Nasdaq Soars To Best H1 In 40 Years; Yield Curve Crashes To 'Most Inverted' Ever

Image Source: Pexels

The past month has seen a massive divergence between macro data reported in US and Europe (the latter seemingly collapsing while the former accelerates). The Global Macro surprise index, however, fell back into negative territory.

Source: Bloomberg

In fact, Q2 saw the biggest collapse in Europe's macro data on record.

Source: Bloomberg

The gap between US and European macro is dramatic. However, we note this has tended not to be a 'decoupling,' but a lead-lag series (so either the US is about to severely disappoint, or Europe is set to soar versus expectations).

Source: Bloomberg

Just one thing, though -- while the macro surprise index is 'relative to expectations,' the Leading Economic Indicators signal has been contracting for a year and screaming for recession.

Source: Bloomberg

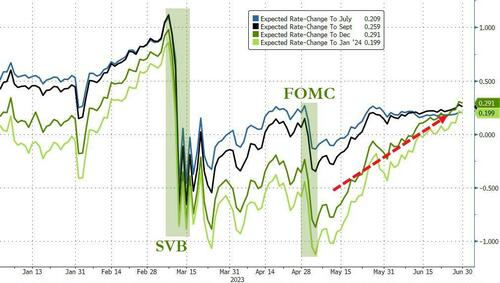

Amid those macro moves, rate-change expectations are shockingly close to unchanged on the year -- despite the massive dovish shift after the SVB collapse (and on the May FOMC 25 bps hike). Since then, the hawks are back in control, pricing in no rate-cuts to year-end.

Source: Bloomberg

However, none of that macro information matters to the equity markets, where the Nasdaq (led by the 'magnificent seven,' or just AAPL) surged in H1. The Dow was H1's laggard, up a mere 3.9%.

Source: Bloomberg

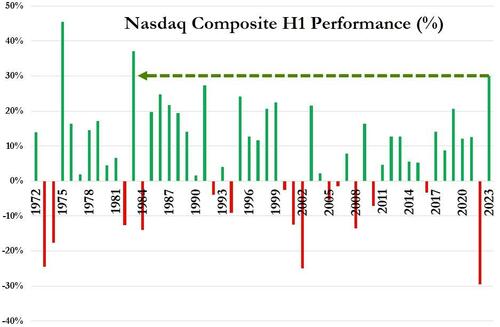

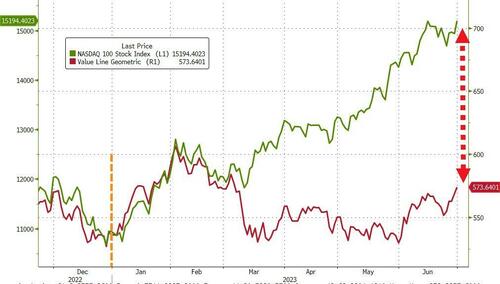

The Nasdaq Composite rose around 31% in the first half of 2023 -- its biggest H1 gain since 1983 (outpaced only by the more concentrated Nasdaq 100 which rose 37%, its best H1 ever). Last year was the second worst H1 in history, and this year saw the third best ever for the composite.

The median for US stocks rose 6% in H1 (based on the ValueLine Geometric Index).

Source: Bloomberg

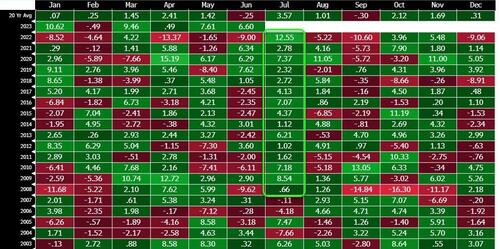

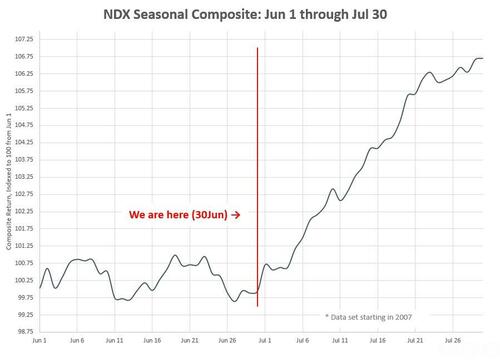

The Nasdaq 100 has been green in July for 15 consecutive years, with an average return of +4.64%.

Source: Bloomberg

The first 15 days of July have been the best two-week trading period of the year since 1928. Since then, July 3 has boasted the highest hit rate for positive returns (72.41%), followed by July 1 (72.06%).

Tech and Discretionary stocks outperformed dramatically in H1, while Energy and Utilities tumbled.

Source: Bloomberg

H1 2023 saw the biggest outperformance of Growth over Value since H1 2020, completely decoupling from the yield curve.

Source: Bloomberg

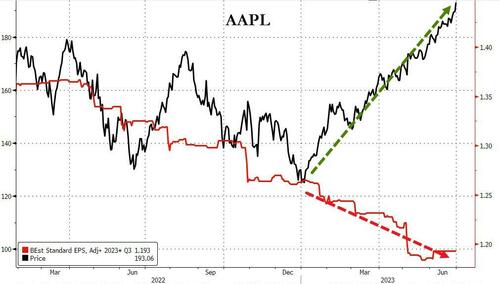

Before we leave the subject of equities, we would be remiss to not bring attention to the fact that Apple is once again a $3 trillion market cap company.

Source: Bloomberg

But there is one thing to note.

Source: Bloomberg

Equities decoupled from the credit market in Q2.

Source: Bloomberg

Additionally, valuations are getting stretched.

Source: Bloomberg

US Treasuries appear very mixed in H1, with the short-end over 40 bps higher in yield while the 30-year yield is down over 10 bps.

Source: Bloomberg

The yield curve crashed lower in Q2, flattening to its most inverted quarterly close ever.

Source: Bloomberg

The dollar ended the month lower, the quarter flat, and down modestly year-to-date. Bloomberg's Dollar Index has basically traded sideways in a small range since Q4's big drop.

Source: Bloomberg

Bitcoin rallied to its best H1 since 2019, up over 80% to $31,000, with Ethereum up over 60%.

Source: Bloomberg

Commodities are down for the fourth quarter of the last 5.

Source: Bloomberg

Oil fell for the second quarter in a row, while gold managed to scrounge up some gains in H1. Natural gas, however, was beaten in H1.

Source: Bloomberg

Gold has fallen for the last two months after tagging near record highs over $2000. Additionally, it was down 2.5% in Q1, but for now it appears to be holding above $1900.

Source: Bloomberg

The bulk of NG's decline was seen early in the year, and it has been rising recently -- though well off its highs.

Source: Bloomberg

We also note that the EU-US arb is back within its long-run historical range, as European NG collapsed even more than US NG in H1.

Source: Bloomberg

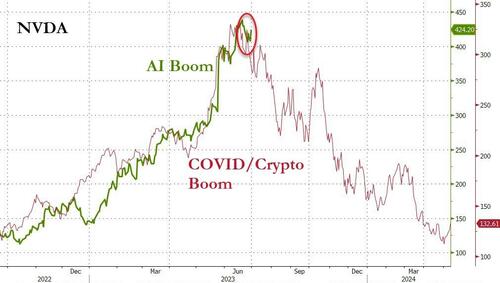

Finally, H1 2023 appears to have rung a similar bell to what was witnessed in H2 2021 for tech.

Source: Bloomberg

So, what will happen next with the AI-boom? Perhaps the oldest adage on Wall Street is not to fight the Fed, but instead as Warren Buffett is fond of saying, “What we learn from history is that people don’t learn from history.”

More By This Author:

Russian Oil Exports From Western Ports To Tumble 18% In JulyFed's Favorite Inflation Signal Remains 'Stuck' As Wage-Growth Re-Accelerates In May

Where Central Banks Have Issued Digital Currencies