Powell Disappoints

After raising the Fed Funds rate 75 basis points and despite widely broadcasted expectations that the Federal Reserve would confirm a slowdown in the pace of rate hikes after last Wednesday's FOMC meeting, Chairman Powell made clear the "...ultimate level of interest rates will be higher than previously expected" and are more important than the pace of increases. The markets expressed their disappointment as in "we'll show you."

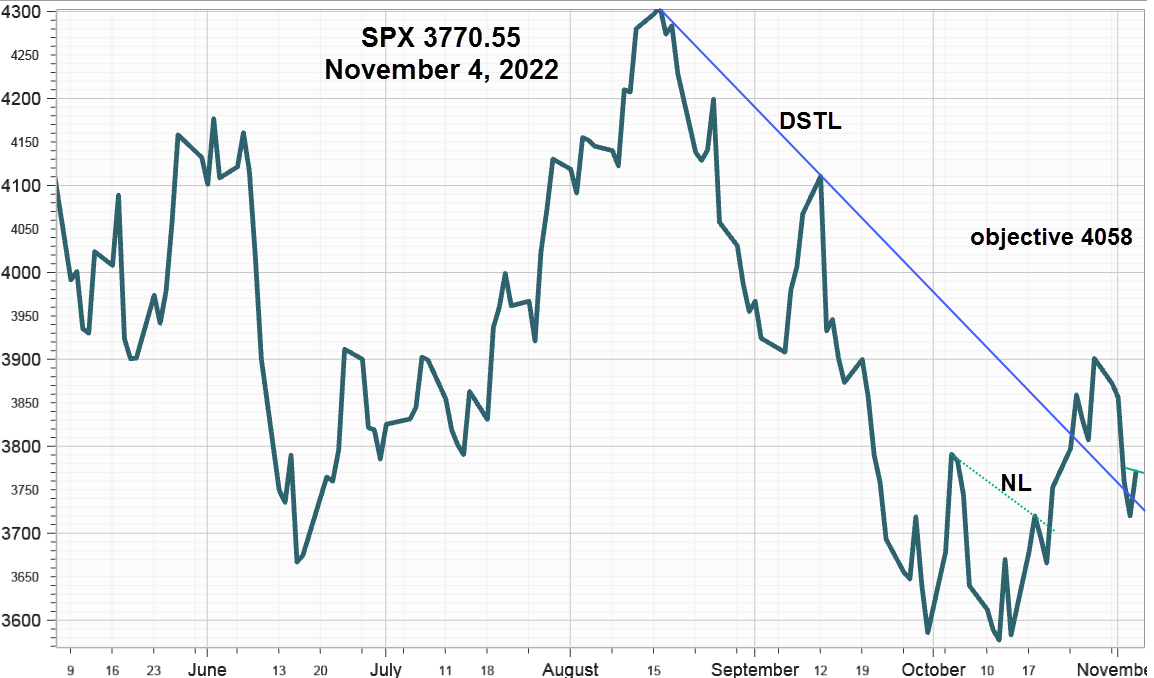

S&P 500 Index (SPX) 3770.55 dropped 130.51 points or -3.35% including a 96.41 point or 2.50% decline on Wednesday during and after Powell answered questions. By  the close it pulled back below the 50-day Moving Average and headed for the downward sloping trendline (DSTL) from the August 16 high at 4325.28 (blue line), although the small head & Shoulder Bottom pattern described in Great Expectations, with an upside measuring objective at 4058, appears to have survived for now.

However, without help from a slowdown in the pace of rate hikes further upside progress will be difficult. The small green line in the lower right on this close-only line chart marks the 50-day Moving Average.

Friday's 50.66 point or +1.36% gain followed unusually large gains made in China on speculation that changes to the COVID-19 lockdown policy would take place soon. The U.S Dollar Index (DX) 110.8.77 dropped 2.053 points or -1.82% highlighting the role the Covid-19 relaxation rumor played across the entire risk asset spectrum. In the early hours before the U.S. equity market opened DX dropped 1.76 points or -1.56% including a brief attempt to stabilize after the employment report before continuing lower. At the close, the Materials sector topped the performance table with a 3.41% gain including an 11.50% gain for economically sensitive big copper producer Freeport McMoran (FCX) 35.19 up 3.63 points.

On Saturday, China's health authorities squelched the rumor making it clear the controversial zero-Covid policy was working and would continue, despite the cost to the economy, saying the measures are "completely correct, as well as the most economical and effective." It seems likely Friday's rush back into economically sensitive cyclicals will soon reverse despite the markets pleading for a policy change.

Market Breadth as measured by our preferred gauge, the NYSE ratio adjusted Summation Index that considers the number of issues traded, and reported by McClellan Financial Publications continued higher adding 277.90 points to finish the week at -454.35, slightly above the 50-day Moving Average. Continuing breadth improvement supports the October turnaround view and the upside measuring objective at 4058 from the small Head & Shoulders bottom mentioned above.

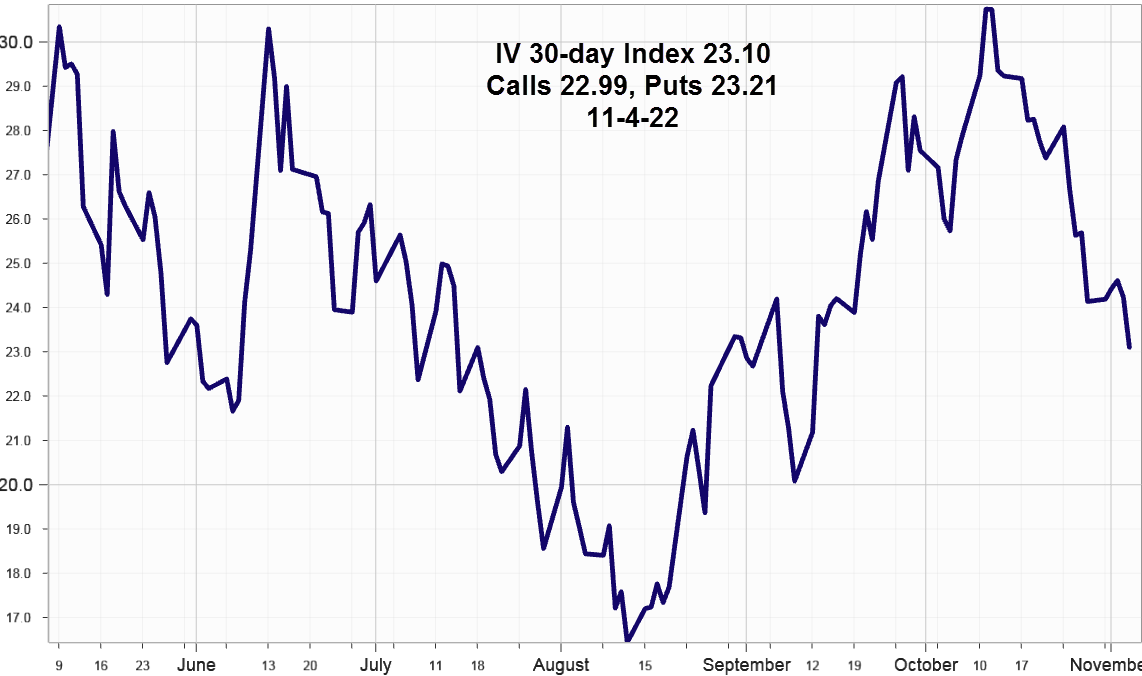

Implied Volatility

SPX 30-day options implied volatility index, IVX slid 1.04% last week to end at 23.10% with Calls at 22.99% and Puts slightly higher at 23.21%. It's now well below the 52-week high at 30.74% on October 11, 2022, and trending lower encouraging the bulls, even though the equity-only put/call ratio spiked up to 1.14 on Wednesday.

Interest Rates

For the week, the 10-Year Treasury Note ended at 4.17 % up 15 basis points (bps). The 2-Year Note added 25 bps to end at 4.66% for a 10-2 inversion of -49 compared to -39 the week before. The 3-month Treasury Bill rate increased to 4.21% up 3 bps.

As of Thursday, the Fed Funds rate ended at 3.83% and the peak rate will be going higher than previously estimated. Fed Funds futures indicate the peak at 5.25% unless, of course, something breaks along the way.

Summing Up

After Federal Reserve Chairman Powell's comments on Wednesday, it's clear the markets are trading the Fed not the economy, and have been for most of the year. Comments such as "We think we have a ways to go" and it is very premature to be thinking about pausing, underscore the Fed's determination to control inflation.

Friday's risk on rotation especially in the Materials sector began in China after rumors persisted they will soon relax COVID-19 restrictions. However, on Saturday China's authorities insisted they have no intention to change policy.

Breadth continues improving adding support to the view that SPX will reach the upside objective for the October bounce at 4058

More By This Author:

The Fed’s PushbackFundamentals Start To Catch-Up

Sectors Dislocations Between Europe And The U.S.

Disclaimer: IVolatility.com is not a registered investment adviser and does not offer personalized advice specific to the needs and risk profiles of its readers.Nothing contained in this letter ...

more