Interest Rates: Budget Deficit, Borrowing Woes Worrying Bond Investors

Image Source: Pexels

Stocks have recently been selling off amid the passage of President Trump’s “big, beautiful” budget bill. Why? It’s been doing little to quell anxieties in the bond market. For years, people have said government borrowing and deficits are on an unsustainable path. But it appears 2025 is the year that it is coming home to roost, observes Amber Kanwar, host of the In the Money with Amber Kanwar podcast.

After an all-night voting process, the US House narrowly passed a budget bill that would increase federal deficits by $4 trillion, according to the Congressional Budget Office. This is largely through tax cuts.

To offset the lower revenue from taxes, the budget cuts spending by $1 trillion on the back of reduced eligibility for Medicaid and food stamps. Plainly, it’s a budget that benefits the highest-income earners while limiting resources for the lowest-income earners. It also pares back spending on Biden-era green energy incentives.

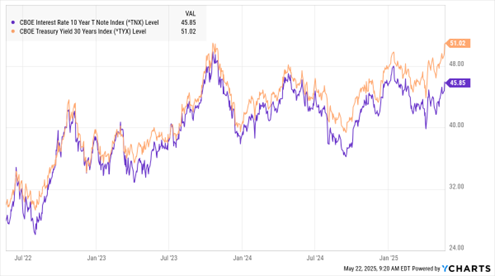

CBOE 10-Year, 30-Year Yield Indices Chart

Data by YCharts

The bigger problem for the markets is the size of the deficit. The yield on the US 10-year spiked to 4.6% -- the highest since February, while the yield on the 30-year bond edged past the 2023 high to reach the highest level since 2007.

Put simply, investors are charging more for buying US debt because of concerns about the government’s ability to pay going forward. This is not just a US problem, either. We are seeing a similar tantrum in Japan right now.

Bitcoin has been showing its might in this environment, as it reached a record high earlier this week, while gold also advanced. It's fitting that Bitcoin hit a record high on “Bitcoin Pizza Day.” On the day 15 years ago, Laszlo Hanyecz bought two large pizzas in the first real-world purchase using Bitcoin. He used 10,000 BTC, which at today’s prices is the equivalent of buying them for around $1.1 billion.

About the Author

Amber Kanwar hosts the investing podcast "In the Money with Amber Kanwar." Throughout her 15-year career, she has interviewed hundreds of portfolio managers, CEOs, political leaders, and newsmakers from around the world, becoming one of Canada’s most trusted and recognizable business journalists.

For over a decade, Ms. Kanwar was a familiar face on Canada’s flagship business channel, BNN Bloomberg. She has also appeared as a contributor on CTV and Bloomberg.

More By This Author:

Carnival Corp.: An Undervalued Consumer Play You Shouldn't Pass UpEPU: An Attractive ETF For Playing Higher Metals Prices

Dollar: Will The Greenback's Recent Giveback Persist?

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more