Mediocre, Tailing Sale Of 5Y Paper Concludes Treasury Auction Doubleheader

After today's mediocre sales of $42 billion in 2Y paper, moments ago the US Treasury completed the second auction of the day (courtesy of the week's abbreviated schedule) when it sold $43 billion in 5Y notes in another average auction.

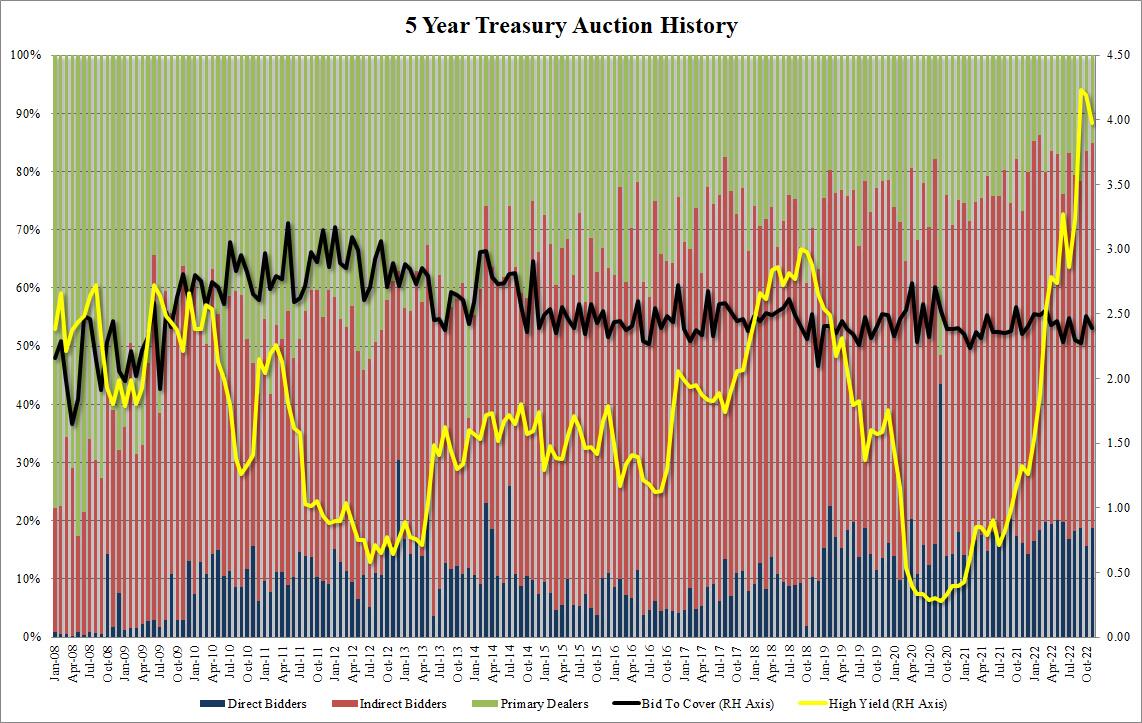

The high yield of 3.974% was the second consecutive decline after peaking at 4.228% in September. It also tailed the When Issued by a modest 0.7bps (vs a 1.8bps stop through last month). This was the 6th 5Y auction tail in the past 8 auctions.

The bid to cover of 2.39 came in below last month's 2.48 but was above the 6-auction average of 2.37.

The internals were also fine, with Indirects taking down 66.2%, down from 68.0% last month, and above the 62.4% recent average; and with Directs awarded 18.7%, Dealers were left holing 15.1%, the lowest since February.

Overall, a mediocre, tailing auction but with stronger-than-expected internals. And with that we now look to tomorrow's last for the week sale of 7Y paper ahead of the holiday.

(Click on image to enlarge)

More By This Author:

"I Am Returning": Disney Shares Surge After Iger's Surprise Comeback AnnouncementThe US Accounts For Nearly Half Of Global Diabetes Drug Sales

JPM Makes 2023 Recession Its Base Case, Expects Million Jobs Lost By Mid-2024

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more