Market Analysis - Tuesday, July 1

SPX futures declined to 6187.00 this morning, breaking the week-long burst of Cyclical strength in a market showing weakening participation. Often reversals come on days of trending strength, surprising those investors who haven’t yet realized how thin the ice really is. The Cycles Model is now showing trending strength on the downside. The next three days may produce a panic as the majority of investors are now on the wrong side of the market.

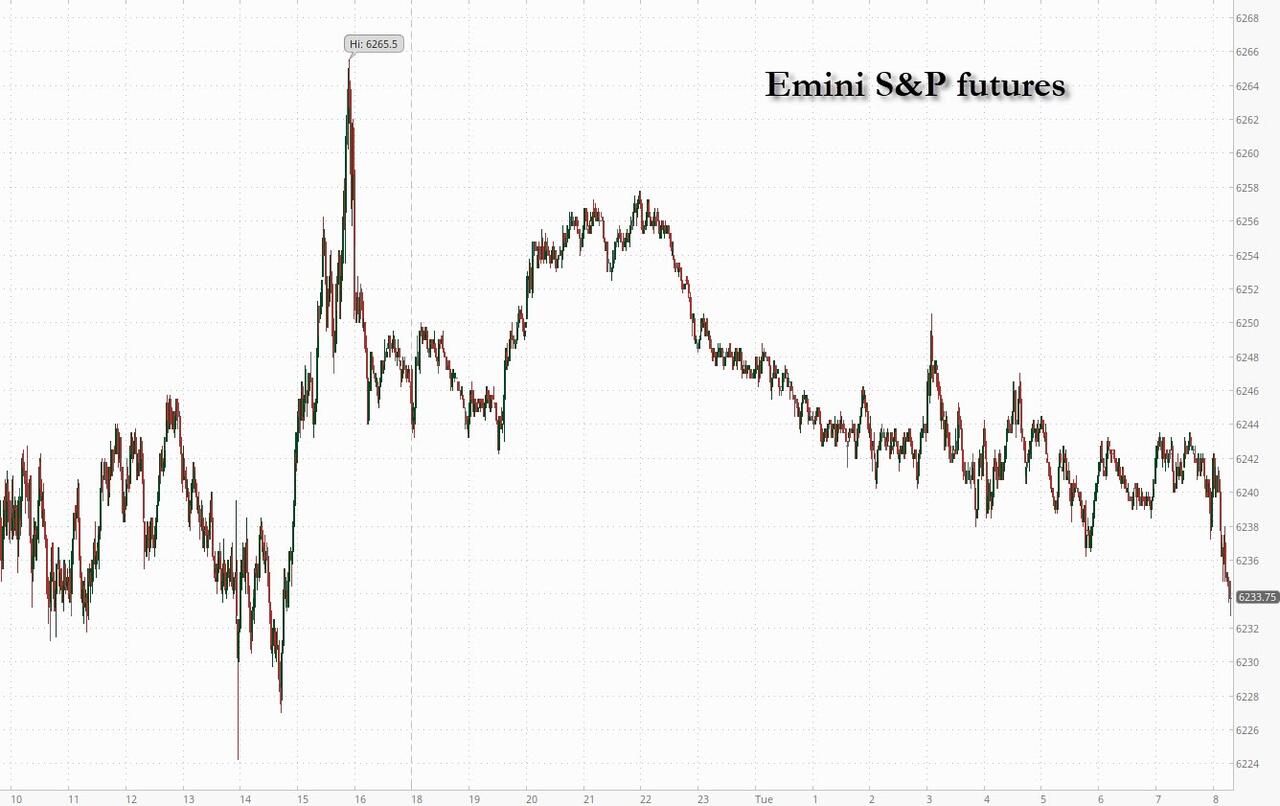

Today’s options chain shows Max Pain at 6195.00. Long gamma may begin above 6235.00 while short gamma strengthens beneath 6175.00.

ZeroHedge reports, “US equity futures – which closed at a fresh all time high after the best quarter since 2023 put them in extremely overbought territory – are weaker, dragged by Tech as TSLA is -5% pre-mkt on Musk vs Trump part 2. Pre-mkt, the balance of Mag7 is mixed with Staples outperforming. As of 8:00am, S&P futures are down 0.2% following two successive closes at all-time highs as sentiment remains linked to progress of trade negotiations and the fate of President Trump’s tax and spending bill, which the Senate has failed to pass. Nasdaq futures also drop 0.3% while European stocks also fell. Bond yields are lower as the curve flattens with USD continuing to decline, setting another 52-wk low. As discussed yesterday, the dollar had its worst H1 since 1973 while SPX has its best quarter since 23Q1. Commodities are weaker although gold is soaring. Today is the first piece of the labor market puzzle with JOLTS but we also receive ISM-MFG and vehicle sales. Powell speaks at 9.30am. The voting process on the tax/budget bill continues.”

VIX futures rose to 17.48 this morning. The Master Cycle bottom was made on Thursday, giving the appearance of a crash. However, testing the floor gives warning of a possible change in trend. The Cycles Model calls for a rally in the VIX to mid-August. The past month has been a great time to accumulate shares in the VIX. The Cycles Model shows the VIX rising in strength for the next three weeks. Thereafter, the rally may resume to late August.

Tomorrow’s options chain shows Max Pain at 18.00. Short gamma remains strong beneath 17.00 while long gamma strengthens above 20.00.

TNX is rising off its low, but it may be early to declare a bottom. Today is day 251 of the current Master Cycle, suggesting the bottom may come in the next week. Arguments about the spending bill are threatening a firestorm. In addition, soft financial data are indicating a possible rate cut in the near term. The release of the FOMC minutes on July 9 may indicate the bottom of the Master Cycle.

ZeroHedge remarks, “With the passage of President Trump’s so-called “Big Beautiful Bill”—a sprawling new fiscal stimulus and infrastructure package—the U.S. bond market should be in the spotlight, if you ask me.

This legislation, which mostly accelerates deficit spending at a time when debt servicing costs are already surging, is colliding with a Treasury market that has shown persistent signs of instability over the past year. Investors should be watching this space very closely.”

Bitcoin is riding the 50-day Moving Average at 105993.00 this morning. There is growing volatility that suggests a possible breakdown by the end of the week. A decline beneath the 50-day triggers a sell signal with repercussions following to the end of the month.

The US Dollar is following the declining Cycle bottom at 96.60 today. The Cycles Model suggests the decline may continue for another month. Fractal rules put a possible floor on the USD near 93.50.

More By This Author:

Market Analysis - Thursday, June 5Market Analysis - Friday, May 30

Market Analysis - Tuesday, May 27

Nothing in this email or article should be construed as a personal recommendation to buy, hold or sell short any security. The Practical Investor, LLC (TPI) may provide a status report of ...

more