Positions For 2022: Outstanding Opportunities In Growth Stocks

What do you expect to be the key driver of stock market performance in 2022? What items will impact market performance - for better or worse?

The main theme in 2022 will be expectations reset. Before the pandemic in 2020, the U.S - as well as Europe and Japan - faced slow economic growth combined with deflationary pressures due to long-term factors: Too much public sector debt, demographic trends, and the deflationary impact of technology, among other things.

Economic trends in 2021 were exceptional due to the impact of the reopening combined with unprecedented monetary and fiscal stimulus. Adding fuel to the fire, the supply chain problems exacerbated inflationary pressures.

Those factors are going to fade away in 2022 and beyond, and this is going to generate some volatility and uncertainty in the market.

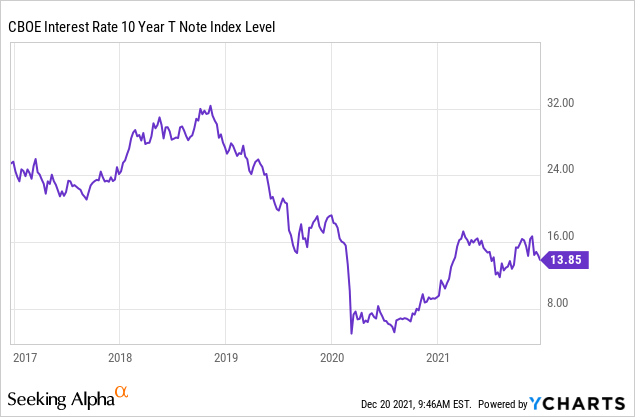

The market is starting to understand this, as long-term bond yields remain notably low in spite of the narrative about an overheating economy and accelerating inflation.

Data by YCharts

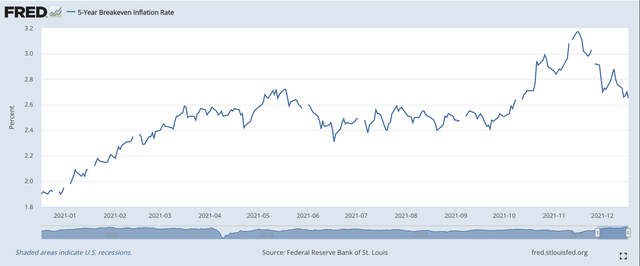

From a similar perspective, inflation expectations in the bond market seem to have peaked on Nov. 15.

As we approach 2022, are you bullish or bearish on U.S. stocks? In terms of asset allocation, how are you positioned heading into the New Year?

For the broad market, I'm rather cautious, and I wouldn't be surprised to see some shakeouts during the year as the market reacts - and overreacts - to an evolving macro landscape with decelerating economic growth.

That said, there are some exceptional opportunities available in high-quality growth stocks that were indiscriminately sold off during 2021.

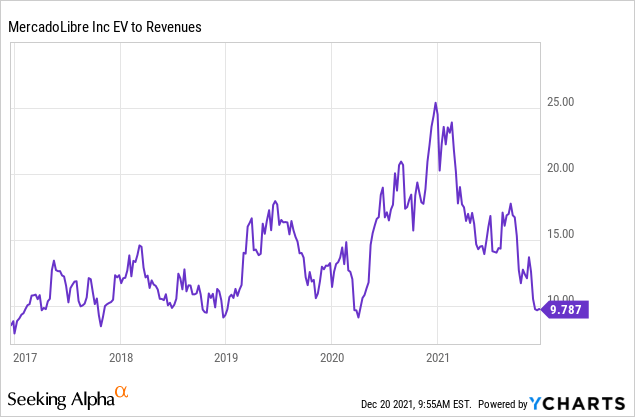

MercadoLibre (Nasdaq: MELI), for example, is trading near the low end of the valuation range over the past five years. The company is the market leader in e-commerce and fintech in Latin America, and it has enormous opportunities for growth in other areas such as advertising. MercadoLibre is now offering crypto trading in Brazil, opening the doors to new growth avenues in the years ahead.

In spite of the tough year-over-year comparisons, MercadoLibre delivered a big increase of 72.9% in FX-neutral revenue last quarter, showing that the business fundamentals remain intact.

Data by YCharts

Proper valuation should always be forward-looking, of course. What really matters is the company's ability to produce growing sales and cash flows in the years ahead as opposed to a backward-looking valuation ratio.

Nevertheless, the point is that the selloff in growth stocks during 2021 has been indiscriminate, hurting both overvalued companies with mediocre fundamentals and some of the best growth companies in the market with exceptional long-term potential.

I have been buying several of these stocks lately, while I'm still keeping my cash balances at around 10% in case we see some even better opportunities.

Moving beyond growth stocks, semiconductors is my favorite sector among the cyclical ones. Semiconductors are powering the digital transformation of the economy, and these stocks remain very reasonably priced as the market is underestimating the long-term shift in demand.

Which domestic/global issue is the biggest risk that could adversely affect U.S. markets in the coming year?

The Fed needs to remain flexible and data-dependent in order to avoid a major policy mistake. Some leading indicators for the economy are already showing signs of weakness, so the authorities should keep a close eye on the data going forward. This is an important risk factor, but it will probably be a source of volatility as opposed to the driver for a new bear market. Powell has shown in the past that he can change his mind when the evidence changes.

More concerning, the economic and geopolitical risk coming from China could be destabilizing, and it could have serious implications for the global economy. If things go wrong in China, the global economy would suffer materially.

Is rising inflation a legitimate fear that could squeeze profits and/or cause valuation multiples to contract?

It's always a risk factor to watch, but the biggest drivers behind the recent acceleration in inflation are mostly due to the dislocations produced by the pandemic and the subsequent reopening. Shifting demand trends outpacing supply, government stimulus, and supply chain issues.

In my perspective, lower than expected economic growth is a much bigger risk than sustained inflation going forward.

How does the political/regulatory climate affect the risks and opportunities for next year?

Political and regulatory risks are having a considerable impact on market sentiment, and this will probably remain the case next year. But chances are that the real developments in this area will not be as bad as the market fears.

I don't see much room for extreme measures based on the current balance of forces. I expect a lot of noise coming from politics, and the market does not like uncertainty. But the real fundamental impact of these discussions will likely be moderate.

What role will the Fed play in the coming year?

A very important one. I expect economic growth to be below expectations and inflation will probably slow down once we move beyond the supply chain problems sometime next year. We really don't want the Fed to be too restrictive with monetary policy in this kind of environment.

Something similar happened at the end of 2018, and the Fed was flexible enough to change direction as markets were under serious pressure. This time they need to be even more flexible and forward-looking because the consequences of an economic policy mistake could be serious in this context.

Do you see value stocks or growth investing leading the markets in 2022?

There will be opportunities on both sides, but the biggest and most attractive opportunities are among growth stocks right now.

The year 2020 was the party year for growth stocks, investors were buying all growth stocks at whatever price, irrespective of their fundamental strength or valuation. The year 2021 is the year of the hangover, almost all growth stocks were killed, this includes mediocre businesses, good businesses, and excellent business.

The magnitude of the price moves in growth stocks through 2020-2021 is unprecedented by many measures. However, it's actually quite normal to see big gains after big losses and vice-versa.

Many of these stocks crashed and got too cheap in March of 2020. This created the conditions for an astronomical rally from the lows until February of 2021. After too much speculation and momentum chasing, growth stocks suffered painful drawdowns during most of 2021.

Now the pendulum has once again gone too far, and many of the best growth stocks are currently offering attractive entry points for long-term investors.

This time it will be important to be selective, though. I don't expect all kinds of growth stocks to deliver big gains once again in 2022, only the best companies with superior attributes and long term growth opportunities.

That said, for investors who own the right stocks, the upside potential is very attractive over the years ahead.

Disclosure: I/we have a beneficial long position in the shares of MELI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in ...

more