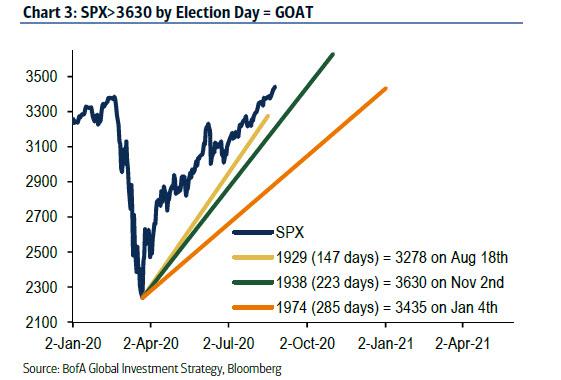

If S&P Hits 3,630 By Election Day, This Would Be The Greatest Rally Of All Time

It's amazing to think that just five short months ago, the S&P was just over 2,100 and Goldman was issuing fire and brimstone reports, warning the S&P could tumble to 2,000 in the "near-term." What happened next was unprecedented: on March 23 the Fed crossed a Rubicon that even Bernanke left alone when the central bank effectively nationalized the bond market, buying corporate bonds and ETFs while injecting hundreds of billions of liquidity in the bond market and even hinting it could start buying stocks next. The response was unprecedented, with the S&P surging a historic 56% since the March 23 lows...

Driven obviously not by some surge in profits, but by a record 90% increase in forward P/E multiples, which as of today are at 26.795 based on the Bloomberg forward consensus, surpassing the dot com bubble high and just shy of the all time high hit in December 1998.

The question, of course, is what happens next. On one hand it is easy to say that stocks have never been more overvalued, which is a fact. On the other, the activist Fed yesterday made it clear that it will (probably never) hike rates again (if anything, we will get NIRP and equity purchases first), prompting traders to frontrun even more liquidity, even easier financial conditions, and even higher stock prices.

According to one hypothetical scenario - and certainly a plausible one - proposed by BofA's Michael Hartnett, with the S&P already at 3,500, it would only take another 130 points in the S&P, pushing it less than 4% higher to 3,630 by Election Day, to make this rally Greatest Of All Time in both speed and magnitude, surpassing the rally off the 1938 lows.

And speaking of the Fed, the genie is now well out of the bottle with even Hartnett admitting that "Central banks are encouraging asset price inflation/moral hazard in attempt to use wealth effect to reduce unemployment and “trickle down” inflation to Main St; at some point race to $3000 gold, $3tn Apple, 300bps HY bond spreads will cause bond yields to jump; but unlike 1999, Fed not tightening in 2020."

To be sure, there is a risk some time in Sept, when we hit peak policy stimulus, resulting in rising pre-election correction risk as bond yields trough, at which point Hartnett says "watch key “floors” for MOVE (40), VIX (20), IG spreads (125bps)…if floors hold signals "peak stimulus."

Of course, fundamentals, technicals, and even market feedback loops no longer matter in a world where the central bank has given Robinhooders the greenlight to buy any dip. And most importantly, there is nothing Trump would want more than to tell the world on the eve of the election that the S&P just enjoyed the biggest and fastest recovery in history. Whether 99% of the population would care is a different story...

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more

Like all chemically induced euphoria, this one can not last for an extended length of time, because the debt and the inflation will spoil everything after a while. So while the financial institutions and many of the shareholders ride the wave to paper riches, the time of reconning will follow as the "high" fades.

The unfortunate problem with debt is that it must eventually be paid back, and the problem with inflation is that it always hurts those unable to create more money. Thus whoever is elected will have an interesting time solving the problem that was started a long time ago.

My hope is that somehow rational thinking will arrive and that somehow the train-wreck can be avoided, or at least reduced to an inconvenience.