Make Bond Buying More Lucrative For You

There have been periods in the past during which investing in bonds was interesting. Some of the best books about Wall Street were written about bond desks in the ‘80s. These days though, the fixed income world is plagued by ultra-low rates. Much of the investment world has turned its attention to equities and other more exciting asset classes.

Nevertheless, there are still plenty of investors who use bonds in their portfolios for their low-risk nature. What’s more, bond investing has expanded by leaps and bounds due to the growth of ETFs. There is now easy, liquid access to corporate bonds, junk bonds, foreign government bonds, foreign corporate bonds, and even emerging market bonds.

The iShares JP Morgan USD Emerging Markets Bond ETF (EMB) trades over 4 million shares a day on average, with 10,000 options per day traded as well. That’s not bad for an asset category that could only be touched by the richest of clients until about 15 years ago.

With EMB, anyone with stock market access can safely invest in emerging market bonds as an asset class. Moreover, EMB pays a 4.1% annual dividend in a market environment that’s starving for yield.

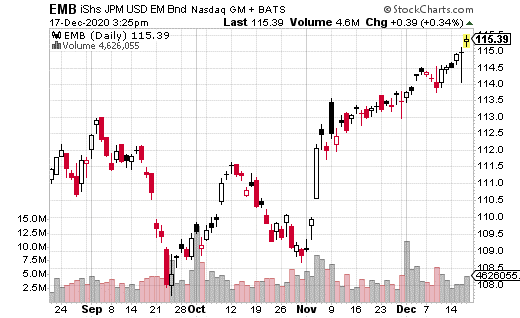

Like most bond funds, EMB doesn’t move all that much. If you ignore the anomalous March pandemic crash, the stock tends to trade in the same $10 range it’s been in for years (roughly $105 to $115). For the last six months, the stock has been in a $5 range between $110 and $115.

Not that there’s anything wrong with consistency. For bond investing, stable prices are a good thing (and EMB recovered quickly from the March crash, along with most other asset classes). Plus, there’s that nice 4% dividend to collect every year.

Still, what if there’s a way to make buying EMB even more lucrative? That’s where covered calls come in. EMB is a perfect candidate for a covered call strategy because it does tend to trade in a predictable range. While the options premiums received aren’t going to blow anyone away, they will stack on top of the already robust dividend, potentially creating a very attractive yield.

For instance, with the stock at $115.43, a trader purchased 340,000 shares while selling 3,400 of the January 15 115 calls for $1.22. This one-month covered call doesn’t allow for stock appreciation, because the calls are in the money; however, by selling an in-the-money call, the yield on this trade is 1.1%.

Remember: this is just a one-month trade. If you annualize the yield, it’s 13%. Throw the 4% dividend on top of the covered call yield, and you could theoretically earn 17% per year holding EMB! Even if the shares get called away (that is, if EMB ends up above $115 on expiration), the trader can simply place another covered call for the next month.

The drawback to this trade is there’s no potential for an upside in EMB’s share price. However, the stock has historically not traded above $115 for a substantial period of time—in fact, it’s more likely that this is the top of its range. For a range-bound ETF like EMB, being able to potentially earn 17% for the year makes this bond fund far more interesting.

Disclaimer: Information contained in this email and websites maintained by Investors Alley Corp. ("Investors Alley") are provided for educational purposes only and are neither an offer ...

more