Physical Gold Has Become More Reliable Than Treasury Bills

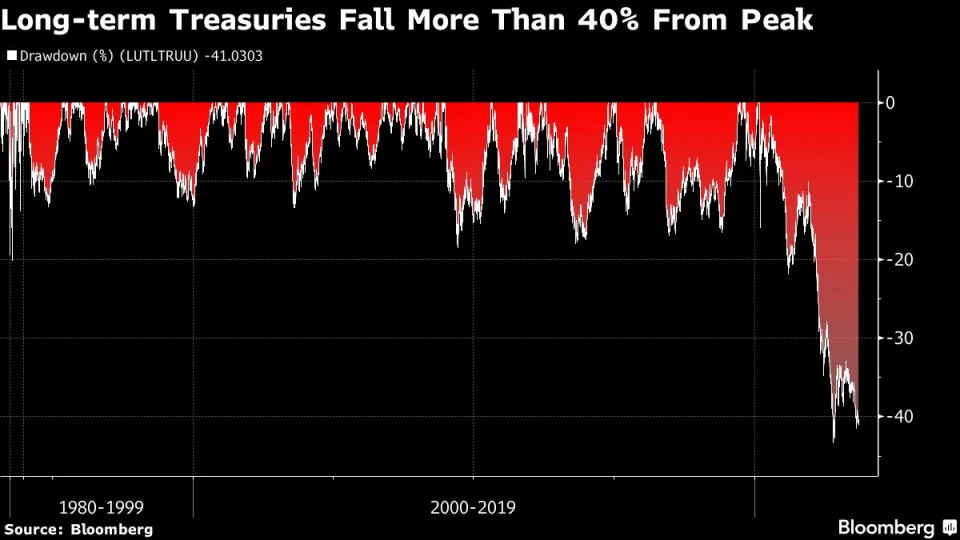

In an article published this week, Bloomberg looks back at the historic underperformance of long-term US bonds:

30-year Treasury bonds have fallen by more than 50%. Losses are starting to mount again, and this is worrying many observers.

Although the US is not exposed to the risk of default, this decline reflects the effects of tighter monetary policy.

These losses are only effective when the organization holding them has to sell them. Theoretically, most buyers of these securities do not use them as short-term liquid products. Such products were logically purchased to be held to maturity.

Nevertheless. In the event of a credit incident, we will see the sale of Treasury bills. And liquidating these assets at a loss would lead to an even sharper fall in their value.

In these conditions, it is easy to understand the importance of avoiding the liquidation of these products at all costs. The historical loss on US Treasuries must absolutely remain "unrealized" and not materialize, in order to avoid undermining the institutions that use these products as the foundation of complex financial instruments.

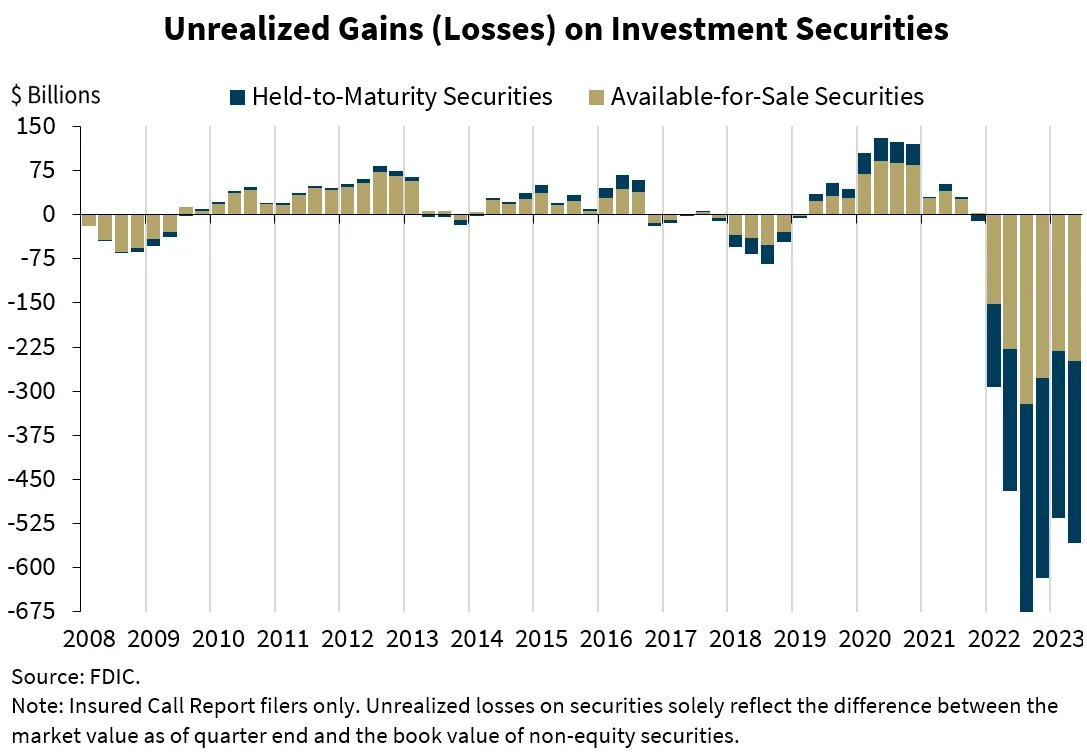

Unrealized losses also concern other products purchased by these institutions when interest rates were kept artificially low by the overly accommodative policies of central banks. The FDIC now estimates these losses at nearly $600 billion:

These figures indicate that a credit incident would have devastating consequences for many financial institutions: with such a high level of unrealized losses, the risk of contagion is probably underestimated.

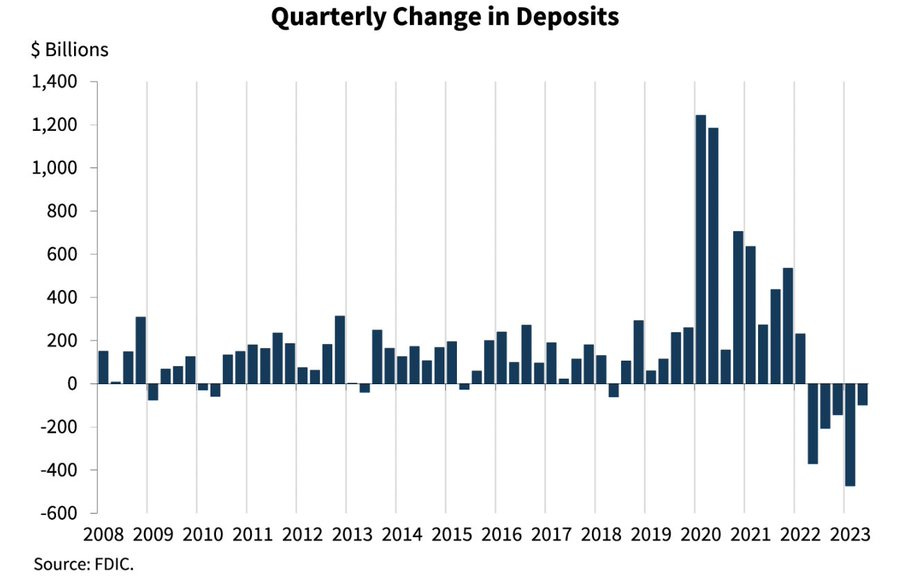

To make matters worse, US banks are seeing deposit withdrawals reach an all-time high:

This makes sense: the rate of return on bank deposits is much lower than the returns offered by money market funds. Americans continue to withdraw their money from banks to invest in safer, higher-yielding products. The bank run triggered by the regional bank crisis last spring has never stopped. The Fed has managed to calm the hemorrhage, but the erosion of deposits continues.

A series of defaults would further weaken the banking sector, which is one of the hardest hit by this sudden change in monetary policy.

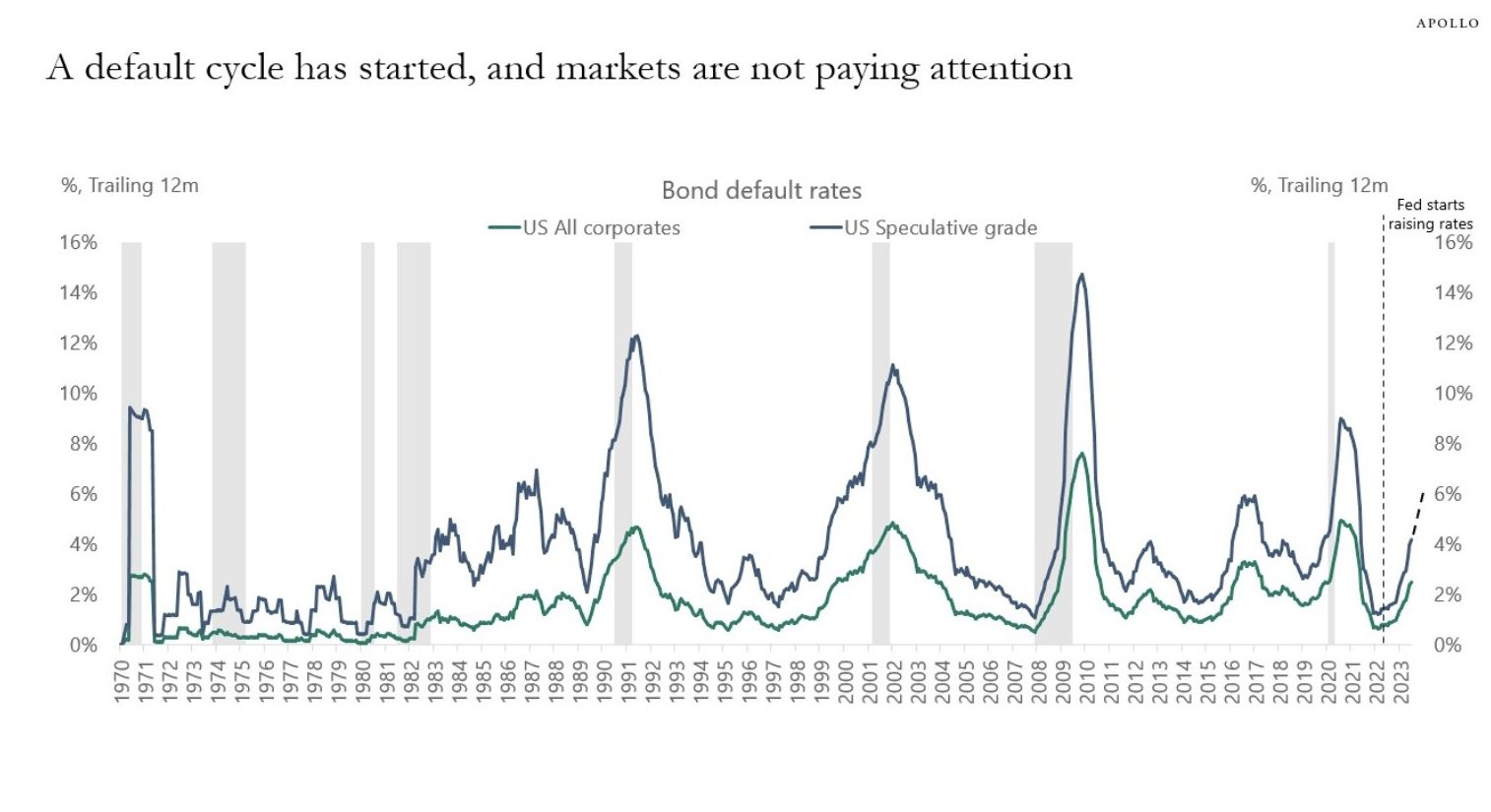

The bad news is that a new cycle of defaults began this summer. But so far, nothing like the figures for 2008...

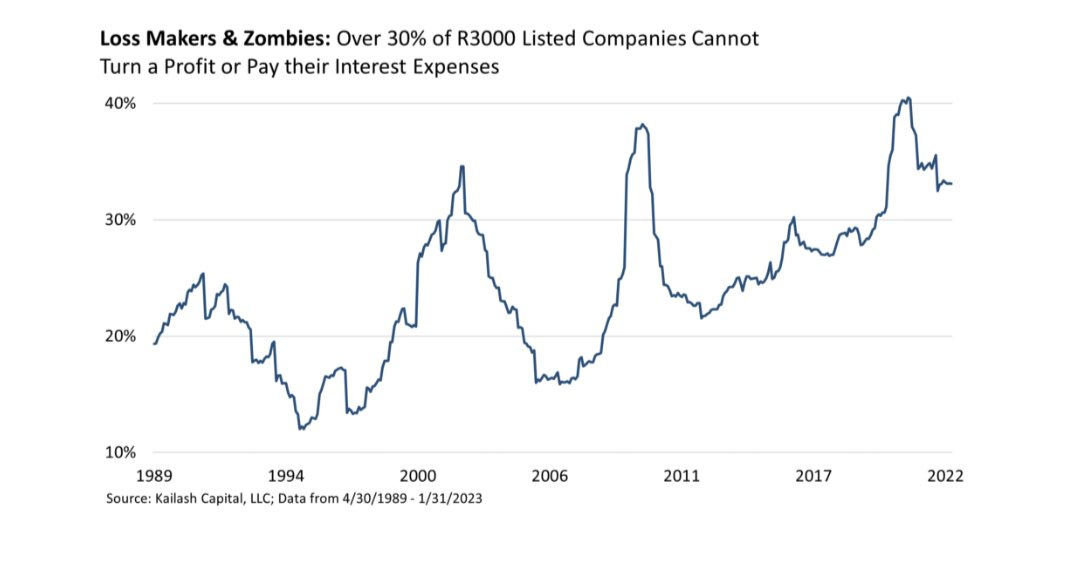

That said, the potential for credit risk is even greater than in 2008, with the number of "zombie" companies even higher than in the last financial crisis:

Around 30% of companies listed on the Russell 3000 are either earning no money or are unable to repay their loans.

Although not yet visible, the potential for defaults linked to sharply rising rates is undoubtedly greater than it seems.

We've changed cycles. Everything that existed during the Fed's accommodative period, when rates were artificially zero, is up for review.

The recent loss on Treasuries breaks a forty-year cycle in which rates were locked in a descending channel:

(Click on image to enlarge)

The TLT index, which measures the performance of 20-year bonds, is falling: the higher yields rise, the lower the index falls. TLT was in an ascending channel from which it abruptly exited, unable to regain it. Graphically, TLT even recently broke a bearish flag, attracting even more bearish speculators to the bond compartment:

(Click on image to enlarge)

TLT is a perfect illustration of the sector's recent decline.

The sharp fall in this index has attracted many speculative shorts to bond assets. In recent months, hedge funds have accumulated record short positions in US Treasuries, which logically increases the risk of a short squeeze should bonds rebound in the short term.

The Fed's decision not to raise rates further could lead to a period of instability in these products.

In this case, bonds would be considered oversold by some participants, sniffing out an opportunity to "squeeze" hedge funds with too much exposure to selling.

The risk of volatility on these products increases significantly, even though these bonds were intended for managers looking for some form of stability in their portfolios.

Treasury bonds may no longer be seen as the stable, reliable asset they have been for forty years. This radical change in perception of US government bonds coincides perfectly with the decorrelation observed between gold and Treasuries (which we discuss regularly in these bulletins).

China has thus reduced its portfolio of Treasuries:

Saudi Arabia followed suit:

It's as if gold is regaining its role as a stable asset at the expense of bonds, which have lost this role.

This loss of the defensive role of Treasuries is underpinning central banks' demand for physical gold:

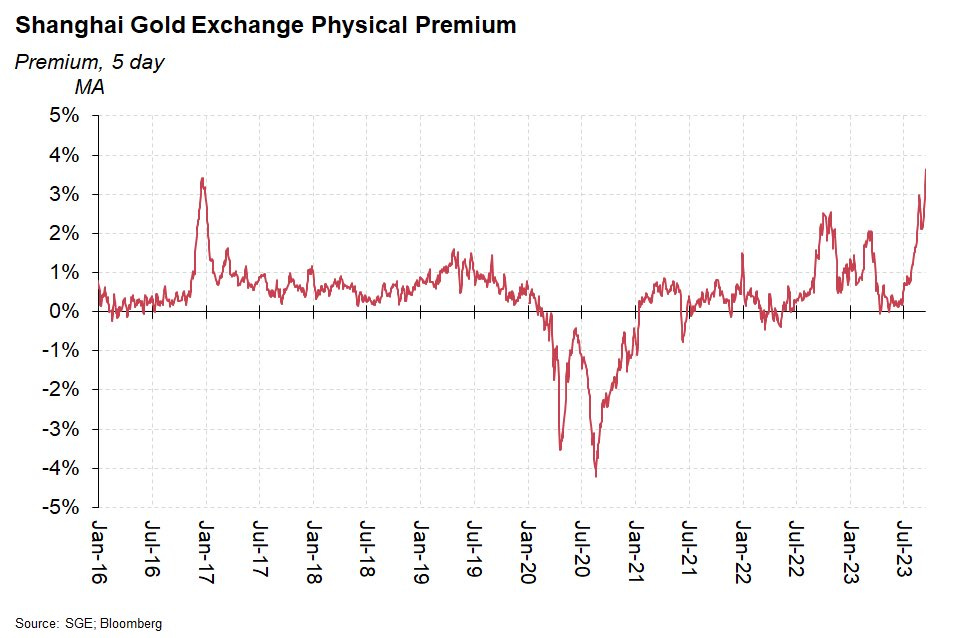

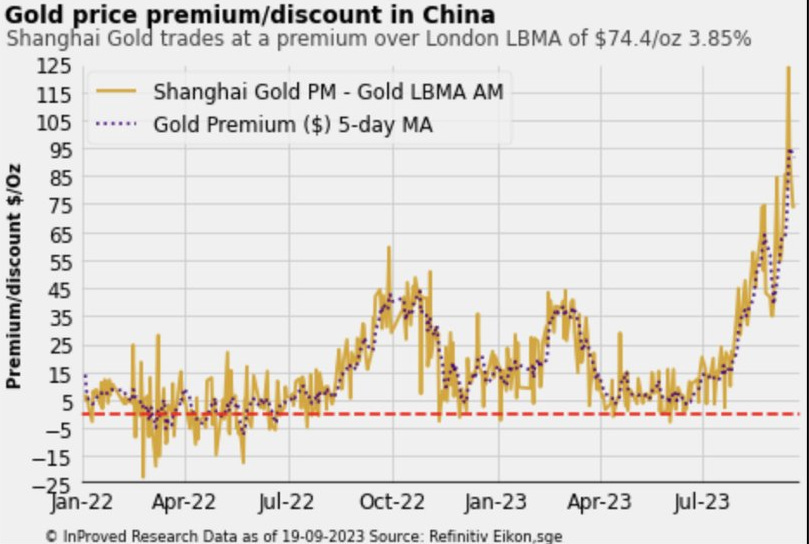

Trading volumes on the Chinese market do not reflect a real rush to buy gold, as the rise in the premium is undoubtedly linked to difficulties in the supply of physical gold.

The effect of this squeeze is to strengthen arbitrage opportunities, increase the flow of physical gold to the East and support the price of gold (precisely because of these arbitrage opportunities).

In recent days, China has raised its import quotas for physical gold, but premiums remain very high. The price of an ounce of gold is $75 higher in Shanghai than in London:

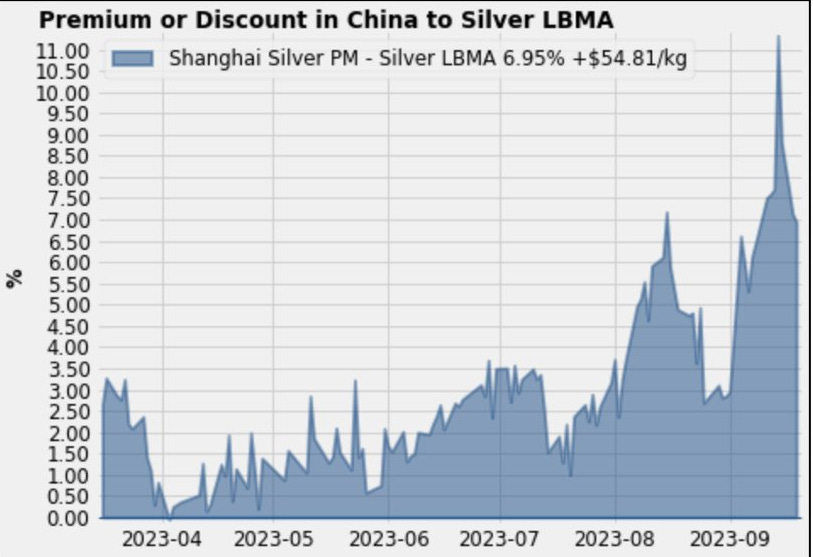

The same applies to silver, on which a +7% premium remains...

If these premiums persist, arbitrage opportunities are likely to accelerate delivery requests on the COMEX, further complicating the control of futures prices by participants wishing to protect their short positions.

Supply tensions in the Chinese market could enable the gold market to move closer to a true price-determining mechanism linked to physical demand.

The importance of physical gold demand and its influence on the gold market is one of the reasons why gold prices are decorrelated with the level of the dollar and interest rates. The reality of the physical market is slowly breaking the influence of derivative markets on the price of the yellow metal.

More By This Author:

Russian Gold Reserves Rose By 3 Tonnes In August

Is It Time To Trade In Your Real Estate For Precious Metals?

Inflation Back On The Rise In The United States

Disclosure: GoldBroker.com, all rights reserved.