Rally Time For Gold

Most investors remember the Ben Bernanke era of falling rates and the rising price of gold.

When there’s deflation, citizens need to hold lots of gold. When there’s inflation… they need even more.

(Click on image to enlarge)

A big bull flag appears to be nearing completion.

The target is at least 6%, 8% is possible… and that’s just a medium-term target. US rates are likely to rise for the next several decades, and maybe even longer.

In the Bernanke era of QE, money managers bought stocks and bonds for price appreciation. Low rates encouraged more debt.

Now, rates going to 8% could ruin these markets and put both companies and governments into a new era of rolling defaults.

The global de-dollarization tidal wave is an issue separate from the US debt problem, but it will make the debt harder to expand and service since there will be less demand for dollars.

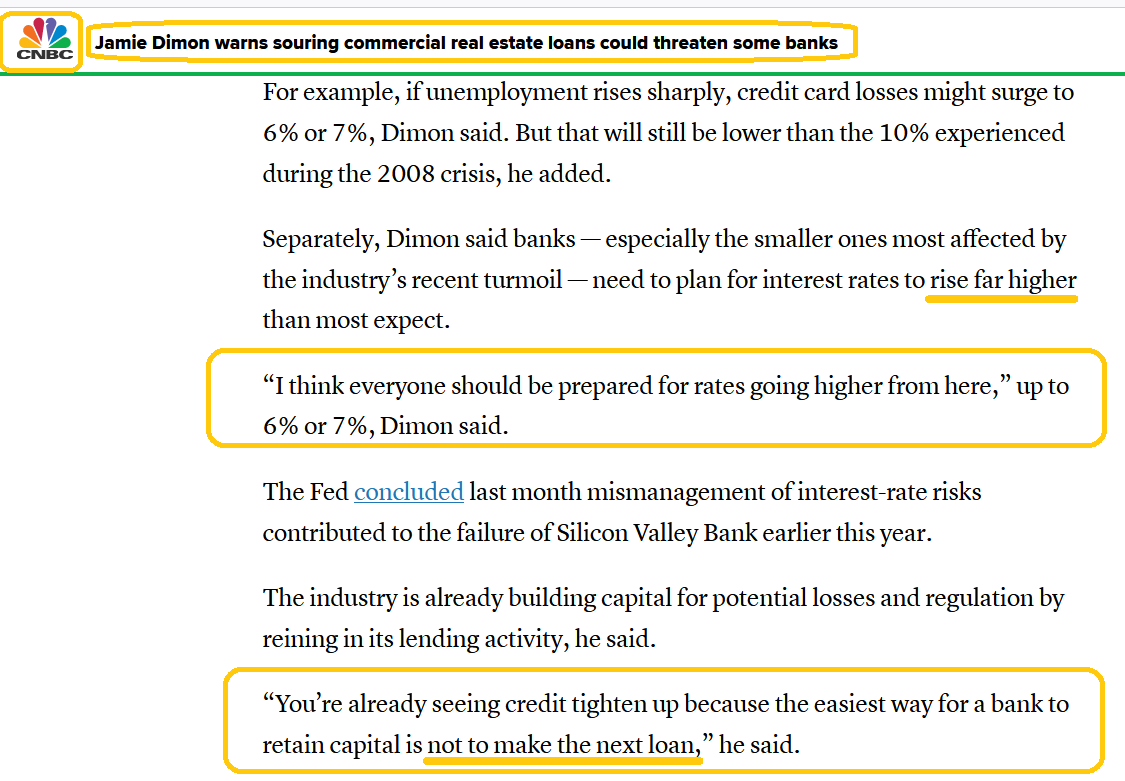

Jamie Dimon approaches the market from an insider/fundamentalist view, and he has the same 6% minimum target for the next hiking phase that I do.

What about the stock market?

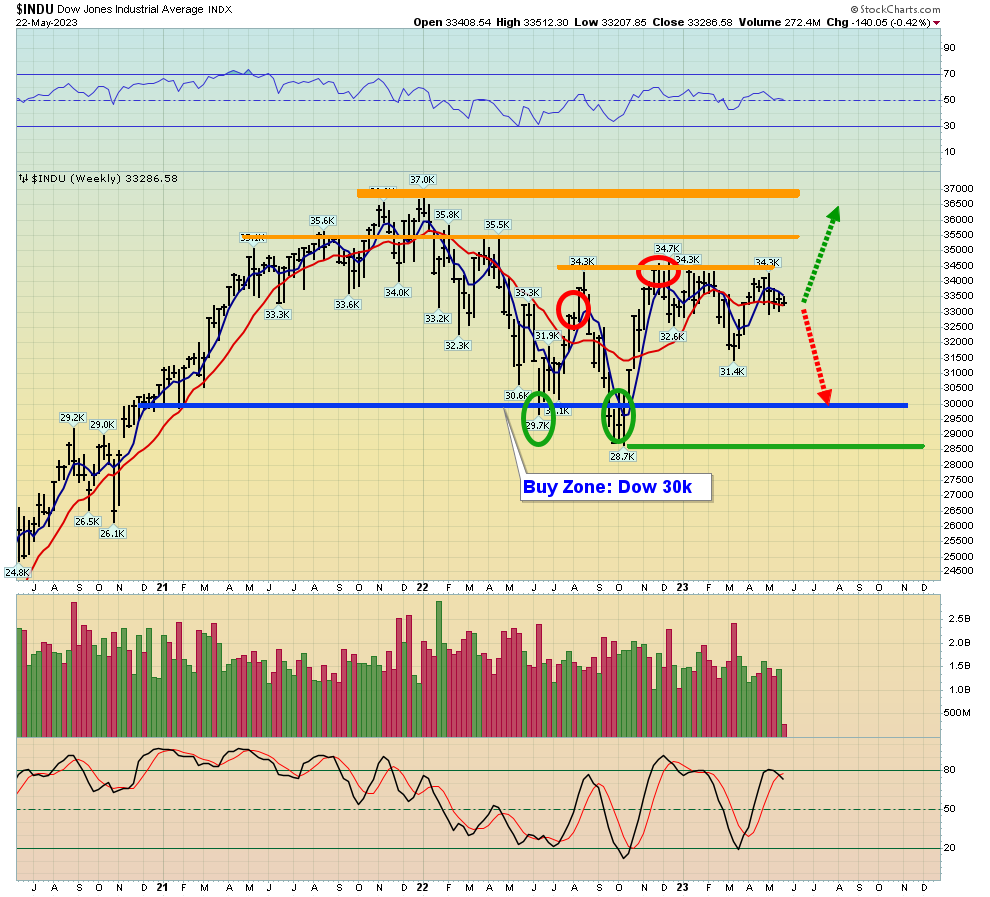

(Click on image to enlarge)

On the one hand, a debt ceiling default or near-default likely sends the stock market back down towards its 30,000 area lows, basis the Dow.

On the other hand, the default is likely to be followed by central bank action (money printing) that is celebrated by money managers.

Regardless, investors need to be prepared for decades of debt crises, even if the red and blue fiat-obsessed “Gmen” get rid of their ceiling.

Getting rid of the ceiling won’t get rid of endless debates about the government debts and deficits. The debt problem will only get worse as the ceiling gets raised or discarded. The bottom line:

Got gold?

(Click on image to enlarge)

Note the key $1960 support zone.

It’s likely that the world’s “Queen of Money” is going to make a low this week and begin a very large rally related to the debt ceiling comedy show.

For a closer look at the action, please see below

There’s a double bottom in play. It could morph into an inverse H&S bottom.

Regardless, a rally looks imminent. That’s the good news. The bad news is that it’s likely a big rally within the reaction from $2080… a reaction that isn’t over.

Gold markets are going to have some big swings before gold roars through $2080 and surges to $2400.

Long term investors should be more patient.

(Click on image to enlarge)

GDX weekly chart

Oscillators are still too high for long-term investors to take action…

And there’s just not much of a price sale in comparison to the big ones of the past.

Long-term investors should focus on the $1900 area for gold. That’s my price of choice for fresh gold and silver stock buys!

GDX daily chart

The price is reacting normally from the huge $2080 resistance zone for gold.

A mining stock rally looks imminent. Investors who have no miners should of course buy a grub stake now. Investors can just hold their ground, and swing trade enthusiasts may get the rally they deserve!

More By This Author:

Inflation In 2023 - A Lull In An Era

Gold Another Leg Higher

A Slapstick Comedy & Gold