Japan Widens Lead Over China As Top Foreign Holder Of US Treasuries

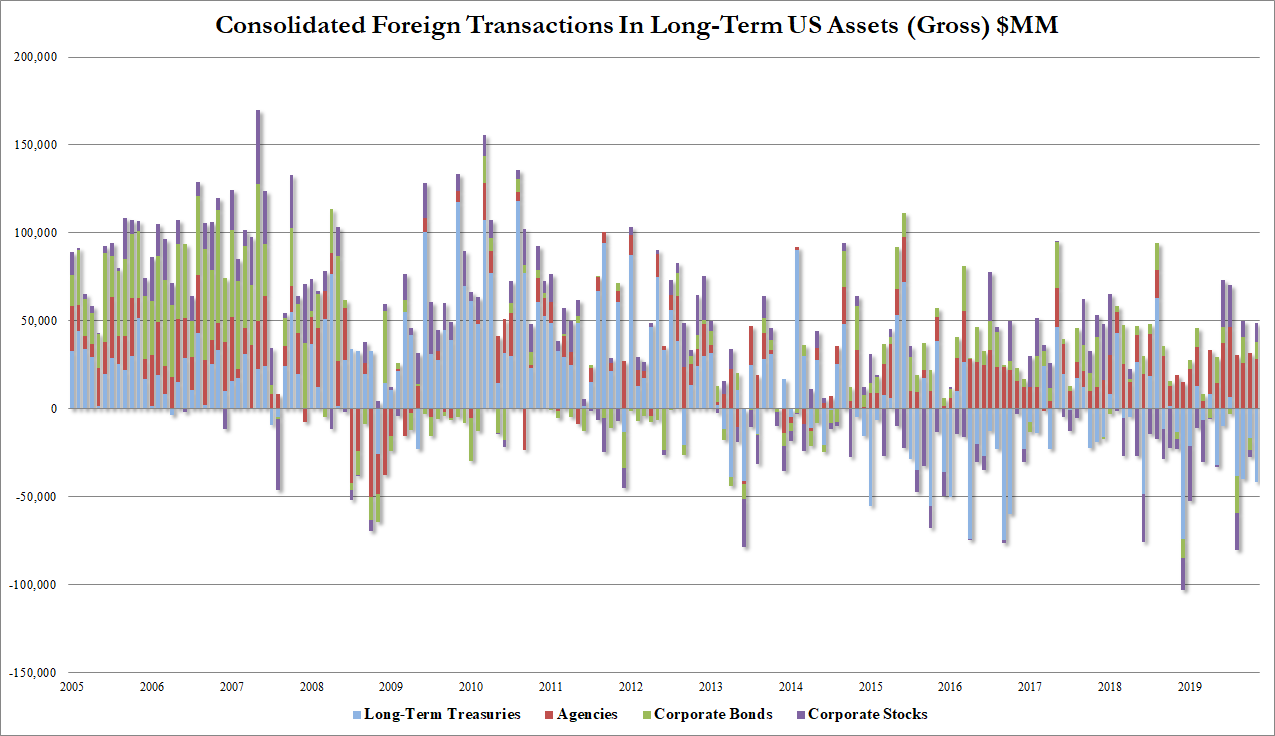

November - the latest data point - saw surprisingly large net capital inflow to US markets, the biggest since Oct 2018 after two notable outflow months...

(Click on image to enlarge)

Source: Bloomberg

Overall foreigners dumped $41.5bn in Treasuries but bought everything else...

- Agencies: +$28.3BN

- Corporate Bonds: +$10BN

- Stocks +$10.5BN

(Click on image to enlarge)

Source: Bloomberg

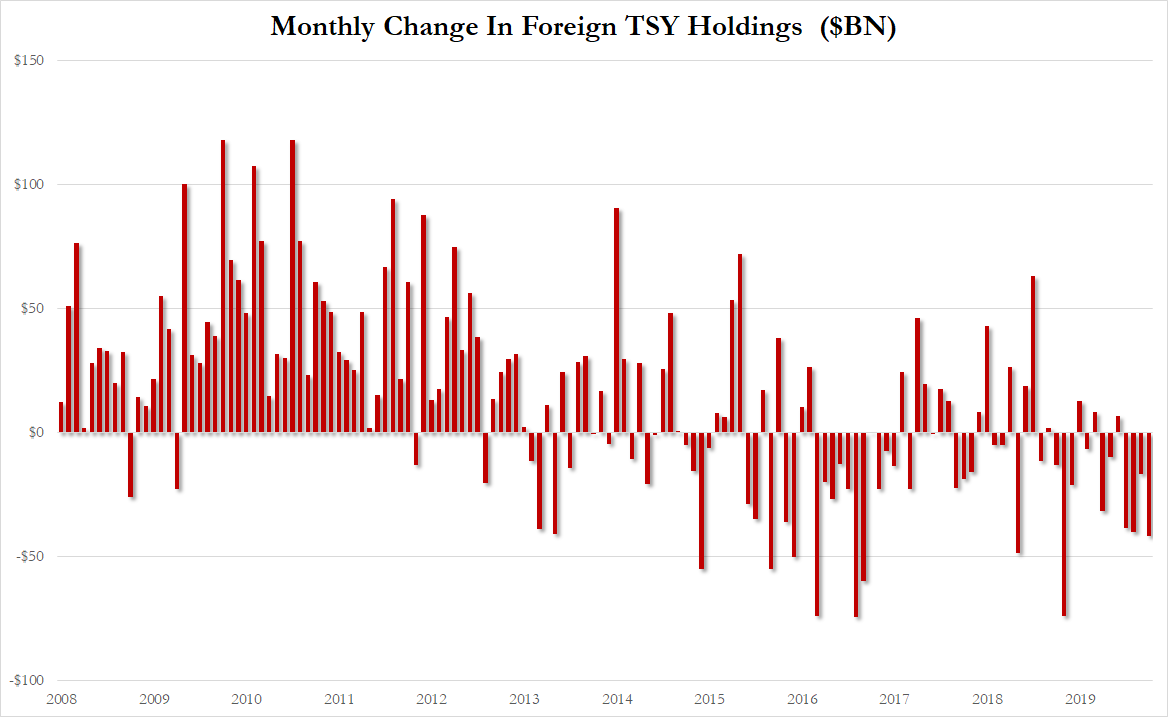

That is the biggest Treasury sale since Dec 2018...

(Click on image to enlarge)

While both Japan and China reduced their holdings in November, Japan's lead over China as the biggest foreign holder of USTreasuries has increased...

(Click on image to enlarge)

Source: Bloomberg

- China holds $1.09t of U.S. Treasuries, a decrease of $12.4b from last month

- Japan sold too: $1.16t, a decrease of $7.2b from last month

As a reminder, in November, China criticized the U.S. for interference in its domestic affairs as President Trump prepared to sign legislation supporting the Hong Kong protesters.

Singapore (+11.8bn) and Ireland (+3.4bn) were the biggest Treasury buyers in November.

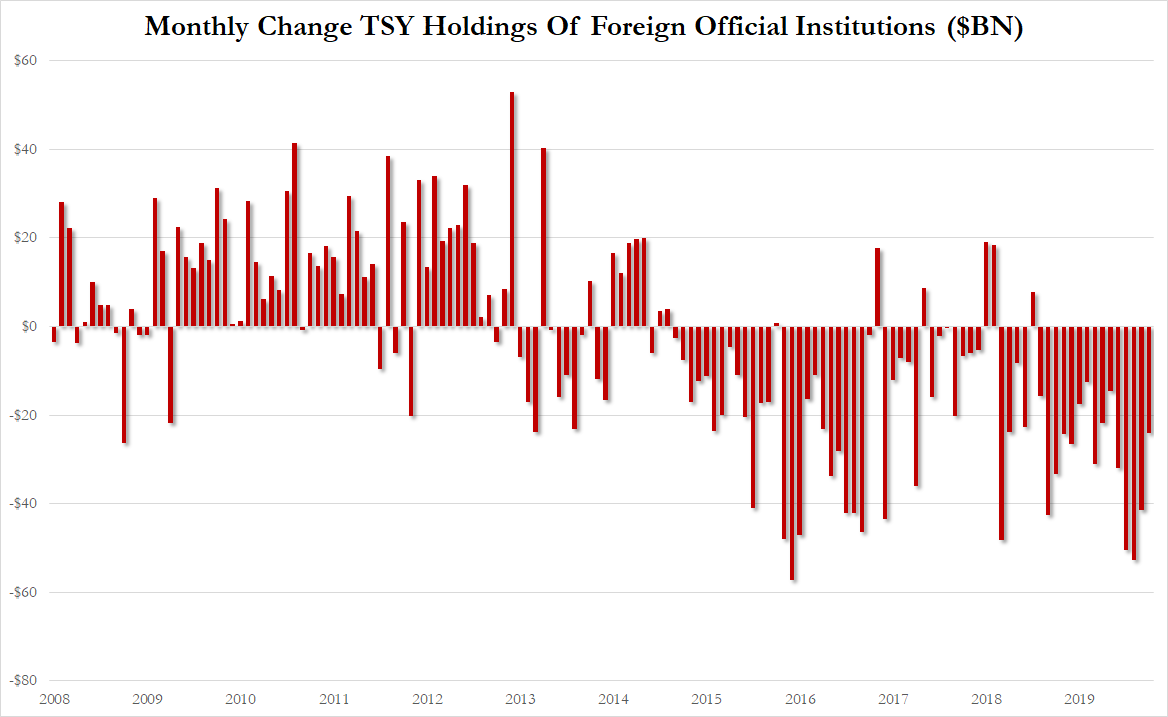

Foreign official institutions (central banks, reserve managers, sovereign wealth funds) have sold US TSYs for 15 consecutive months

(Click on image to enlarge)

...since Oct 2014, foreigners have sold TSYs on 56 of 62 months!!!

(Click on image to enlarge)

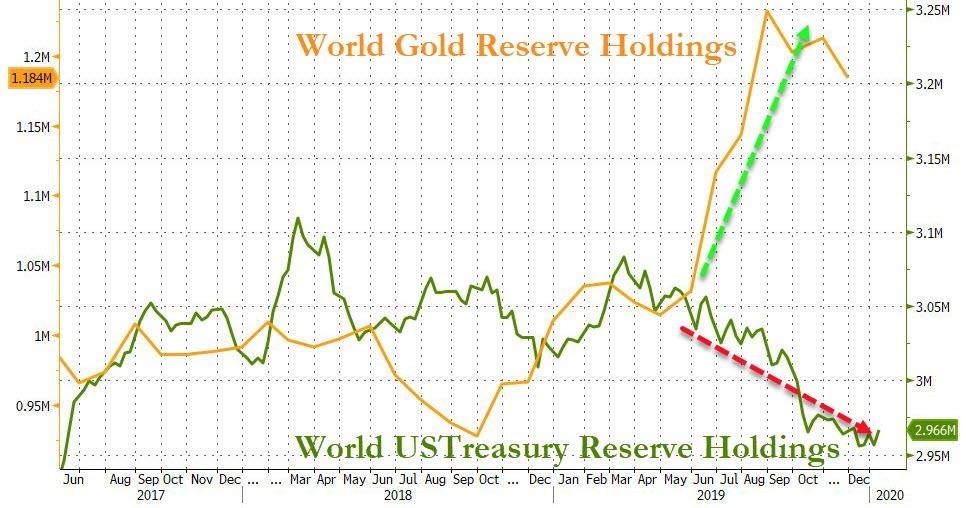

Probably nothing.

Disclosure: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more

In 1990 you can buy a home for 125,000 that same home today is 500,000 so if I took 125,000 put a 30 year bond cash deal in the day I lost Yippee I got an 8% coupon over that time bondholders lose all the time that I say all the time.