My 2021 Predictions

I was recently asked to present my 2021 “Look Ahead” for StockChartsTV's Charting Forward 2021, “a yearly market outlook special featuring technical analysis icons Tony Dwyer, Rick Bensignor, Samantha LaDuc, Mary Ellen McGonagle, Craig Johnson, and Gina Martin Adams.” This is timely, as I see the next year as a transition period or inflection point for markets.

2021 Major Observations

- My Stock-Bond-Volatility ratio analysis suggests explosive bouts of volatility interspersed with explosive rallies. It’s called “Distribution” in market lingo and should continue throughout 2021, leading to larger volatility events starting 2022.

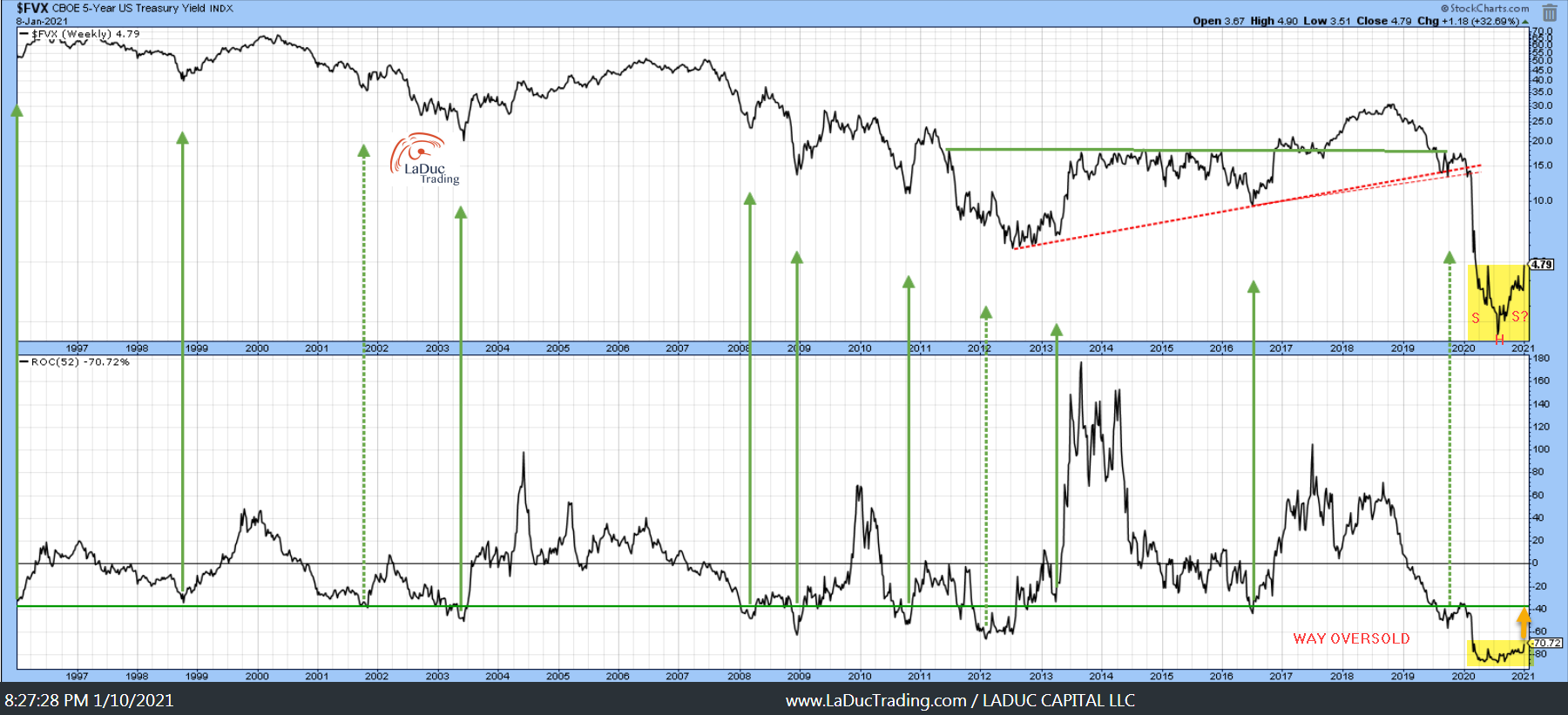

- My Macro and Intermarket read of Bonds/Treasuries indicates they will continue to frustrate fixed income and portfolio managers as their ability to provide ‘risk-free’ returns diminishes, all while real yields rise at the same time the ‘usual’ rotation from stocks to bonds in times of market turbulence fails to materialize and bonds do not serve as a hedge against volatility. Sometimes gold has served as a hedge, sometimes Bitcoin (BITCOMP). For 2021, I believe the US dollar will become trendy again as a hedge.

- My Gold analysis to swing short the Precious Metals complex back on Aug. 6 continues to prove correct – as fiscal policy takes time to pass, as real yields continue to rise, and as inflation expectations front-run actual inflation.

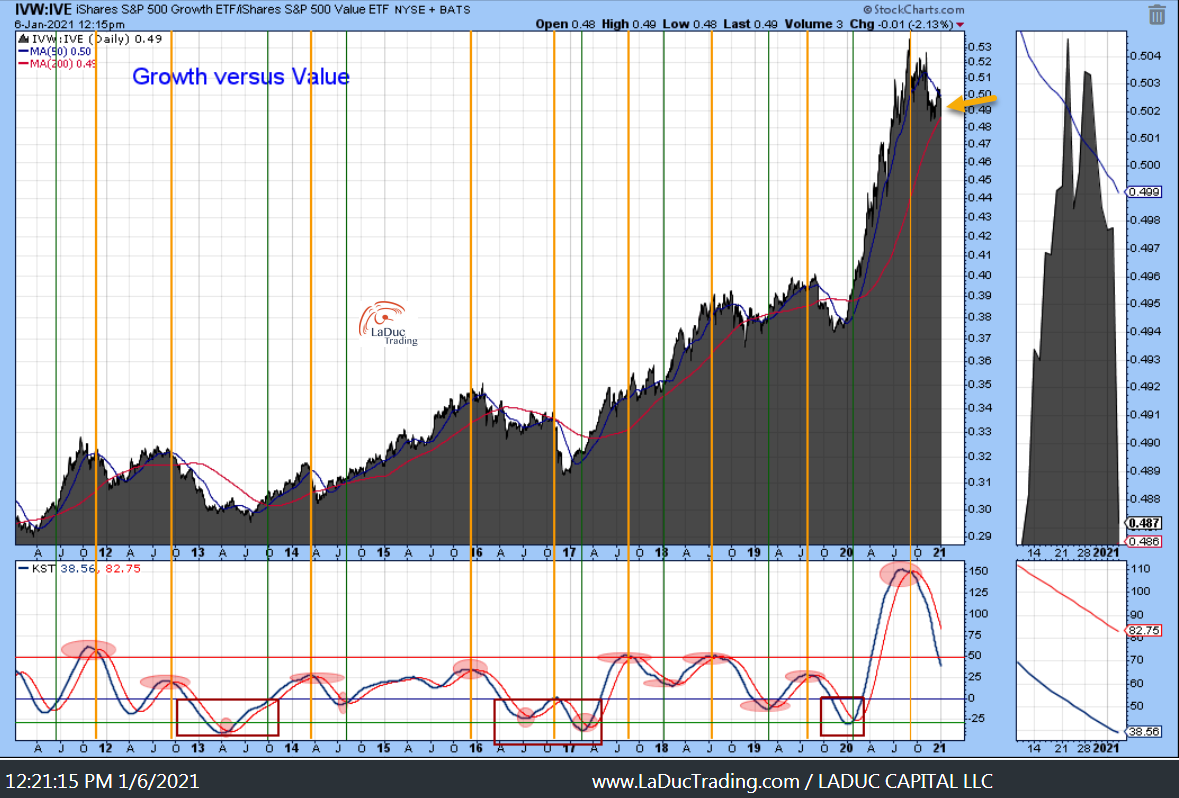

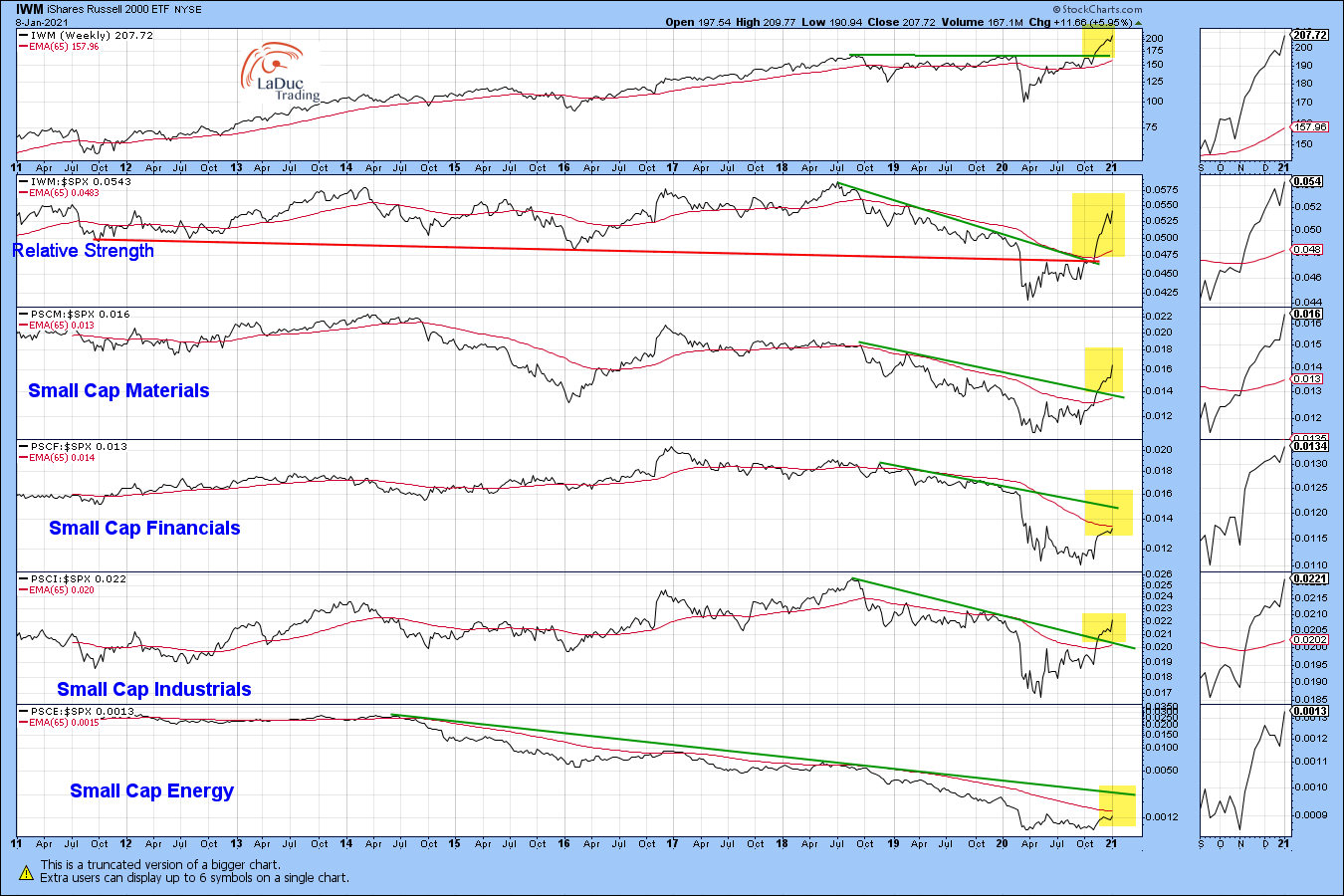

- Since early September 2020, my recommendation to clients was to position for Value to outperform Growth. Since we have seen FANG or MAGA stocks digest sideways for six months, the rotation from Growth (in the form of Big Tech) to Value (in the form of Cyclicals and oversold, left-for-dead short squeeze candidates) has materialized. I contend that this “factor rotation” into Value continues to outperform Momentum – or said another way – Anti-Momentum/Small-caps continue to outperform Momentum/Nasdaq.

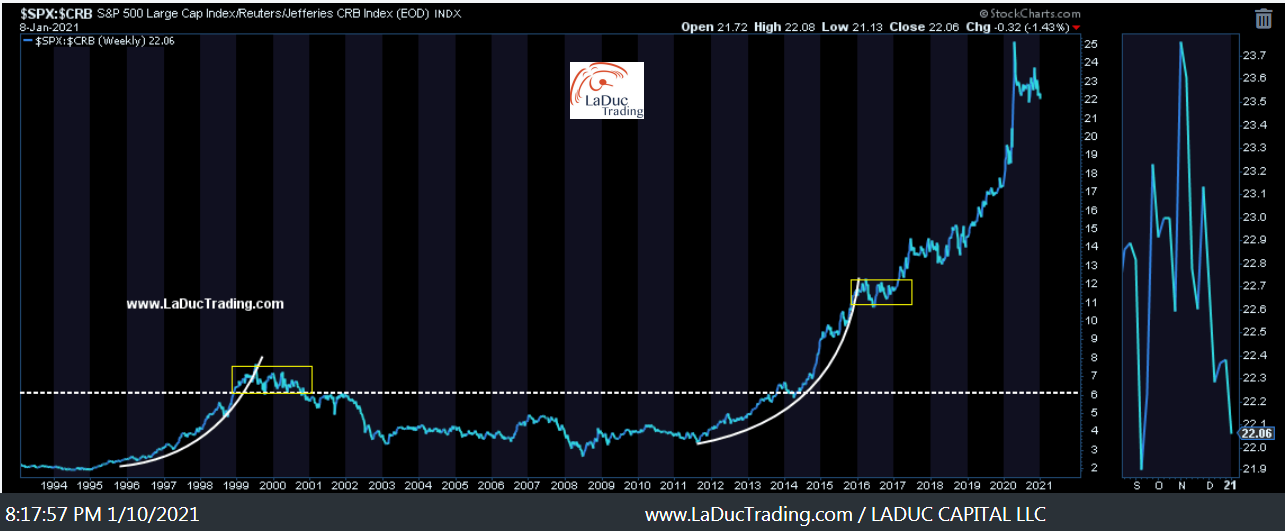

- As part of my “Anti-Momentum” rotation thesis for Q4 of 2020, we have seen an out-sized rotation into commodities. This theme has continued into the new year – especially industrial metals, oil & gas plays, and agriculture. I contend that this is the beginning of a bigger move, but not without being tested – starting now. From my CRB:SPX ratio analysis, it is clear to see that for over a decade, stocks have outperformed commodities. Now commodities are attempting to push through multi-decade lows as they rally into strong resistance. Jumping the shark on the first attempt would be rare – without a major geopolitical or currency event – but I do believe we will have a better picture of this transition by end of 2021 wherein commodities, in time, will outperform stocks.

Current Sector Outperformers and Trends

- MAGA politics rally, while MAGA stocks decline.

- SEMIS succumb to setbacks as China asserts dominance over Taiwan (where the most semiconductor chips are produced) and the Technology (chip-fueled) sector is pressured by both Republicans and Democrats.

- Small-Caps and Short Squeeze candidates produce more upside surprises compared with Growth/Tech plays that have pulled forward valuations/earnings growth that ultimately disappoint and get revised downward.

- Bonds are a bigger risk to the downside than upside.

- Oil has issues with $60.

- Energy over EV (oversold versus overbought).

- Cannabis over Crypto (this is after a pot pullback and a crypto call that does not include Ethereum (ETH-X), which is a better blockchain play).

- Old gold over new gold (both underperform, but Bitcoin falls more).

- Biotech and bugs (both biotech, healthcare sectors perform well relative to many ‘growth’ sectors, as does Cybersecurity).

- Gaming stocks over guns (one trend is worldwide, the other primarily US-based).

- SPACs over Treasuries (until negative real rates in investment grade corporate bonds reverses higher).

- China over US.

Intermarket Chart Attack

The recovery from the devastating effects of COVID-19, a Biden/Harris victory, and a Blue Wave are all events that are very likely priced in. Where does that leave us as we head into 2021 after a euphoric run in markets? It is more likely that we see distribution rather than a continued climb higher.

Pretty much every chart of out-performance looks like this one of Semiconductors – very elevated on every time-frame; from daily to weekly to monthly.

Which leads me as to why I believe we are in a distribution period wherein stocks will rotate to commodities for out-performance if given time.

But not without turbulence – as this CRB monthly chart shows lots of resistance dead ahead.

My ‘Growth-to-Value’ rotation theme since early September is still in play.

Small-caps still have room to go up. Laggards will lead -- take small-cap energy and financials, for example.

Gold will not lead – well maybe relative to Bitcoin, but that’s another story. In short, both are ‘liquidity’ trades and both will be under pressure.

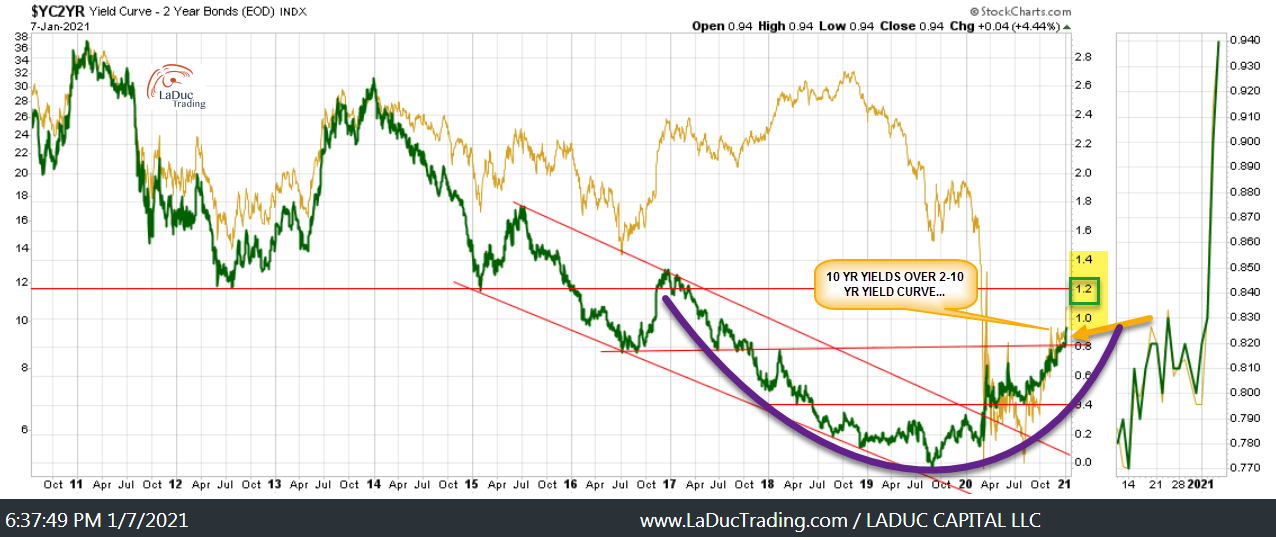

Yields are the wild-card and are tightly connected to commodities – both their rise and fall. Keep eyes on the 5-year as inflation expectations front-run actual inflation.

And speaking of inflation making the (bond) world go round – IG corporate bonds now have a negative real yield for the first time in history. This is an outlier just waiting to revert.

Finally, a continued bear steepener of the yield curve is more likely than not, putting pressure on bonds and equities.