Market Volatility: Reviewing Events That Are Driving Uncertainty

Over the last three weeks, investors have seen the market tank, slightly recover, tank even more, and then slightly recover again. During times like this is even more important that we take a deep breath and do some research that helps us better understand all of the various factors that are causing markets across the world to be so volatile.

Let's start by addressing the elephant in the room which is that uncertainty surrounding coronavirus (COVID-19) seems to be the biggest contributor. With that said, it is also important to say that this level of volatility requires the confluence of several factors in order to elicit this kind of response from the market. My primary goal in writing this article is to help readers gain a better understanding of what is currently happening and discussing some key details that explain how we got to where we currently are.

The topics I will be reviewing include:

- The CBOE Volatility Index (VIX)

- Oil and natural gas pricing

- Treasury rates and economic indicators

- Mortgage rates

- The response of financial institutions to COVID-19

The CBOE Volatility Index

The VIX was created by the Chicago Board Options Exchange (CBOE) back in the early 1990s in order to better understand how the market reacts to investor sentiment. The VIX serves as a fear gauge that helps explain large swings in the market based on negative/positive investor sentiment.

For those who would like a more in-depth understanding of the VIX, you can read the introduction to The Retiree's Dividend Portfolio - John's January Update: Markets Aren't Immune To The Coronavirus.

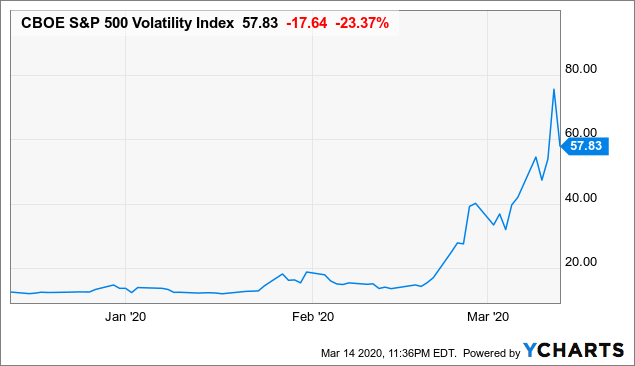

Data by YCharts

In order to put the chart above into context, investors should be aware that a lower VIX score means that the market is in a period of relative certainty and we can expect a slow and steady improvement in stock prices and throughout the major indexes over time. When the VIX score is above 30 that means investors are concerned and typically creates an environment where the market loses value over time.

The VIX rarely demonstrates the following characteristics:

- The VIX is rarely below a score of 10.

- The VIX is rarely above a score of 30.

As you can see from the chart above, the VIX score has escalated quickly and was at one point well-above a score of 60.

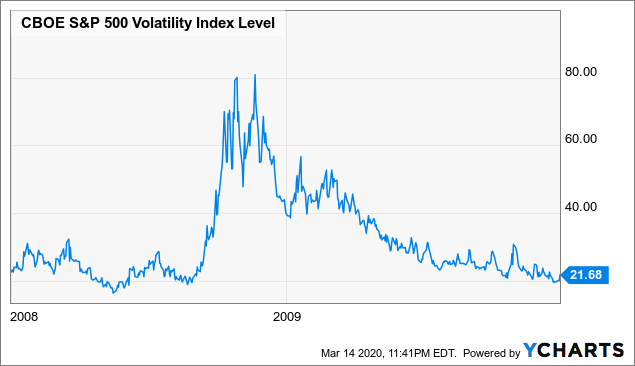

So what does the current VIX situation look like when compared with other moments in history where volatility escalates rapidly? The chart below demonstrates what the VIX index looks like over a two-year period starting in January 2008 and ending in December 2009.

Data by YCharts

I find it interesting that the VIX levels recently reached have only been achieved once before which took place during the financial crisis in 2008.

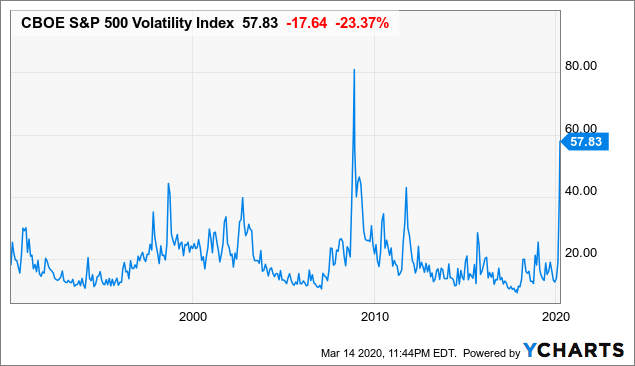

Data by YCharts

One thing that I find particularly compelling about the VIX chart above is that it shows periods of volatility do not last for long, even in the case of the financial crisis which saw the VIX exceed a score of 30 in September 2008 and dropped back below a score of 30 around April 2009. This means even during one of the worst financial crises we have seen since the 1980s (and arguably the worst we've seen since the Great Depression) that investors were able to begin regaining their confidence in the market.

The Federal Reserve and government officials have chosen to address COVID-19 as a very serious matter and they have taken steps (many of which are discussed later in this article) that include everything from closing schools to lowering the Fed funds rate to 0%. These moves are not to be taken lightly which tells me that the Federal Reserve and government officials are extremely interested in making sure that the current situation doesn't turn into a full-blown recession.

Oil And Natural Gas

In order to make sense of what is happening in the energy markets, we have to address what happened with Saudi Arabia, OPEC countries, and Russia at the beginning of March. I found the article No End in Sight to the Oil Price War Between Russia and Saudi Arabia (FP) to be a straightforward explanation of what is taking place.

First, Russia had previously cooperated when it came to previous production cuts (this cut was specifically going to address the following price of oil due to the coronavirus outbreak). This elicited a completely different response from Saudi Arabia as they reversed their willingness to make production cuts and instead dropped its price for a barrel of oil and then decided to make significant increases in output.

What makes this situation unique is that Russia and Saudi Arabia are highly dependent on the price of oil and output for funding the national budget. This means that both countries have entered into a race to the bottom and the winner will be the country that is most prepared to endure pain for the longest period of time.

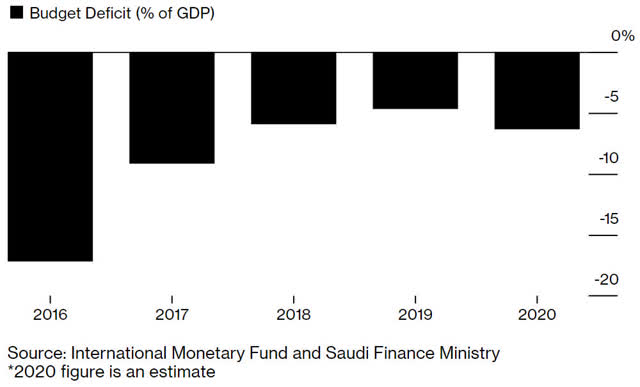

Based on my research it appears that both countries have positioned themselves to take some pain and each country ultimately has a weakness. Saudi Arabia is looking particularly vulnerable as it was set to run a budget deficit of 6.4% in 2020 and that was before oil prices crashed (image below was based on a Brent average of $65/barrel). Bloomberg noted that Saudi Arabia would need $84/barrel in order to balance its budget in 2020.

Source: Bloomberg

Russia appears to be more prepared to endure the crisis according to FP as they have build reserves that allow them to endure low oil prices. the article from ForeignPolicy gives a pretty concise breakdown of Russia's ability to weather the storm.

Russia has spent the last five years tightening its budget and building up $550 billion in reserves that officials say will let it cope with oil prices between $25 and $30 a barrel for up to a decade, if need be. On Monday, Russia’s finance ministry said that it would draw from its $150 billion national wealth fund in order to supplement the budget even if oil prices stay low. If crude sells for an average of $27 a barrel—it was in the low-$30s most of this week—Russia would need to draw $20 billion a year from the fund to balance the budget.

Although Russia appears to be better positioned, the funds from selling oil are critical for funding infrastructure investment and social spending (FP). At this point, Putin has some tools at his disposal, however, low oil prices would create the need for increased taxes or decreased spending.

In refusing to reduce production Russia has an additional motive to deal a blow to U.S. shale oil production and we have seen the impact for smaller and large producers as their share prices have been hammered along with the rest of the market. At this point, I would highly suggest investors only invest capital in large companies who have the ability to weather low oil prices created by the Saudi Arabia vs Russia conflict.

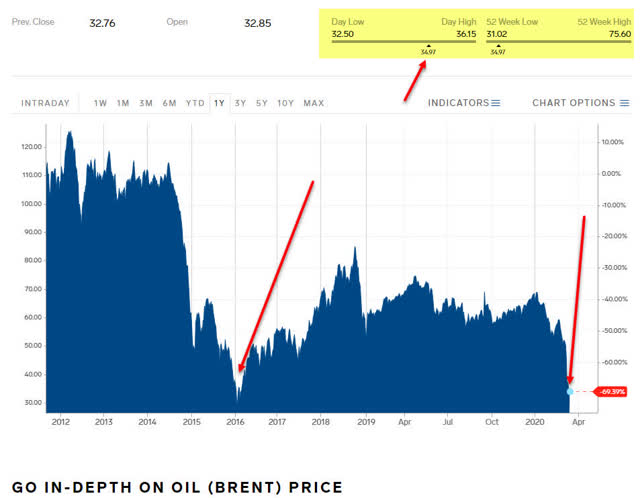

Source: Business Insider

At $60/barrel most major US-based oil companies were able to make a reasonable profit and use the proceeds to pay a generous dividend while also attempting to deleverage since many of these companies are heavily indebted. While it is true that most companies will not be able to break even at current prices, I believe that we will see only a temporary setback on the price that is similar to what we saw at the beginning of 2016. Assuming this is true, it does not seem unreasonable that Brent oil will end up selling between $45-$50/barrell.

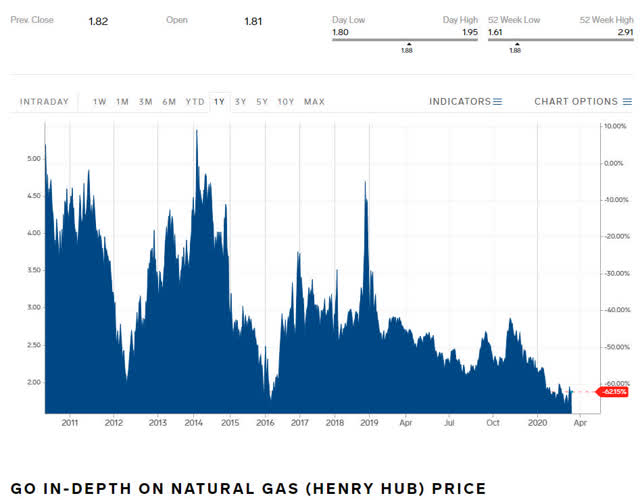

In Scott DiSavino's article U.S. natural gas demand is at a record - and prices keep dropping he points out that natural gas demand has continued to increase and prices have continued to decrease which is not something we would not normally expect.

Source: Business Insider - Natural Gas

Although we have many opportunities to take advantage of natural gas use throughout the United States (including liquefied natural gas or LNG) we have seen the rate of production clearly outpace its use. LNG presents a major opportunity for the United States to ship its product to countries around the world that do not have their own cost-effective sources. In short, the challenge with natural gas is that we have a massive abundance of it but we lack the infrastructure to properly transport it out of areas like the Permian Basin.

Treasury Rates & Economic Indicators

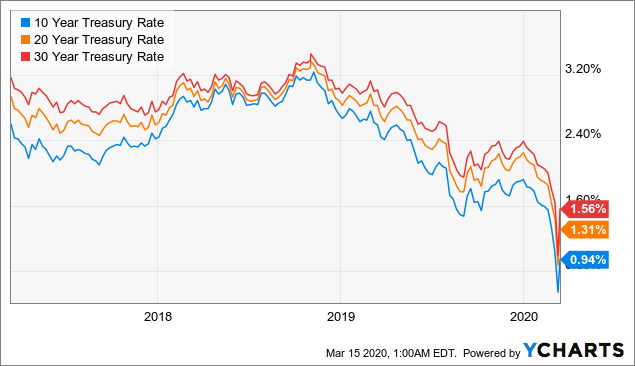

Treasury rates hit their peak towards the end of 2018 and have steadily continued to fall to less than half of where they currently were at the end of 2018. Although there are a lot of factors that contribute to rising/falling treasury yields, the volatility associated with the current environment is entirely rooted in fear from the potential impact coronavirus will have and just how long we will need in order to recover. The chart below illustrates that bond yields have peaked in 2018 and had begun falling long before coronavirus was even the thing.

Data by YCharts

According to CNBC, bond yields edged higher as the market appeared to react positively to the government declaring "a national emergency over the coronavirus pandemic." CNBC also noted that the Federal Reserve announced that it would resume quantitative easing by purchasing all durations of treasury notes in order to put the market at ease and then followed up with cutting the federal funds target rate by 100 basis points to 0%. Currently, the Federal Reserve has promised to increase "holdings of Treasury securities by at least $500 billion and holdings agency mortgage-backed securities by at least $200 billion." (Federal Reserve)

Outside of the impact from coronavirus, we had been seeing positive indicators as recorded by the U.S. Bureau of Labor Statistics:

- Overall inflation rate close to 2%

- Monthly jobs report of nonfarm payrolls rose by 273K for February 2020.

- The unemployment rate remains steady at 3.5% (steady over the last 6 months).

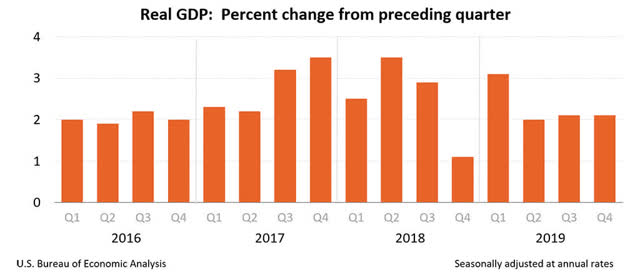

Where things aren't looking promising is in GDP numbers because we have been enjoying a solid streak of quarterly improvement from the preceding quarter as shown by the U.S. Bureau of Economic Analysis.

Source: U.S. Bureau of Economic Analysis

The next update GDP change will be announced on March 26th. As I am writing this article the Federal Reserve announced a 0% Fed funds rate which means that we may see treasury rates fall even further.

Mortgage Rates

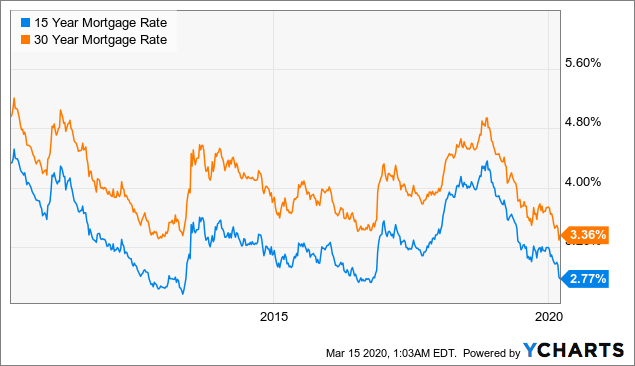

Mortgage rates have followed Treasury yields down to match their lowest rates in the last 10 years. The 15-year and 30-year mortgages have reached a point where they are nearly 150 basis points below recent highs seen a little more than one year ago.

Data by YCharts

The spread between the 15 and 30 year mortgage rates have remained considerably tight as rates steadily climbed from 2016 through 2018 but fallen rapidly over the last year due to concerns about the economy slowing down. Unfortunately, coronavirus could not have come at a worse time as it caused even further deterioration in mortgage rates which means that we can expect to see lower-for-longer mortgage rates for the foreseeable future. I believe that lower-for-longer rates will have both negative and positive effects.

Potential Negative Consequences

- Rates dropping typically increases the amount of purchase activity because lower rates mean that more borrowers are able to afford a mortgage payment, however, I believe that coronavirus will have a significant impact on economic output and reduce the ability of the average person to purchase a home for the remainder of 2020.

- I am slightly concerned about the price of homes and I believe that the combination of fewer purchase transactions and the financial impact from coronavirus will have a negative impact on housing prices for 2020.

- If housing prices are negatively affected it is possible that we will see a reduced refinance market (specifically for homeowners who purchase their homes in the last few years) since they may lack the equity to refinance their home.

Potential Positive Benefits

- I believe we can expect to see more home refinances including cash-out transactions over the next several months as high home prices mean that there are still a number of homeowners who can refinance to lower payments, eliminate PMI, and even pay off burdensome credit card debt.

- Although housing prices may fall some, I believe that many homeowners have the potential to tap equity even if it means their house appraises for a certain amount less than what was expected.

- Refinancing homes could be a strong catalyst for consumers' expendable income which means that although the rest of 2020 is expected to be lackluster, that more disposable income by homeowners will allow for a faster recovery.

Because of mortgage rates' rapid decline, we can also expect to see higher prepayment speeds which are a function of how many borrowers choose to pay off their existing mortgage (can be from refinancing or by selling their current residence and financing a new one). This has a serious impact on banks that have a large focus on mortgage activities including financial institutions that have a large book of mortgage loans.

Falling interest rates increase loan prepayment speeds because the likelihood of benefiting from a refinance increases as interest rates drop. The lesser-known impact about increased loan prepayment speeds is that lenders who service their own mortgages (collect property taxes, insurance, HOA dues, etc.) will also see a significant drop in the value of the servicing rights because those servicing rights disappear when the loan is paid in full. Sudden changes mean that companies like Umpqua Bank (UMPQ) and Wells Fargo (WFC) are likely to experience additional pain. Even if UMPQ or WFC can recapture those mortgages, they will receive the fee income but will also end up booking a loan that has a much lower yield than the rest of their portfolio.

Real Estate Investment Trusts (REITs) such as New Residential (NRZ) also have the potential to underperform since they focus on investing in excess mortgage servicing rights. As mentioned previously, when mortgages are paid early it can have a significant impact on the value of mortgage servicing rights.

Consumer Relief For Coronavirus

Many banks and credit unions have already begun discussing how they can create relief among customers/members which should help prevent the situation from spiraling out of control. There is no doubt that low-income workers and those who are involved in the energy/oil and hospitality/travel industry are likely to be the most impacted. Some of the ideas mentioned in Forbes: List Of Banks Offering Relief To Customers Affected By Coronavirus (COVID-10) include:

- Waiving fees

- Allowing interest-only-payments

- Moving and upcoming payment to the end of the loan

- Waiving fees associated with early withdrawals from certificates of deposit

These are just some of the main offerings that were mentioned in the article but it does seem like appropriate steps are being taken in order to make sure that the drastic measures implemented don't cause financial ruin for the most financially vulnerable in the population.

Conclusion

The markets may be rattled but the steps taken by the Federal Reserve and government officials demonstrate that they are doing everything possible to limit the impact COVID-19 will have on the economy. At this point, we have to consider that the Fed funds rate will likely stay at 0% for the remainder of 2020. With lower interest rates, we can expect to see an uptick in mortgage originations, many of which I believe will be to refinance existing loans.

Ironically, all of the news mentioned above is and what concerns me the most because I am most concerned with how people choose to react to these events. Even those who are determined to act rationally can easily become irrational when they begin to see things like lines out the door or emptied grocery store shelves. As with all things, this too shall pass but I fully expect that things will get worse before they get better. At this point, I believe the development of a working vaccine or a reduction in the number of newly diagnosed individuals would initiate a return to normalcy.

Market fundamentals are still strong even when we consider the negative impact COVID-19 will have on GDP for at least the first six months of 2020.

Disclosure: I am/we are long UMPQ. John and Jane are currently long UMPQ, NRZ.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it ...

more