"Never Seen Anything Like This": Junk Bond Yields Slide Below 4% For First Time Ever In Record Buying Spree

“Never Seen Anything Like This”: Junk Bond Yields Slide Below 4% For First Time Ever In Record Buying Spree

It’s party time for zombie companies everywhere as “high yield” is now officially “low yield.”

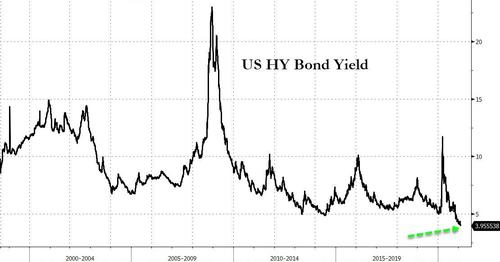

The record stock market euphoria and the resulting “dash for trash” seen in recent days as pennystock after pennystock has exploded higher on the back of bull raids orchestrated by redditors and complicit hedge fund managers, has spilled over into the junk bond market where the average yield on US junk bonds just dropped below 4% for the first time ever as investors keep piling into an asset class historically known for its “high yields” (hence the name), although if sub-4% is considered high then there is a problem.

As shown below, the Bloomberg Barclays U.S. Corporate High-Yield index dipped to 3.96% on Monday evening, its sixth straight session of declines.

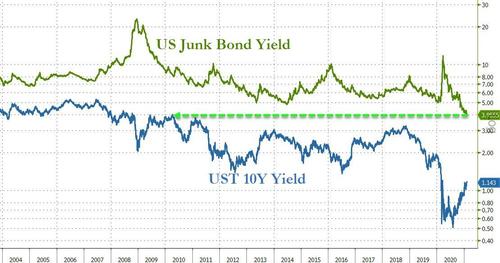

Despite the recent rise in nominal treasury yields amid surging 10Y breakevens, investors have continued to gobble up junk bonds at a record pace as an alternative to the “not so high yield” offered by what is known as less-risky bonds such as Treasurys.

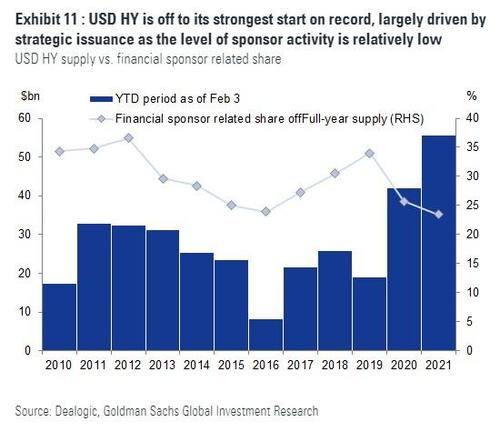

The surge in demand for junk, which is now also explicitly backstopped by the Fed which last year purchased various high yield ETFs effectively removing risk from the equation, has led to the strongest start to any year on record according to Goldman.

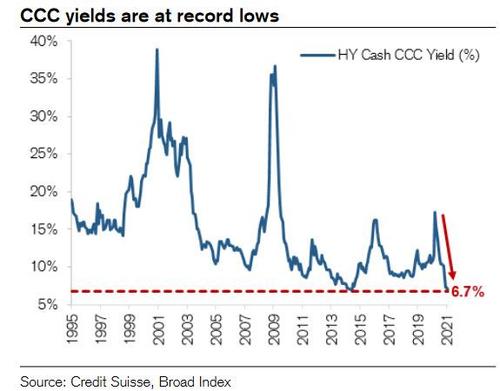

As a result of this unprecedented demand for junk, a majority of new issues, even those rated in the riskiest CCC tier of junk, have been hugely oversubscribed. So much so, in fact, that according to Credit Suisse, this year has witnessed a remarkable rally in lower quality HY paper with the “triple hooks”, i.e., the lowest quality CCC bonds up already +1.9% for the year and yields now sitting at record lows at 6.7% for our the broad Credit Suisse index.

While CCC bonds have outperformed the rest of the market for three consecutive months, according to Bloomberg, the spread compression means that there is now virtually no difference between the various junk bond tranches: notes rated single-B now average a 4.30% yield, while BBs yield 3.05%.

“I’ve never seen anything like this”, said a fixed income bond manager who has lived through the euphoria of the housing bubble and lived to tell about it.

Meanwhile, as Bloomberg adds, demand for the debt has outweighed supply by so much that in a novel spin on reverse inquiry “some money managers are even calling companies to press them to borrow instead of waiting for deals to come their way.”

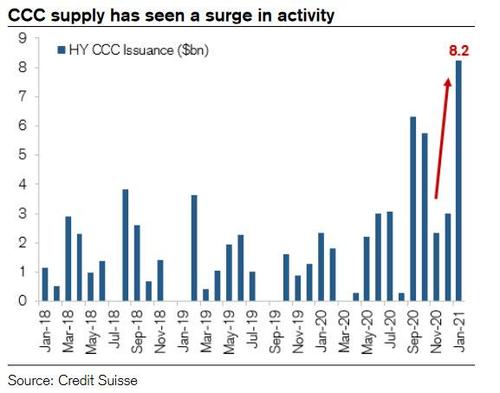

Indeed, the ravenous appetite for the lowest quality paper has fueled a spike in issuance with January seeing $8.2bn in CCC supply, the busiest month for that rating since… the financial crisis.

It also means that the infamous PIK are back. According to Bloomberg, the relentless demand for crap means that “some of the riskiest types of transactions come to market, such as bonds that are used to fund dividends to a company’s owners and so-called pay-in-kind bonds that allow a borrower to pay interest with more debt.”

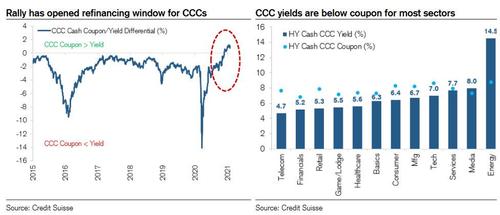

Furthermore, in a remarkable twist, the rally has now become self-sustaining because as CS also note, the rally has opened up a rare window of opportunity for CCC names to refinance as average coupons now sitabove average yield, which means that the lower yields drop, the more CCC issuance will flood the market!

While this avalanche of junk is great news for zombie corporations which will be able to obtain cheap access to cash, allowing them to continue their cash burning, deflationary existence for another year or two, it’s an ominous sign for the bond investors buying paper at the absolute top of the market because even the smallest hiccup would send yields soaring. Then again, judging by their comments, not only are they not worried, they just want moar: Speaking to Bloomberg, David Norris, head of U.S. credit at TwentyFour Asset Management, said that CCCs bonds which have accounted for a significant chunk of recent supply, may be one of the best parts of credit this year:

“This robust new issue pipeline of lower-quality credit is worth poring over as there are likely to be some good stories in here for investors with sufficient liquidity to get involved,” he said.

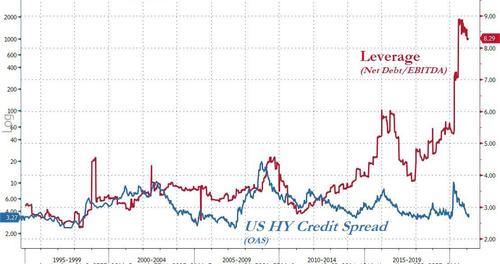

It wasn’t clear if he was trying to convince others or himself that his purchases are prudent, because while the party can and will go on as long as there are greater fools, one look at the fundamentals…

… confirms that the party will only last as long as central banks keep injecting hundreds of billions into the market each and every month.

More By This Author:

Saudi Aramco's Profits Soar On High Oil PricesOil Plunges, Sending Energy Stocks Sharply Lower: Here's What Driving The Selloff

The State Of Unemployment In Europe

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more