Government Bond Bear Market About To Get Worse, Says Joe Friday

The bond market has had a bad 12-months, as interest rates bottomed in March of 2020. Popular Government Bond ETF (TLT) has lost more than 15% in the past year!

Are bonds about to receive more bad news? Sure could!!!

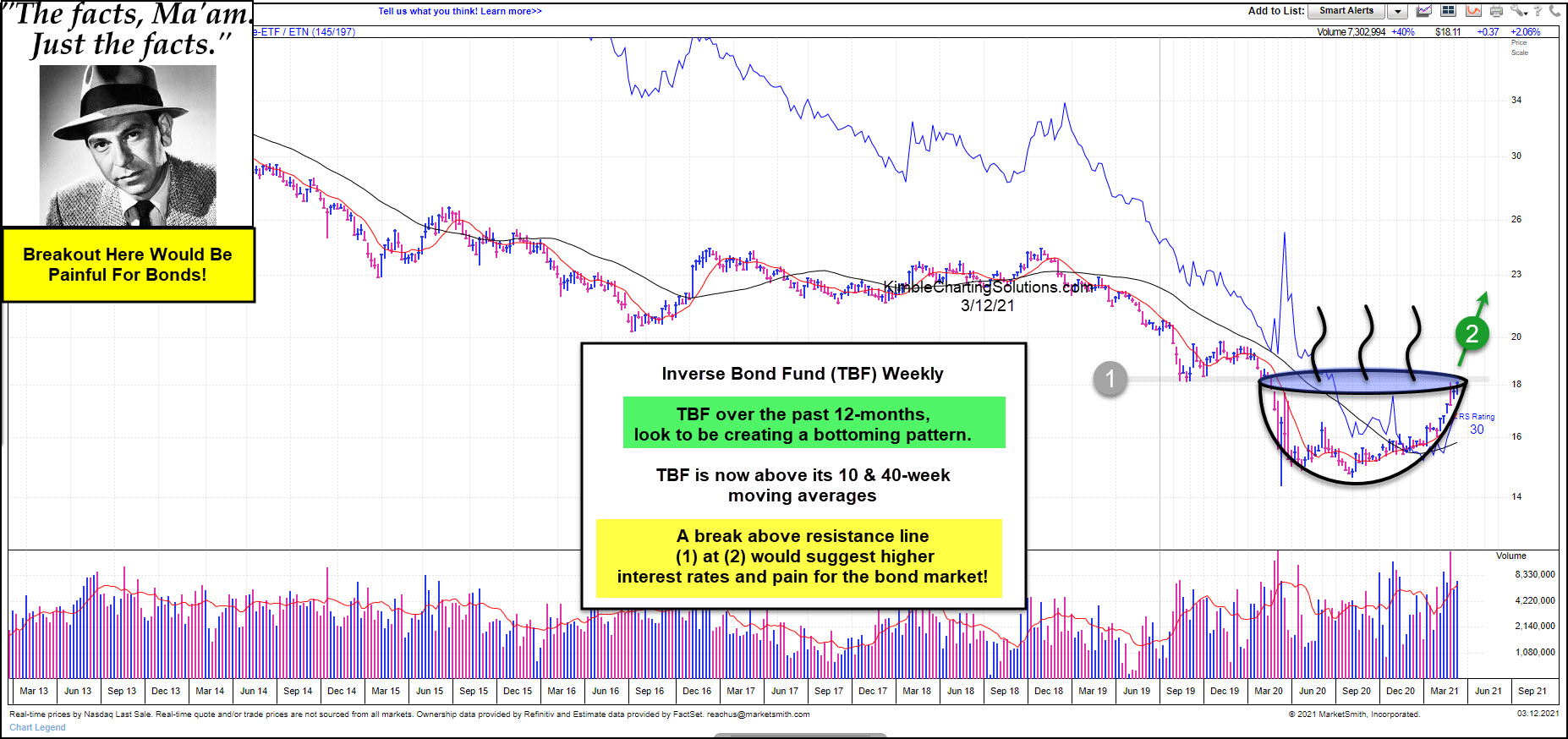

This chart from Marketsmith looks at the Inverse Government bond ETF (TBF) on a weekly basis. It has been a poor choice to own for years and years, as falling interest rates have pushed it lower.

Its long-term trend could be changing as it looks to be creating a bottoming pattern over the past 14-months and the recent rally in TBF now has it above its 10 & 40-week moving averages.

It is now testing its 2019 lows at the top of this cup pattern at the line (1), as relative strength continues to move higher off deeply oversold levels.

Joe Friday Just The Facts Ma’am; If TBF breaks out at (2), look for the bear market in bonds to accelerate.

(Click on image to enlarge)

Disclosure: Sign up for Chris's Kimble Charting Solutions' email alerts--click here.