Poor 10Y Auction Tails Despite Surging Yields

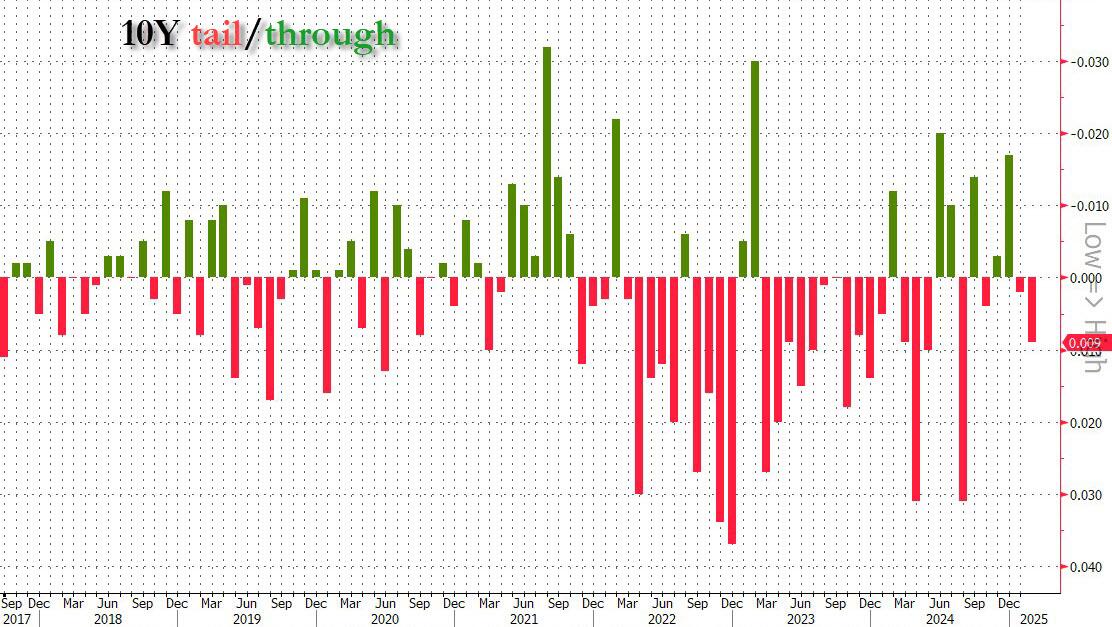

After yesterday's stellar 3Y auction, many were expecting today's sale of benchmark 10Y paper to also be very solid too, especially after the massive post-CPI concession which sent the 10Y surging by over 10bps. It did not quite work out that way, and when the Treasury sold $39BN in 10Y paper at 1:00pm ET, the auction tailed by 0.9bps, the biggest tail since August, in a sale that left a lot to be desired.

(Click on image to enlarge)

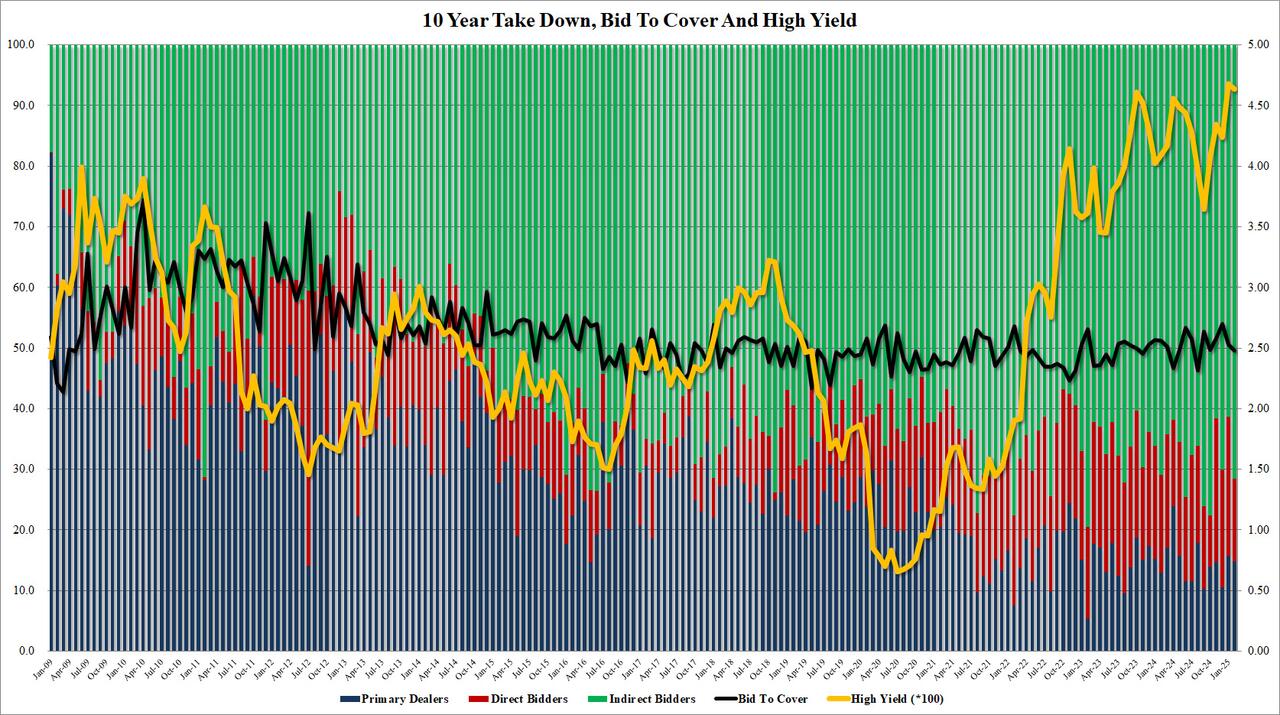

The bid to cover dropped to 2.48 from 2.53, this was the lowest bid to cover since August.

The internals were better with Indirects rising tom 71.6% from 61.4%, the highest since October 24. And with Directs awarded 14.8%, Dealers were left holding just 13.6%, the lowest since last October.

(Click on image to enlarge)

Overall, this was a disappointing, if hardly terrible auction, and considering the massive surge in yields, it probably should have had better participation, although the market was hit by way too many other news to care about this particular sale and predictably, the 10Y barely moved in the secondary market after the news of the auction broke.

More By This Author:

Stocks Slump With Rate-Cut Hopes As CPI Soars In January

Chair Powell Tells Congress Fed's In 'No Rush To Cut Rates', Inflation "Well Anchored"

Tesla Exec Tells Jay Leno: Cybercabs Will Begin "Rolling Around" In Austin, Texas, In June

Disclosure: Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more