"No Deal" On Brexit Or COVID Relief Slams Stocks, Sends 2Y Yields Near Record Lows

Deal or No Deal? The answer on both sides of the pond is simple - No Deal - as EU-UK talks collapse in Brussels and COVID Relief bills keep dying on the floor in Washington

US equity markets are unhappy about it (Dow is only outperforming thanks to DIS's ridiculous squeeze higher - up 16% adding 125 points to The Dow).

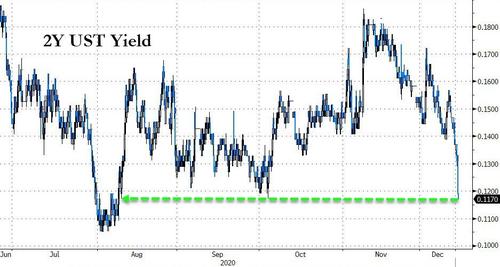

And bond yields are sliding fast with 2Y at its lowest since August.

And they're getting close to record lows.

Source: Bloomberg

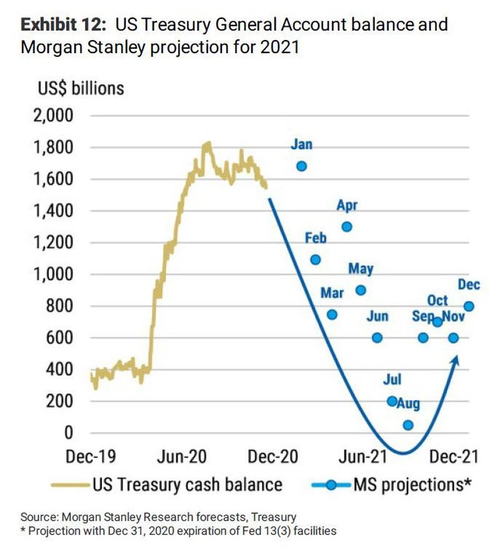

So what is on traders' minds? The answer, as we detailed previously, seems a supply-demand imbalance: increasing bank reserves and an expected steep drop in Treasury bill supply.

The Federal Reserve has the tools to keep front-end rates above zero, but the debate is when it could use them, against a backdrop of virus fallout, fiscal-stimulus deadlock and Brexit risk.

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more