Here We Go Again! Buy The DJII

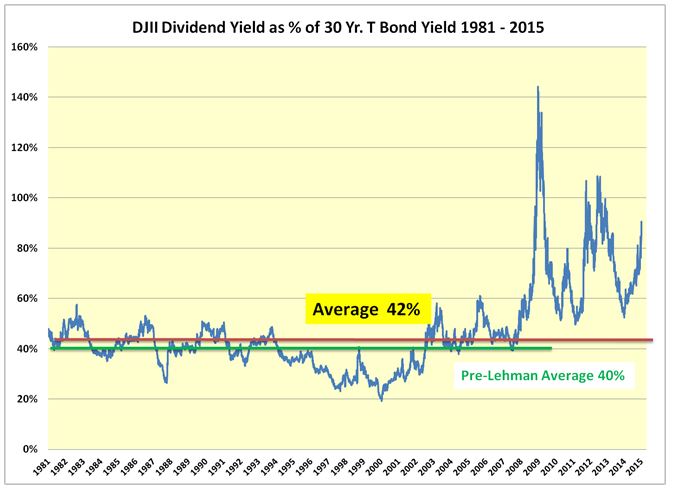

DJII falls, U.S. Treasuries rise, pushing Dividend-Discount value to record

Despite the consensus that U.S. Treasury rates have nowhere to go but up, they are falling and at today’s intraday low of 2.49% on the 30 Year T Bond it is fast approaching its lowest ever level of 2.44% of July 2012. At 1.91% the 10 year T Bond yield is also falling towards its record low.

These rates are low in absolute terms. However, relative to the yields of comparable bonds of other sovereign nations, U.S. bond yields are considered far too high.

In 2014 the yields of 10-year Italian and Spanish government bonds plunged well below those of comparable U.S. securities. Only a short time ago Italy and Spain were among the PIGS of Europe and considered financially pariahs. Their borrowing costs are now well below those of riskless U.S. government bonds.

Yields on comparable French government bonds are now less than half of those in the U.S., while yields on benchmark German bonds have fallen to near Japanese levels, more than 160 bps lower than U.S. 10-year notes.

Portugal has rates comparable to those of the United States. At the end of 2014, Portuguese 10-year bonds were yielding less than 2.50%, or just 40 bps higher than comparable U.S. securities. This does not make much sense given Portugal’s debt is rated by three major agencies as: Ba1/BB/BB+, i.e., junk, while the U.S: Aaa/AA+/AAA. Furthermore, Italy and Spain can borrow for less than the United States while France can borrow half the U.S. rate.

While market dislocations occur fairly often, things return eventually to normal, rational levels. As Euro zone economies are either already in recession or close to it and the latest Greek crisis can only aggravate matters, the ECB has already promised to start buying bonds early this year. This should further drive down rates on Euro sovereign bonds.

Despite the economic circumstances in the Euro zone being worse than in the United States, U.S. yields have a lot of adjusting to do. Furthermore, the relative strength of the U.S dollar along with higher sovereign rates could well accelerate the flow foreign funds into U.S. Treasuries putting additional downward pressure on U.S. yields.

Pre-Tax DJII Yield Stands at 91% of U.S. 30 Year T Bond Yield

On an after-tax basis the DJII yield is much higher than the U.S. 30 year T Bond and since the DJII dividends grow over time the DJII is extremely attractive to U.S. buyers as well as foreigners. This is particularly so when economic conditions improve and long rates start eventually to edge upwards.

DJII Dividend-Discount Value Hits Intraday 37,200 vs. Price of 17,262

The selloff of the past couple of days is totally unwarranted and the DJII should be bought, as its Price is only 46% of its Dividend-Discount Value.

One can only wonder how long it will take to eliminate the irrational pessimism that has dogged the DJII since the days of Lehman.

more

Tony, what instruments do you suggest for buying the Dow? How do you feel about DIA (the ETF)?

I have no argument with your choice.

Tony