Important Bond ETFs Trading At Critical Resistance

When interest rates fall, bond prices rise. And while it has been some time since we’ve been able to say interest rates are dropping, the past few months have done just that.

The pullback in interest rates is coinciding with investors optimism that the Federal Reserve is done raising rates and inflation is subdued.

Taken together, this has had a very positive effect on bond prices over the past few months.

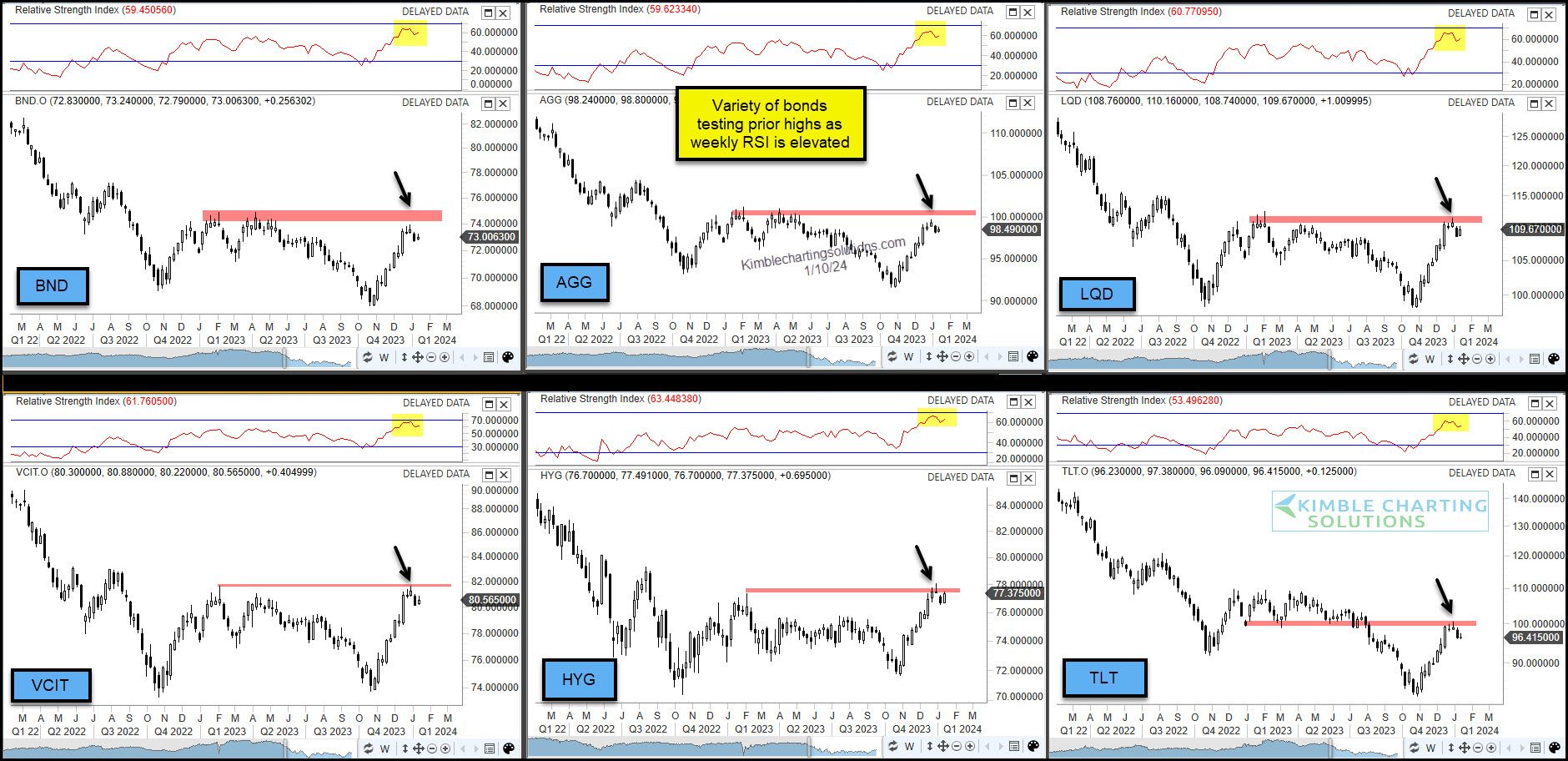

And we can see this in today’s chart 6-pack of important bond ETFs (that range from junk to corporate to treasury bonds).

That said, the rally from the October lows has each ETF nearing overhead resistance. And this is also occurring while the RSI indicator is near 2-year highs for each asset.

It will be important how these bond ETFs handle this resistance.

(Click on image to enlarge)

More By This Author:

Large Cap Tech Stocks Possibly Repeating 2021 Pattern

German Bond Yields Reach Sink Or Swim Moment?

Are Junk Bonds Starting To Weaken? Stock Bulls Hope Not

Disclosure: Sign up for Chris's Kimble Charting Solutions' email alerts--click here.