New Uptrend Just Startting

I thought that a short-term downtrend had started on Nov. 18. Either it was a very brief downtrend, or I labeled it incorrectly because the market definitely didn't look like it was correcting this past week. For now, I'm just going to call it a new uptrend as of Nov. 25.

One reason that I am comfortable calling it a new uptrend is because of this chart below of the NYSE Summation.

Early in November, there were quite a few people expressing concern about an overheated stock market, and, as a result, I think there was some profit-taking causing the broader underlying trend to start to turn lower.

But now, I think after a number of stocks had some time for a breather, the trend for the majority of stocks has turned upwards again.

Should we buy into this new uptrend? The market has been experiencing a powerful shift from pessimism to optimism, and it seems to me like the market still has room to convert more bears to bulls. So this means we buy stocks, doesn't it?

However, the best time to find short-term buying opportunities is when the PMO index is at the bottom of its range, not close to the top. So, with this in mind, I am comfortable letting some cash sit uninvested while the market reaches up to new highs. I'm going to think of the uninvested cash as a bit of insurance.

Switching to the bond market, the medium-term trend remains lower, but so far it continues to look like a correction within a larger uptrend.

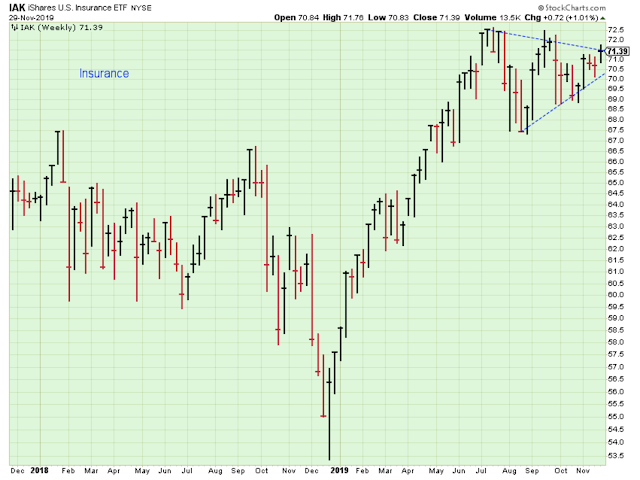

Regarding sector strength, there a number of very interesting charts. For instance, the insurance group looks promising.

The payment processors are showing some very nice strength.

Outlook Summary

The long-term outlook is weak-growth as of Oct. 5.

The short-term trend is up as of Nov. 25.

The medium-term trend for the price of bonds is down as of Oct. 11 (prices lower, yields higher).

Investing Themes:

Technology, Home Construction, Biotechnology, Clean Energy, Insurance, Payment Processors

Strategy During a Bull Market:

- Buy large-cap stocks and ETFs at the lows of the medium or short-term market trends

- Buy small-cap growth stocks on breaks to new highs in the early stages of market trends

- Reduce buying when the market trend is at the top of the range

- Take partial profits when the market uptrend starts to struggle at the highs

- The cardinal rule is never invest based on personal politics because the stock market can do well regardless of which political party is in control

Disclaimer: I am not a registered investment advisor. My comments above reflect my view of the market, and what I am doing with my accounts. The analysis is not a recommendation to buy, ...

more