October 2022: Market Valuation, Inflation And Treasury Yields

Our monthly market valuation updates have long had the same conclusion: US stock indexes are significantly overvalued, which suggests cautious expectations of investment returns. In a "normal" market environment -- one with conventional business cycles, Federal Reserve policy, interest rates, and inflation -- current valuation levels would be a serious concern.

On August 4, 2020, the 10-year Treasury yield hit its all-time low of 0.52%. As of October 31, 2022, it was at 4.10%.

Here is a scatter graph with the market valuation on the vertical axis (log scale) and inflation on the horizontal axis. It includes some key highlights: 1) the extreme overvaluation and irrational period of the Tech Bubble, 2) the valuations since the start of the last recession, 3) the average P/E10 and 4) where we are today. The inflation figure in the highlighted box is YoY. We have also highlighted the inflation "sweet spot" in green, which we discuss below.

Note on inflation: the inflation figure is extrapolated for the last month and is based on the previous two months. The Census Bureau's CPI figure does not come out until mid-month for the previous month. These extrapolated figures are then updated to the current CB number when released.

The inflation "sweet spot", the range that has supported the highest valuations, is approximately between 1.4% and 3%. See, for example, the highlighted extreme valuations associated with the Tech Bubble arbitrarily as a P/E10 of 25 or so and higher.

The latest P/E10 valuation is 28.3 at a 7.92% year-over-year inflation rate, which is within the sweet spot mentioned above and the P/E10 valuation is in extreme valuation territory. Again, a note on inflation: the inflation figure is extrapolated based on the previous two months. The Census Bureau's CPI figure for the previous month does not come out until mid-month. These extrapolated figures are then updated to the current CB number when released.

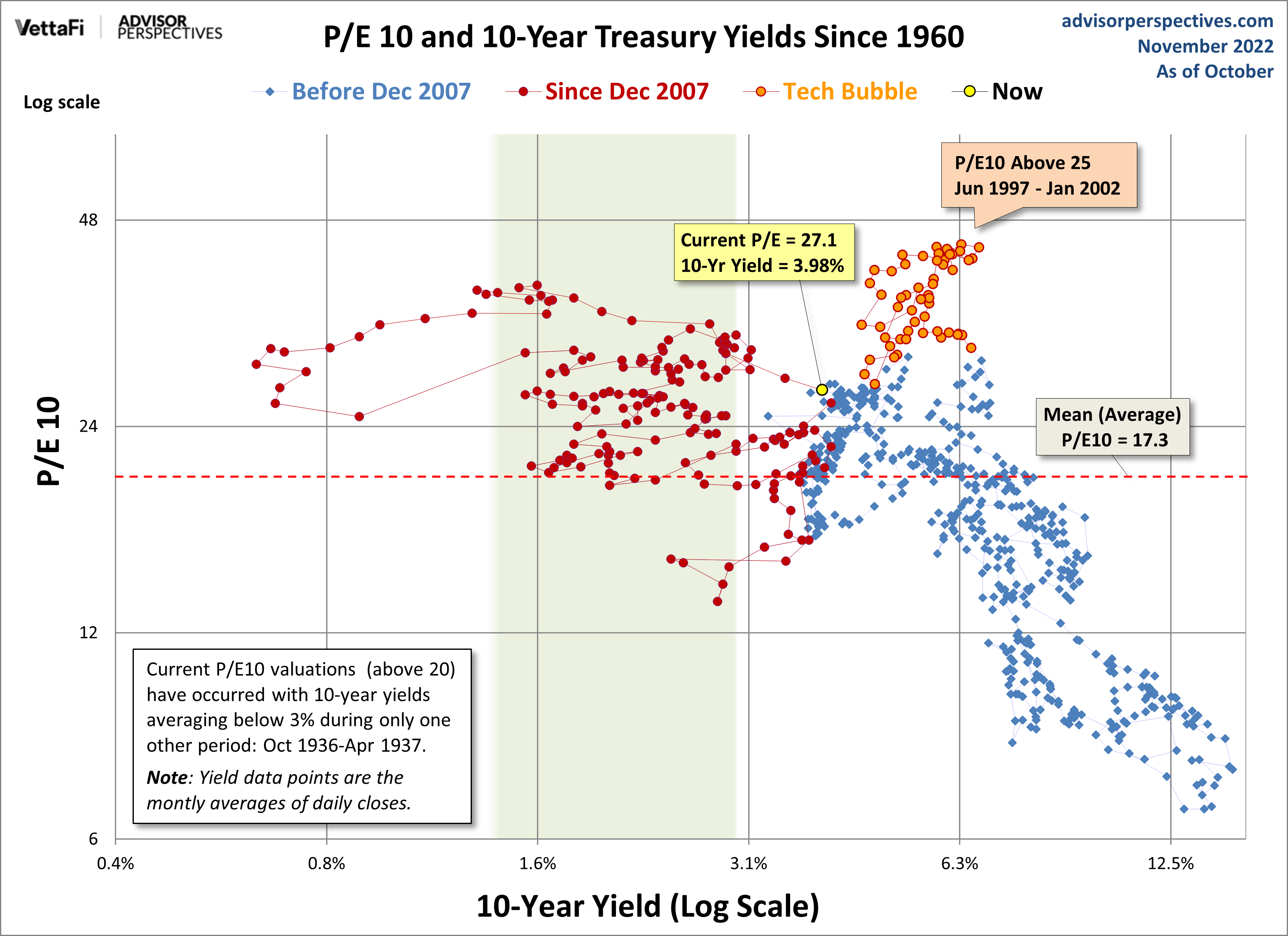

P/E10 and the 10-Year Treasury Yield

A common question is whether a valuation metric such as the P/E10 has any merit in a world with Treasury yields at current levels. Investors who require portfolio growth might indeed be motivated to disregard historic indicators that warn of an overvalued market. But what does history show us about the correlation between the P/E10 and the 10-year constant maturity yield? The next scatter graph offers some clues. The horizontal axis has been switched to the 10-year yield. The chart uses a log scale to better illustrate the relative yield values.

On the recommendation of Ed Easterling of Crestmont Research, we have adjusted the chart to begin in 1960. Prior to the 1960s, bond yields did not respond consistently to changes in the inflation rate. We've highlighted the inflation "sweet spot" here as well. Note that the P/E valuation is in extreme valuation territory - the highlighting is only meant to spotlight the inflation interval.

In the months following the Great Financial Crisis, we have essentially been in "uncharted" territory. Never in history have we had 20+ P/E10 ratios with yields below 2.5%. The latest monthly average of daily closes on the 10-year yield is at 3.98%, which is above its all-time monthly average low. As of August 4, 2020, the daily 10-year note hit an all-time low of 0.52%.

What can we conclude? We have been in "uncharted" territory. Despite the end of QE, many analysts assume that Fed intervention through its Zero Interest Rate Policy (ZIRP), will keep yields in the basement for a prolonged period, thus continuing to promote a risk-on skew to investment strategies despite weak fundamentals.

On the other hand, we could see a negative market reaction to a growing sense that Fed intervention may have its downside, resulting in an aberrant bond market and increased inflation/deflation risk.

More By This Author:

Treasury Snapshot - Thursday, Nov. 10Consumer Price Index: October Headline At 7.75%, Smallest YoY Increase Since Jan 2020

Weekly Unemployment Claims: Up 7K, Worse Than Forecast