Inflation Sensitivity: How Do Your Stocks Stack Up?

What are the current inflation risks to the market? I guess it depends on who you ask. More importantly, what is the market saying about inflation, and is your portfolio positioned to outperform based on that direction?

Let’s talk about some of the data on inflation, how the market’s posturing, and the sensitivity of certain stocks to inflation.

Inflation Outlook

It’s not hard to describe the temperature of the water. That essentially what the Consumer Price Index does (although a little understated and biased). However, as investors we need to be thinking about the future!

One consideration for inflation expectations are forecasts. The image below is plotting inflation forecasts for the IMF and an average global prediction by country. Currently, the IMF is expecting an inflation rate of 3.52% for 2022 and an average of global predictions for the U.S. is 5.3%. That is way above the Federal Reserve’s target inflation rate of 2%.

(Click on image to enlarge)

What Bonds are Saying

I get it, we’ve been experiencing a 40-year high in inflation and it’s hard to imagine a future without rising prices. However, the supply issues will hopefully get worked out and the structural barriers caused by policy will hopefully be removed so that we can start producing again. Looking at the price of goods is really only one part of the inflation equation. The other is financial assets and the very stark change in Federal Reserve policy that is about to reverse in the coming months.

The bond market is giving a lesser view of inflation. The chart below represents the yield curve with the 30-year Treasury Bond (Purple), 10-year Treasury note (Red/Green), 5-year Treasury note (Green), and the 13-week T-bill (Blue).

(Click on image to enlarge)

Notice how the 5, 10, and 30 lines are converging. The 13-week T-bill line is also rising sharply as the Fed is indicating it will raise rates soon. If inflation were a meaningful concern over a longer period of time, the lines should be diverging, not converging. With shorter-term rates rising at a faster rate, the potential for a Fed policy error is becoming more pronounced.

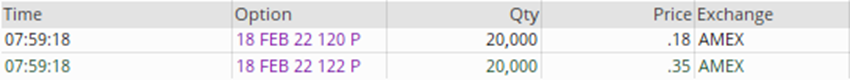

This next piece isn’t as meaningful as the yield curve. However, I thought this option trade on the iShares TIPS Bond ETF (NYSEARCA: TIP) was fitting. Here is the trade:

The above trade is a long put vertical spread for a $0.17 debit. Not exactly the most expensive trade but it was filled in one print of 20,000 contracts. Not exactly a retail trader. The expectation of this trade is the price of TIP will fall below $120 in the next 28 days. For a product that is indexed to CPI, that’s not exactly a ringing endorsement for inflation.

How does your portfolio stack up?

The Federal Reserve has done a bang-up job of ramping up inflation of financial assets. I guess expanding their balance sheet by $5 trillion will tend to that. Now that they’re looking to begin winding down, what does that mean for your portfolio? I think this week gave you a glimpse, but let’s dig deeper. Here is some data provided by Credit Suisse.

First, how do stocks perform with changes in inflation outlook. The chart below shows that the market generally likes inflation. This is indicated with higher inflation expectations producing a positive return and falling expectations producing a negative return.

(Click on image to enlarge)

The next image reflects the reflation caused by the Fed and it’s impact on inflation-sensitive stocks and sectors.

(Click on image to enlarge)

As you may have guessed, Financials, Cyclicals, and Technology favor reflation cycles. As you consider sensitivity to inflation, those that favor rising prices have performed the best at nearly double the rate.

The issue now is whether it’s the same in 2022 as it was most of last year. The bond market is saying no and the trajectory of Fed policy is saying this year is going to be different as well. Read Stagflation, It’s More Than a ‘High Class Problem’

While the above breakdown is focusing on specific sectors that performed well, it’s also helpful to know traditionally inflation-sensitive sectors. Sectors like Energy, Materials, and Industrials typically perform well later in a cycle as inflation heats up. With all of the disruptions over the past two years, some of the performance in these sectors have been more muted. However, energy has really been heating up in 2022, but may not last long as the tightening cycle is about to begin.

Stock Inflation Sensitivity

It’s impossible to produce an exhaustive list in a post like this. This post is more about highlighting the risks of the current environment and becoming aware of the sensitivity to inflation trends on stocks. That being said, here is a list of companies produced by Credit Suisse that highlights the degree of sensitivity to inflation.

(Click on image to enlarge)

Conclusion

This is a really good time to think about your portfolio. Is it skewed to perform better during times of rising inflation expectations or falling? The backdrop for rising inflation and asset prices is beginning to diminish and identifying stocks or investments that will perform well in a disinflationary environment may be a key to preserving capital.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more