Higher Inflation Contributing To Higher Equity Risk Premium

The recent focus of investors and strategists has centered on the higher level of inflation seen in the economy driven in part by higher home prices, higher lumber prices, and higher automobile prices, just to name a few areas. One focal point of the debate is whether the elevated inflation rate is transitory or not. Even some individuals in the transitory camp believe inflation could persist for a year or longer. Nonetheless, with inflation running at a 5% annual rate today this has implication to investors' return expectations on a wide range of investment assets. June's inflation reading will be reported Tuesday (July 13) and consensus expectations are for year over year inflation to remain elevated at 4%.

I have written in the past how an investor's view of the appropriate equity risk premium (ERP) level should play a part in their asset allocation decision. The equity risk premium quantifies the additional rate of return an investor requires to compensate for the risk of investing in stocks versus a risk-free asset, the 10-year U.S. Treasury Bond in this case. As this is being written, the yield on a 10-year U.S. Treasury is 1.36%. If one subtracts out the recent 5% annual inflation rate, one sees an investor in this risk-free bond will lose money on a purchasing power basis. This negative real interest rate factors into the equity risk premium too.

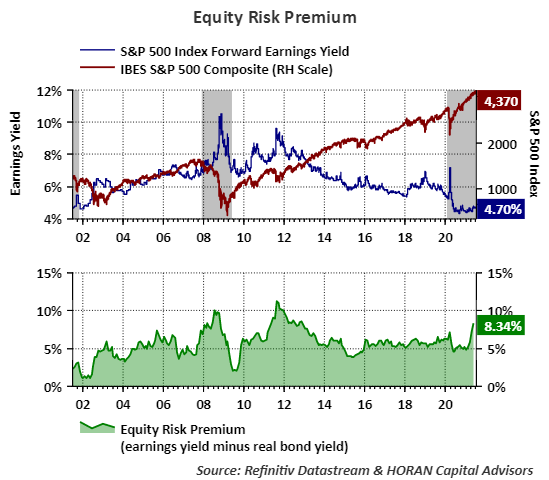

There are a number of ways one can calculate the ERP. For this article, I start by taking the earnings yield on the S&P 500 Index, which is simply the inverse of the Index's price-earnings ratio or P/E, and then subtract the real 10-year bond yield, i.e., the bond yield minus the inflation rate. This result provides an investor with the return or premium one expects to earn over a risk-free investment, the 10-year U.S. Treasury bond. The bottom half of the below chart shows the current ERP for the S&P 500 Index, i.e., 8.34%.

As the above chart shows, the earnings yield (blue line) is down substantially from the high during the 2008/2009 recession. The high forward earnings yield in 2008/2009 was due to the collapse of the market forward P/E multiple during the market's decline during the housing bubble recession. Conversely, the forward P/E for the market today is higher, which equates to a lower earnings yield (E/P), yet the ERP is increasing, largely due to a low-interest rate and a higher inflation rate environment. In one study by Aswath Damodaran at NYU's Stern School of Business, his paper shows that higher inflation does lead to a higher ERP. Because the inflation rate is subtracted from the bond's yield, a negative number is a result, i.e., a negative real yield. Then subtracting a negative number from the earnings yield is simply adding this to the earnings yield as follows:

- ERP = (E/P) minus (bond yield - inflation rate)

- ERP = 4.70% minus (1.36% - 5.0%)

- ERP = 4.70% minus (-3.64%)

- ERP = 8.34%

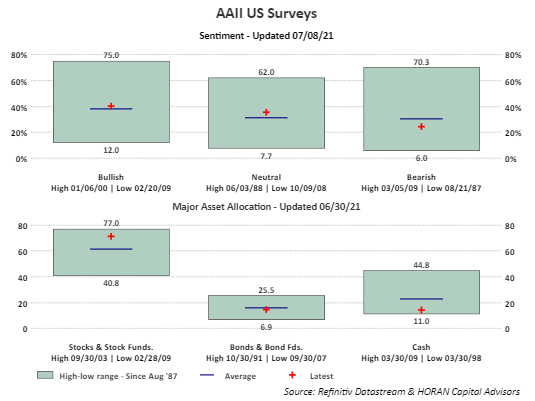

The negative real return on bonds currently facing investors is likely leading them to take on more risk in other areas of their portfolio. Of course one area that meets the higher risk requirement is allocating more funds to stocks. The red plus sign on the bottom half of the below chart shows individual investor responses to the American Association of Individual Investors asset allocation survey. Based on the responses investors have increased their weighting in stocks.

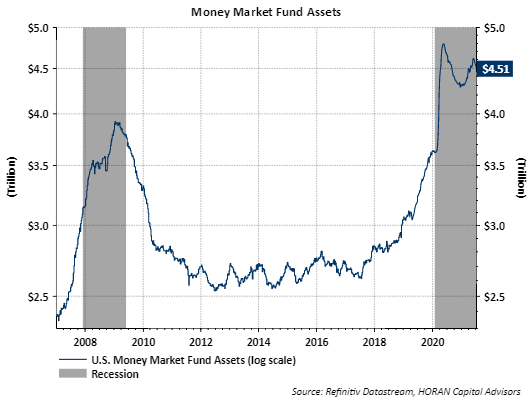

With the elevated level of the ERP though, this would suggest investors are receiving a reasonable level of premium over the expected return in bonds. The response to investor bond weightings is near the long-run average. It is a bit surprising to see survey respondents indicating they have a low weighting in cash when actual reported money market fund assets equal a high $4.51 trillion.

Image

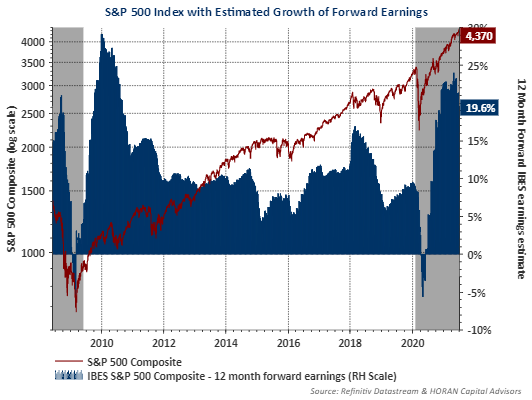

In conclusion, the low-interest-rate environment coupled with an elevated inflation rate is contributing to a higher equity risk premium. Also working in favor of a higher equity risk premium is the fact the forward valuation or forward price-earnings ratio for the market (S&P 500 Index) is trending lower as evidenced by the trend higher in the blue earnings yield line seen in the first chart at the beginning of the article. This is due to the strong earnings growth being achieved by companies broadly and specifically those that comprise the S&P 500 Index. Importantly, recent strong stock returns have been supported by strong earnings growth and this growth looks to continue into 2022 as analyst expectations for 12-month forward earnings growth remains near 20%, all else being equal.

Disclaimer: The information and content should not be construed as a recommendation to invest or trade in any type of security. Neither the information nor any opinion expressed constitutes a ...

more