Rates And The Yield Curve Rise

“Davidson” submits:

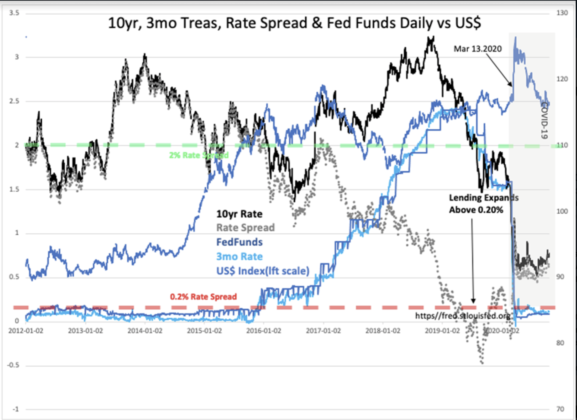

The US$ is normalizing to pre-COVID levels after rising sharply during the panic of COVID. US$ strength was due to a rise in global investor fears which drove capital to US markets. Part of this rise occurred on the heels of European bans on short-selling, a technique used to hedge portfolio declines. With the US markets the only liquid market permitting short-selling, capital flooded the US. Another hedge applied was shorting oil futures. WTI hedges drove prices briefly below (negative) – $30+/BBL. A price level never witnessed previously. Such has been the impact of algorithmic trading. As short-selling bans ended, the US$ has returned to pre-COVID levels. WTI remains well below pre-COVID levels.

The earlier thesis that Modern Portfolio Theory (MPT) seeking returns in EmgMkts has boomeranged back to Western Sovereign Debt and real estate markets appears intact. Sovereign Debt rates remain historically low relative to economic growth. How long the global MPT misallocation continues is anyone’s guess. At some point, investors may recognize the US has a much faster recovery from COVID than any other country and focus solely on US markets. The US$ could regain some strength at some future point.

(Click on image to enlarge)

Historical studies reveal that US loan activity rises when the spread between T-Bills/10yr Treasury is above 0.20%. That spread is rising with a rise in the 10yr Treas rate to 0.82% and is now 0.72%. This trend is welcome and represents a higher level of economic optimism as economic trends since April reflect a rapid recovery from the COVID shutdown. Rates rise when investor optimism increases. Pessimism continues at high levels.

Advice to investors remains the same. Invest solely in US Domestic equities and avoid fixed income.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests ...

more