Oil Prices Are Not An Economic Predictor

Image Source: Unsplash

“Davidson” submits:

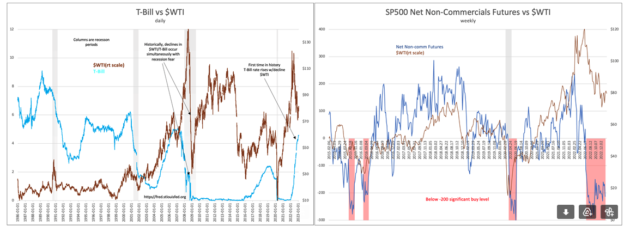

One of key assumptions behind commodity markets is that it is economic demand that drives pricing. It is the long-held belief behind the moniker “Dr. Copper” as an early predictor of economic trends. Oil prices carry a similar assumption. Neither assumption is supported by the historical data. Two charts compare WTI, Recession periods, T-Bill rates and the SP500 Net Non-Commercial Futures Position which prove the point WTI is a sentiment indicator along with the other sentiment driven indicators. The only true economic indicator in this mix is Recession periods.

(Click on image to enlarge)

It has been long-conflated that sentiment drives economic activity and that certain correlated indicators are believed to be economic measures and good predictors of future economic activity and equity markets. At first glance, it appears that all are correlated with recessions till one looks between recessions. Sentiment does turn pessimistic during recessions but a prime measure of sentiment, SP500 Net Non-Commercial Futures Position, which is highly correlated to negative headlines has multiple downturns, below -200, between recessions when economic growth is trending higher. Oil prices follow every time. As markets have grown in value, institutions have been forced to deploy algorithms to shift capital as rapidly as possible to in an effort to produce attractive quarterly results. In the process, algorithms have incorporated WTI and other commodity prices as indicators believing them to carry trending and early economic indications when they do not.

In my opinion, institutions have hedged portfolios buying 5yr-10yr Treasuries with the expectations that 1) The Fed will cause a recession and drive inflation lower which in turn will cause additional equity correction and 2) drive 5yr-10y rates lower resulting in a profitable trade. The current period of pessimism has been one of the most intense since the Great Recession of 2008, perhaps even more so. It has been so intense a period with 12mos of recession predictions that a very unusual spike in T-Bill rates has developed. This spike has never occurred in prior markets when investors have been this pessimistic. Investors historically have driven T-Bill rates lower as they sought the safe haven of short-term maturities. Not occur this time. Instead, T-Bill rates have soared as 5yr-10yr rates declined pushing longer-dated rates well-below current inflation. This has all the appearances of a speculative hedging bet on transitory inflation and lower rates with a recession onset. Never in history have so many initiated such a trade in the face of intense recessionary anticipation. In my opinion, this trade will prove incorrect.

The problem with the current positioning by institutions is that the 40% expansion of M2(Money Supply) which has occurred with more on the way creates inflation that lasts several years regardless of how high rates rise. This is so because a 40%+ explosion in M2 represents currency expansion without economic productivity. Only economic productivity can create the economic value to offset M2 expansion without inflation. Several years of productivity at least are required. Inflation will prove a continuing problem till either productivity catches up or government reverses spending. Higher rates and higher commodity prices are a feature of inflation once investors come to realize that longer-dated maturities carry more capital risk than initially assumed. Those calling for transitory inflation and the Fed’s ability to control it is misread of history.

The recommendation remains to avoid longer-dated maturities and to populate portfolios with industrial and energy related issues which have economic demand and the flexibility for inflation pass through.

More By This Author:

It’s Just Odd Out ThereAre We Done Raiding The SPR?

Sentiment Vs Fundamentals

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more