How Small Investments Make A Big Impact Over Time

With a fortune of $159 billion, Warren Buffett largely credits compound interest as a vital ingredient to his success—describing it like a snowball collecting snow as it rolls down a very long hill.

How Small Investments Make a Big Impact Over Time

Time is an investor’s biggest ally, even if they start with just a modest portfolio.

The reason behind this is compounding interest, of course, thanks to its ability to magnify returns as interest earns interest on itself.

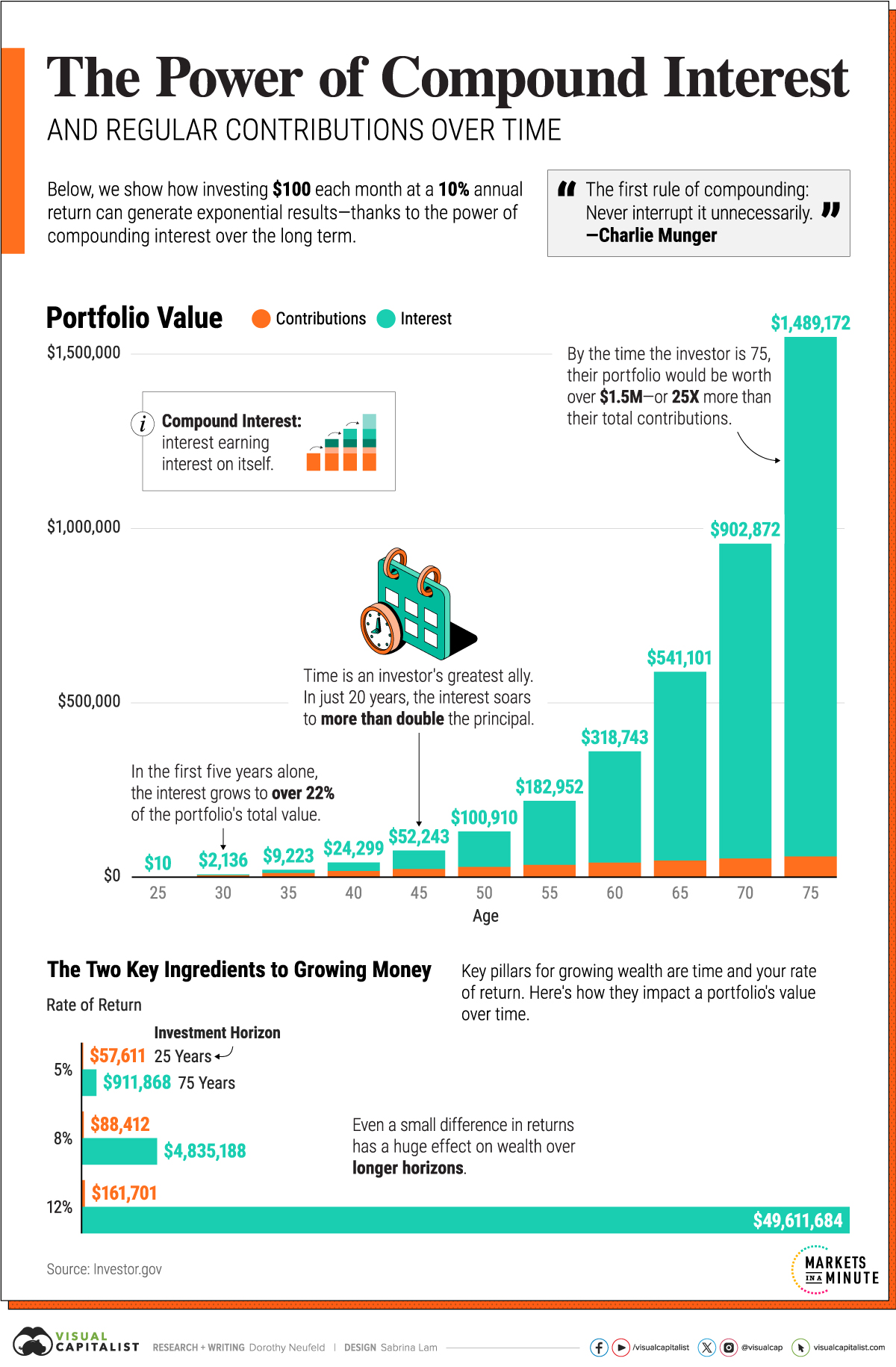

The graphic shows how compound interest can dramatically impact the value of an investor’s portfolio over longer periods of time, based on data from Investor.gov.

Why Compound Interest is a Powerful Force

Below, we show how investing $100 each month, with a 10% annual return starting at the age of 25 can generate outsized returns by simply staying the course:

| Age | Total Contributions | Interest | Portfolio Value |

|---|---|---|---|

| 25 | $1,300 | $10 | $1,310 |

| 30 | $7,300 | $2,136 | $9,436 |

| 35 | $13,300 | $9,223 | $22,523 |

| 40 | $19,300 | $24,299 | $43,599 |

| 45 | $25,300 | $52,243 | $77,543 |

| 50 | $31,300 | $100,910 | $132,210 |

| 55 | $37,300 | $182,952 | $220,252 |

| 60 | $43,300 | $318,743 | $362,043 |

| 65 | $49,300 | $541,101 | $590,401 |

| 70 | $55,300 | $902,872 | $958,172 |

| 75 | $61,300 | $1,489,172 | $1,550,472 |

The Two Key Ingredients to Growing Money

Generally speaking, building wealth involves two key pillars: time and rate of return.

Below, we show how these key factors can impact portfolios based on varying time horizons using a hypothetical example. Importantly, just a small difference in returns can make a huge impact on a portfolio’s end value:

| Annual Return | Portfolio Value 25 Year Investment Horizon |

Portfolio Value 75 Year Investment Horizon |

|---|---|---|

| 5% | $57,611 | $911,868 |

| 8% | $88,412 | $4,835,188 |

| 12% | $161,701 | $49,611,684 |

With this in mind, it’s important to take into account investment fees which can erode the value of your investments.

Even the difference of 1% in investment fees adds up over time, especially over the long run. Say an investor paid 1% in fees, and had an after-fee return of 9%. If they had a $100 starting investment, contributed monthly over a 25-year time span, their portfolio would be worth over $102,000 at the end of the period.

By comparison, a 10% return would have made over $119,000. In other words, they lost roughly $17,000 on their investment because of fees.

Another important factor to keep in mind is inflation. In order to preserve the value of your portfolio, its important to choose investments that beat inflation, which has historically averaged around 3.3%.

For perspective, since 1974 the S&P 500 has returned 12.5% on average annually (including reinvested dividends), 10-Year U.S. Treasury bonds have returned 6.6%, while real estate has averaged 5.6%. As we can see, each of these have outperformed inflation over longer horizons, with varying degrees of risk and return.

More By This Author:

G20 Inflation Rates: Feb 2024 Vs COVID PeakThe World’s Biggest Oil Producers In 2023

Chart: The Declining Value Of The U.S. Federal Minimum Wage

Disclosure: None