Most Slices Of The US Bond Market Posting Gains In 2024

Year-to-date returns for US fixed income are skewing positive this year ahead of the Federal Reserve policy announcement this afternoon. Although the central bank is expected to leave rates unchanged today, markets are pricing in a September cut and much the US fixed-income market is all-in on anticipating that outcome.

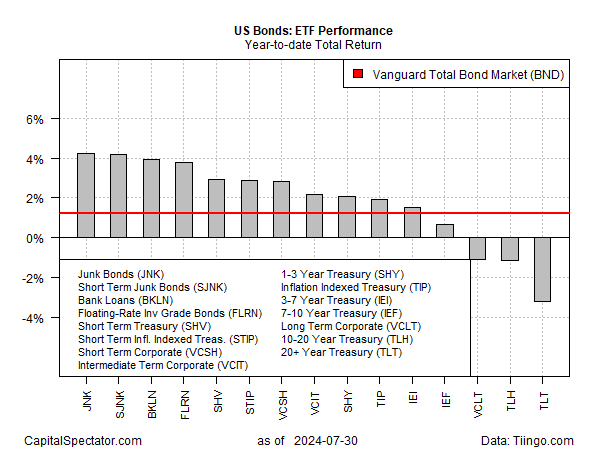

Using a set of ETFs to profile the various segments of bonds shows that 12 of 15 sectors are higher on the year through yesterday’s close (July 30). The three exceptions: long-term bonds, which remain moderately underwater for the year, although it’s worth pointing out that the red ink has faded substantially vs. earlier in 2024.

The top performer so far in 2024: US junk bonds (JNK) with a 4.2% advance. That’s sharply above the rise in US investment-grade benchmark (BND), which is ahead by 1.2% this year.

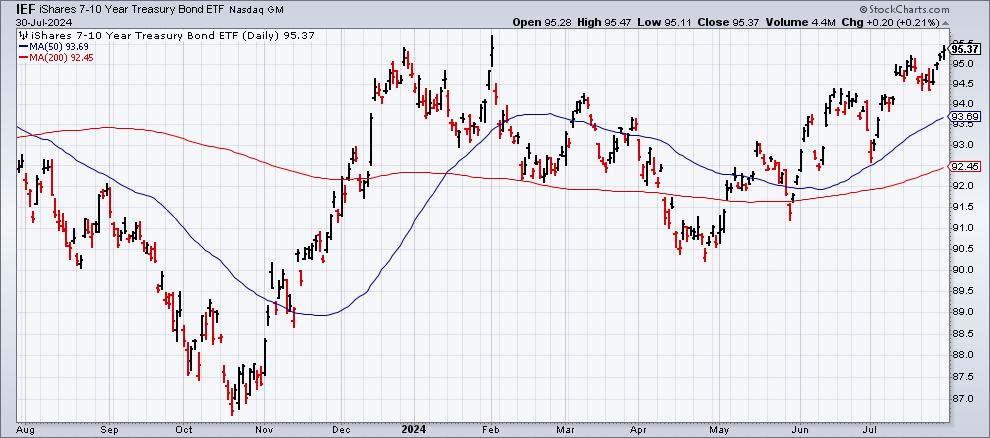

US Treasuries are a key part of the recent strength for bonds overall. The iShares 7-10 Year Treasury Bond ETF (IEF), for instance, is on track to score its third straight monthly advance.

“With cuts already delivered by the [European Central Bank], Bank of Canada, and the Swiss National Bank, we’re reminded that as the proverbial policy tide begins to turn, divergences between major central banks tend to be short-lived,” advise BMO Capital Markets strategists Ian Lyngen and Vail Hartman in research note on Monday.

“This makes the case for a September Fed cut stronger than it does a move on Wednesday — if for no other reason than the [Federal Open Market] Committee will have the benefit of two additional [consumer-price index] prints before the mid-September decision.”

Fed funds futures this morning are pricing in implied probabilities of a near-certainty for no change in today’s policy announcement (2:00pm eastern) and a similarly high-confidence estimate for a rate cut at the Sep. 18 FOMC meeting.

More By This Author:

Will The Fed Meeting Support A September Rate Cut Forecast?Despite The Latest Correction, US Stocks Still Lead Global Markets

Strong US GDP Rise For Q2 Derails Recession Forecasts… Again

Disclosure: None.