMI release days brought about a significant increase in Bund yields was in December 2022, as seen in the chart below. Since then there have been a lot more downside moves on PMI days. Consensus already foresees a rise in the PMI and thus a significant move of yields would probably require a fair bit more than a small nudge upwards.

So a large jump in yields is unlikely, but a recovery of PMIs could contribute to the broader narrative of recovering eurozone growth. Last week we argued that for this reason the 10y UST-Bund spread could see some narrowing, and although the Bunds bear flattening on Wednesday already narrowed spreads, there should be scope for more. And markets still price in the probability of an ECB rate cut by April at around 35%, a number that should nudge lower in our view if PMIs continue their positive momentum.

PMIs have triggered a lot more yield drops than jumps the past year

(Click on image to enlarge)

Thursday’s events and market view

In addition to country PMIs, we’ll have US data on jobless claims and home sales and also final January CPI numbers from the eurozone.

After the FOMC released January minutes on Wednesday, we will receive the ECB minutes on Thursday. With still two camps in the timing of ECB rate cuts (April vs June), the nuances in the minutes could budge the short end of the curve. No speakers from the ECB on the agenda, but we do have four speakers from the Fed.

The most notable issuance for the day will be USD9bn of 30y TIPS.

More By This Author:

Polish Construction Falls Sharply In Early 2024The Commodities Feed: US Natural Gas Jumps After Chesapeake Plans For Output Cuts

FX Daily: Rand In Focus On Pre-Election Budget

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more