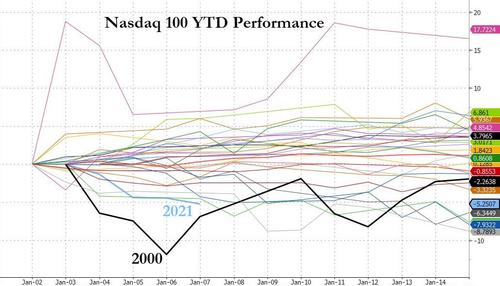

Nasdaq 100 Suffers Worst Start To Year Since 2000; Rates & Risk-Parity Routed

Investors appear to be starting the year with an aversion to long duration stocks and are instead leaning into value stocks with closer ties to an economic recovery. Growth stocks fell to a key technical level this week relative to value stocks.

Source: Bloomberg

The Nasdaq has been down seven of the last eight days and was by far the week's worst performer, as The Dow was mostly unchanged today (but faded into the close to end red like the rest). The S&P 500 ended down 2% and small-caps fell down 3% on the week. This has been the Nasdaq's worst week since February 2021.

“Many retail investors have arguably too high exposure to speculative growth equities and thus they have high interest rate exposure without knowing it,” writes Peter Garnry, Saxo Bank’s head of equity strategy. “As we have said for a year now, it is wise to begin balancing the portfolio blending growth with more low equity duration assets and especially those with supposedly inflation hedging capabilities.”

For context, this is the worst start to a year for the Nasdaq 100 since 2000.

Source: Bloomberg

Energy and financials outperformed this week as tech and healthcare lagged.

Source: Bloomberg

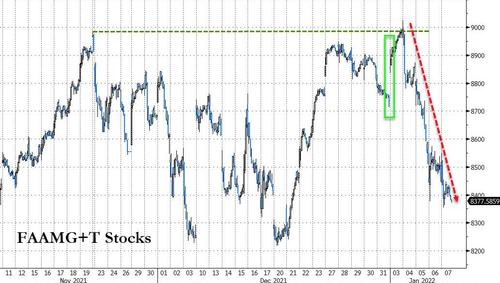

FAAMG+T stocks (which represent 25%+ of the S&P 500 market cap) were a disaster this week, erasing the Santa Claus rally gains.

Source: Bloomberg

The Nasdaq Biotech Index is on track to close 5.8% lower in its worst weekly drop since March 2020, breaking below key support back to December 2020.

Source: Bloomberg

The S&P Airlines Index rose over 7% this week - its best week since early November - as Omicron anxiety began to fade and several nations lifted travel restrictions.

Source: Bloomberg

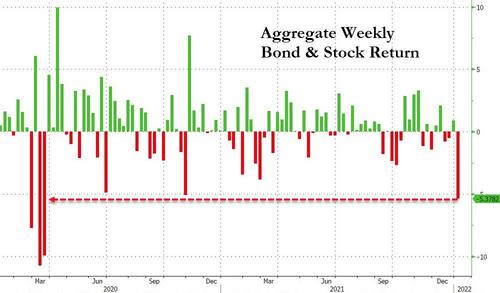

Risk-Parity and vol-focused funds were clubbed this week with one example, RPAR, suffering its biggest weekly drop since the COVID-19 collapse in March 2020.

This helps explain why both bonds and stocks were hammered (obviously along with the hawkish tilt from policymakers) as RP funds force-deleveraged. The start of 2022 saw the worst aggregate weekly loss for bonds and stocks since the market carnage in March 2020.

Source: Bloomberg

On the bond side of the world, it was a bloodbath with the belly also clubbed (7-year +26 bps on the week, 2-year +13 bps, and 30-year +20 bps).

Source: Bloomberg

The 10-year Yield broke out to its highest in two years, while the 30-year Yield remains below the October 2021 highs for now.

Source: Bloomberg

U.S. interest-rate swap spreads were wider across the curve today as corporate treasurers braced for another swath of high-grade corporate supply while money managers hedge interest-rate risk. That widening kept pressure on Treasuries. Higher rates inspired corporate borrowers to pay in 30-year swaps and sell cash bonds about 30 minutes after the December labor market data.

That means they are locking in rates in the long-end ahead of future issuance. Next week’s issuance is expected at ~$30 billion, but if this week’s more than $60 billion in issuance is any guide, that number is likely to rise, especially given the increase in borrowing rates.

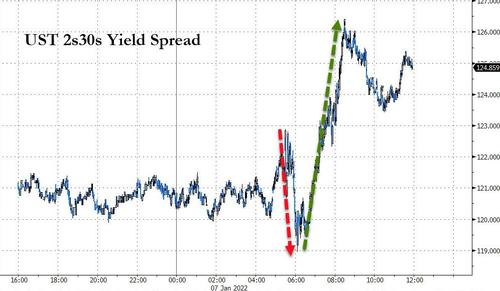

All of which explains why the yield curve suddenly flipped from flattening (a fundamental-based move driven by policy-error fears) after the payrolls print to steepening - a technically-driven move.

Source: Bloomberg

Notably, after the last two peaks in COVID-19 cases, 10-year Yields jumped 50-60 bps for the following three months.

Source: Bloomberg

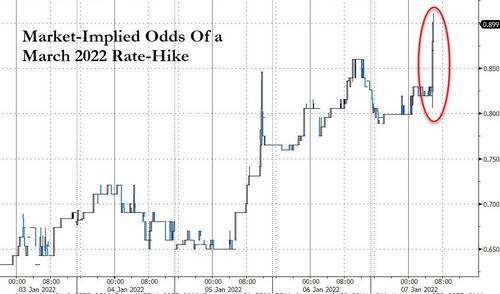

This morning's sent STIRs soaring, pushing the odds of a March 2022 rate-hike above 90%, as well as a 50% chance of a 4th rate-hike by December 2022.

Source: Bloomberg

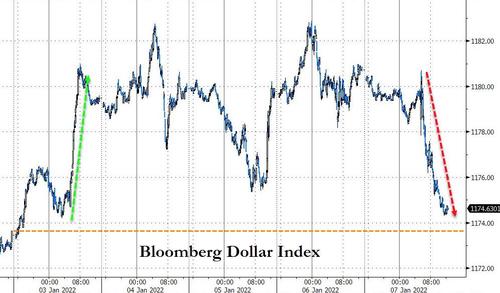

The dollar ended the week only marginally higher, oddly giving the week's gains back today after the 'hawkish' jobs data.

Source: Bloomberg

Cryptos were ugly this week, with Ethereum (ETH-X) being the worst performer.

Source: Bloomberg

This is along with Bitcoin (BITCOMP) breaking down to a $40,000 handle today, its lowest since late September 2021.

Source: Bloomberg

Notably, the US session is dominating the selling pressure on cryptos, perhaps suggesting this is more related to mega-cap tech liquidation.

Commodity markets were very mixed, with crude surging while precious metals and copper were sold.

Source: Bloomberg

WTI rallied up to $80 this week, erasing all concerns over Omicron impacting demand and any short-term gain from Biden's plan to cut gas prices.

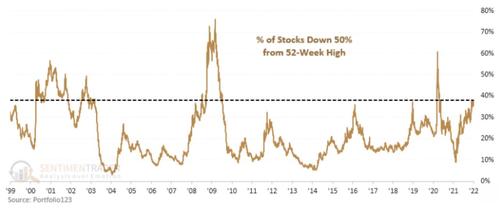

Finally, we note that Sentimentrader points out there is a massive meltdown in Nasdaq stocks: "After Wednesday's post-FOMC selloff, more than 38% of stocks trading on the Nasdaq are now down 50% from their 52-week highs. Only 13% of days since 1999 have seen more stocks cut in half."

And in case you believe in BTFD, you probably should consider this: "When at least 35% of stocks are down by half, the Composite has been down by an average of 47% (!) from its 3-year high." And there is simply no way that a modest 2% drop in the S&P will trigger the Powell Put.

Disclaimer: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more