Here Are The Best Performing Assets In April And YTD

April was another solid month for financial markets, with 31 of the 38 non-currency assets in Deutsche Bank's main sample gaining ground (alas, unlike Goldman, DB refuses to include cryptos to the main sample of assets it tracks).

As DB's Henry Allen writes, investor sentiment was supported by the continued economic recovery and blockbuster earnings, with numerous indicators showing incredibly strong growth, as well as reassurance from the Fed that they were in no hurry to withdraw monetary stimulus anytime soon. Against this backdrop, the major equity indices climbed to all-time highs, commodities saw a big rally, and even haven assets like gold and US Treasuries recovered after a poor Q1. DB does note that even though it does not show its performance in the summary charts (see below), the one asset that wasn’t so lucky was Bitcoin, with April seeing its run of six successive monthly gains finally come to an end.

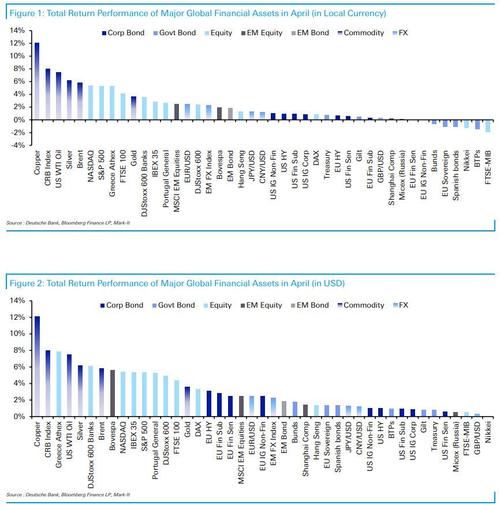

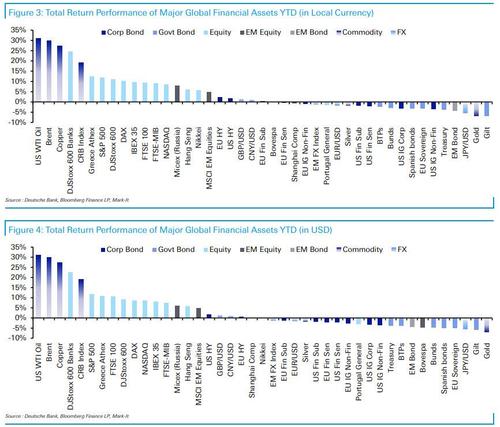

Bitcoin aside, the biggest story in April was a major rise in commodity prices across the board, with agricultural prices in particular seeing an astonishing surge. Starting with the bank's main sample, the key industrial bellwether of copper topped the leaderboard with a +12.1% increase, which took the metal to its highest level in a decade. The move has been aided by continued hopes for the global economic recovery as the vaccine rollout proceeds, as well as the fact that copper stands to benefit from a wave of fiscal support that’s set to see fresh spending on infrastructure and clean energy goals. Meanwhile oil prices maintained their existing YTD lead, with WTI (+7.5%) and Brent (+5.8%) both moving higher, to take their YTD gains to +31.0% and +29.8% respectively. As with copper, hopes for a strong recovery after the pandemic have supported gains, with oil set to be in demand as economies open up once again.

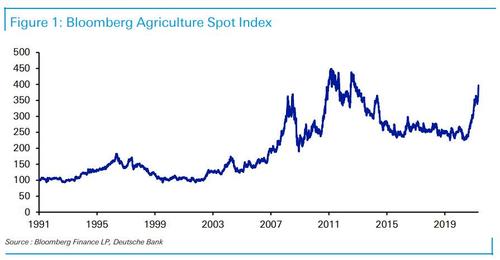

Staying on commodities, it’s worth noting those gains in agricultural prices, even though like Bitcoin, Deutsche does not include them in its main sample. Bloomberg’s agriculture spot index has risen +13.4% over the last month, which is its biggest monthly gain since July 2012, and leaves the index up +72.3% year-on-year. This is down to the combination of bad weather in a number of key regions along with a rise in Chinese imports that have had effects on both the demand and supply side.

Looking at the individual products, the big advances include sugar (+18.1%), wheat (+20.1%), and corn (+31.1%), which could have a big impact on many emerging markets as consumers there spend a larger proportion of their income on food. Indeed, for corn futures, April marked their biggest monthly increase since all the way back in June 1988. As DB wrote in a recent Chart of the Day, this is certainly one to watch, since sharp rises in food prices of this magnitude previously through history have been connected to periods of social unrest.

Elsewhere, equities had a great month on the whole in April, with the major global indices reaching new all-time highs. The US indices were among the strongest performers, with the S&P 500 (+5.3%) and the NASDAQ (+5.4%) seeing solid gains on a total returns basis, with the latter rising for a 6th consecutive month. Over in Europe, the STOXX 600 gained +2.4%, though Japan’s Nikkei (-1.3%) was one of the few to lose ground on the month as the country grappled with a fresh wave of Covid19 cases.

Turning to sovereign bonds, US Treasuries ended a run of four consecutive monthly declines as they rose +0.8% in April. That came as the Fed continued to reassure investors that they were in no rush to roll back monetary stimulus, and wanted to see actual rather than just forecasted progress. Yields on 10-yr US Treasuries ended the month -11.5bps lower, which is the biggest monthly decline since last July. Over in Europe however, sovereign bonds lost ground, with bunds (-0.7%), OATs (-1.0%) and BTPs (-1.5%) all declining. And although gilts were actually up +0.5% over the month, they’re now the worst performers in our sample on a YTD basis, with a -6.9% decline. This is because gold, which had been the worst performer in Q1 with a - 10.0% decline, managed to pare back some of this with a +3.6% gain over the month.

Finally in FX, the dollar (-2.1%) had a poor performance in April, following a relative strong Q1 (+3.7%). This helped other currencies on a relative basis, with the euro up +2.5% vs the US dollar, and the Japanese Yen up +1.3%. However, we also saw another big milestone in April, as bitcoin’s run of 6 successive monthly gains came to an end. Although the cryptocurrency peaked at an all-time intraday high on April 14 of $64,870, a subsequent pullback over the last couple of weeks left the cryptocurrency down -3.6% over the month as a whole.

Visually, here is the April return of all assets in both local and USD currency basis...

... and the return YTD.

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more