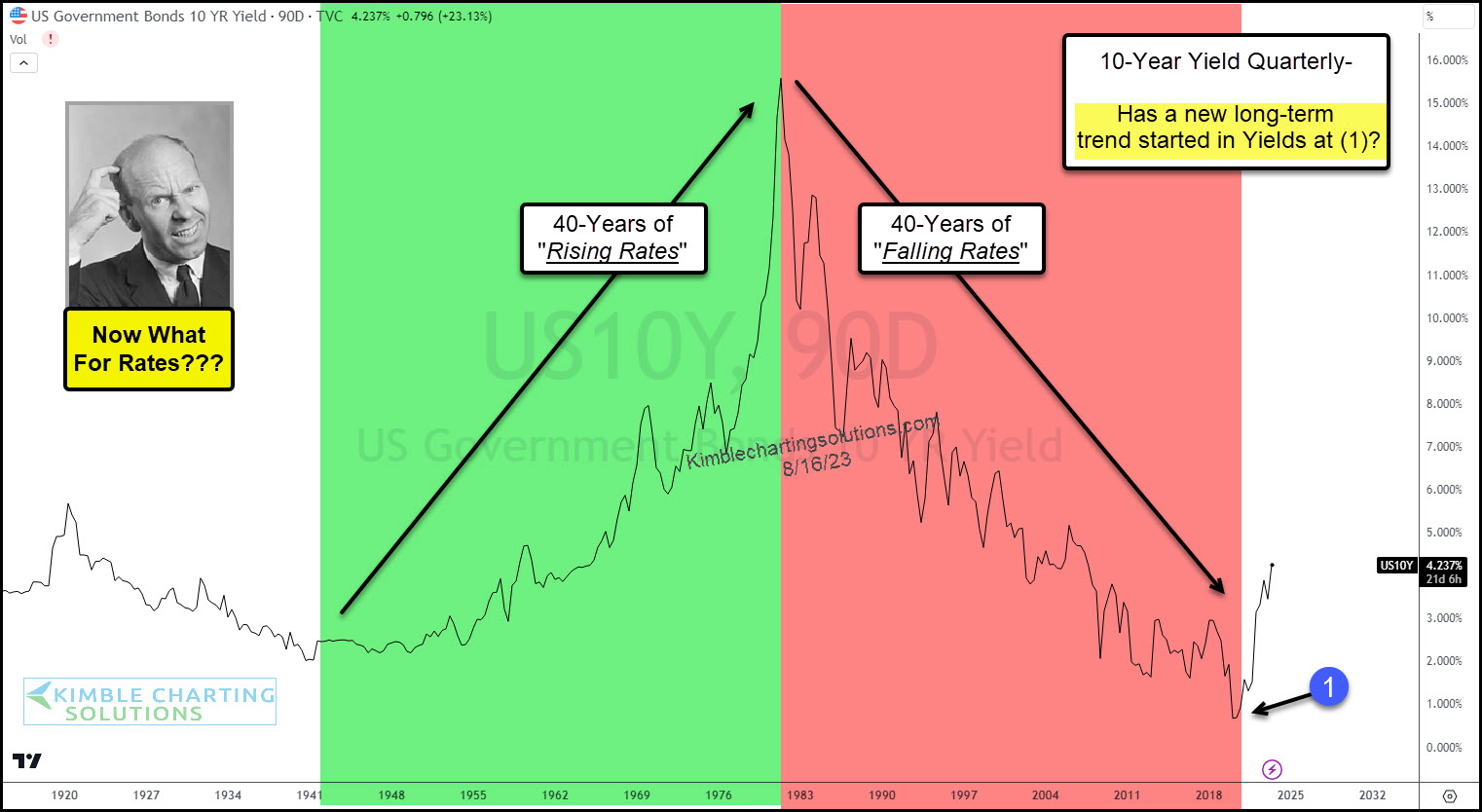

Have U.S. Bond Yields Began A New Long-Term Trend Higher?

Rising interest rates are beginning to spook investors. And rightfully so.

It’s been the fastest rise in rates in decades. And just when we thought interest rates were easing, they pushed higher once more!

40 years up and then 40 years down… now what for bond yields?

As most investors know, consumer rates are often tied to the 10-year US treasury bond yield.

And when we look at today’s long-term “quarterly” chart, it appears yields are attempting a breakout amidst a broader trend change.

So while interest rates could pull back at any point over the coming weeks/months, we may need to adjust in a new market trend of higher rates. And this has investors and consumers feeling a bit uneasy.

(Click on image to enlarge)

More By This Author:

Are Technology Stocks About To Send Risk-Off Signal?

Is The Doc Copper Price Decline About To Turn Ugly Again?

U.S. Dollar Testing Important Support; Gold Bulls Watching

Disclosure: Sign up for Chris's Kimble Charting Solutions' email alerts--click here.