Gold: Ready To Rumble!

Fundamentals

Most of the fundamentals have changed, even before the Fed's announcement about raising interest rates. Just the possibility of interest rates going up causes extreme volatility. It is a sign of the leverage that is in the market; which is at record levels. It's a precarious situation for the monetary system globally. It has never been in this situation. We have never had such debt levels. If interest rates rise, it would increase the payments on such debt astronomically. Even just talking about possibly raising interest rates led to extreme volatility. The market cannot handle an increase in interest rates. Contrary to the short squeeze talk, the fundamentals, and a bullish picture, gold has gone down into the $1700s since August of last year. The markets will do what they want to do, when they want to do it, regardless of the sentiment. The sentiment right now is being moved to extremes faster than before because of the internet. Information travels faster. The key is how you use that information. Markets are almost always contrarian. In the face of a global pandemic that shut down most of the global economy, the stock market is at record highs. Fundamentals do not work. They lag the market. Therefore, we focus on technical analysis and let the market tell us what it is likely to do.

Courtesy: ema2trade.com

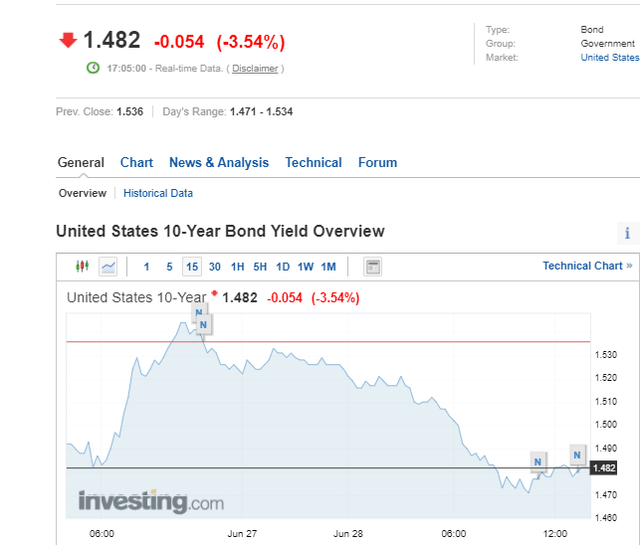

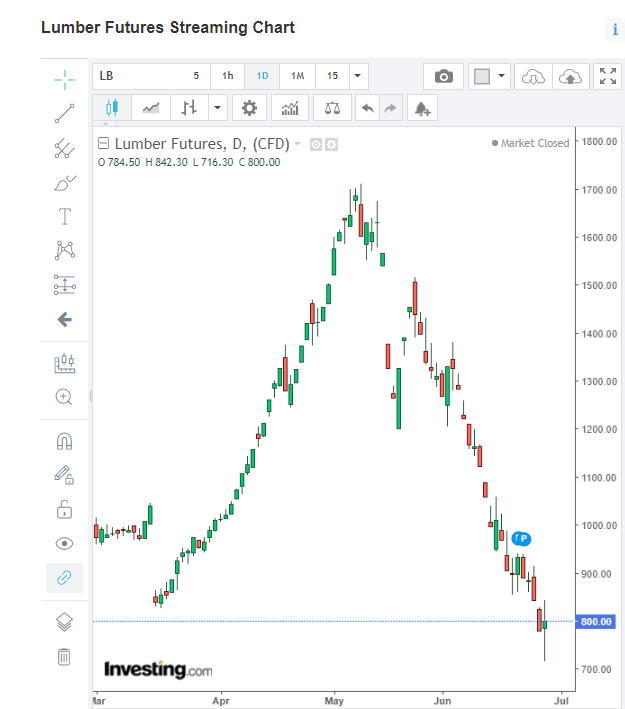

The sentiment now is focused on inflation. Although we are seeing the reaction of people coming back into the economy, we are seeing supply chain bottlenecks and disruption. Prices are rising. More money is chasing fewer goods, so prices rise; such as in real estate. The 10-year note, which is an indicator that we closely watch in relation to inflation, tells us that the bond market is not panicking on inflation fears. In fact, yields are coming down. The 10 year is at about 1.482.

The market knows what is happening. It is not inflationary. Rates may revert back down again. Another economic indicator is lumber, which has collapsed to around 763, although it came back to about 790. This may have been a bottom in lumber but in any case, it is not inflationary.

Gold

Courtesy: TDAmeritrade

Gold is at $1781; up about $3. We activated a Variable Changing Price Momentum Indicator (VC MI) buy trigger from $1773 early this morning and we just completed the target of $1782.

We use the VC PMI to identify extreme levels above and below the mean, which are the entry points for high probability trades since the market is likely to revert back to the mean from those levels. We avoid trading near the mean since the market near a mean price is as likely to go up as go down.

We often look for harmonic convergences when the daily, weekly and/or monthly numbers coincide. For the weekly level at $1781 and the daily at $1782, we can see that these levels are very strong harmonically. If gold closes above $1782 using the 15-minute bar, it will set up a bullish trend momentum. Right now we are neutral, but the VC PMI identifies the level to pay attention to and, if the market closes above it, the targets above of $1791 and $1800 are activated. The next levels are $1797 to $1800. The weekly average is $1781, so the market trading above that level has activated the Sell 1 target of $1797. The VC PMI Sell 2 weekly target is $1812, which has also been activated. The market activated a day trading VC PMI Buy trigger with a target of $1790/$1791.

If gold closes above $1782, it will activate a bullish price momentum with the target of $1797 activated again.

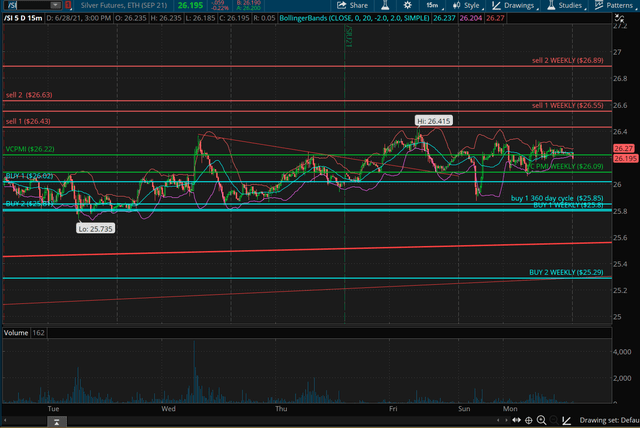

Silver

Silver is showing a lot more strength than the gold market. Silver has activated a bullish price momentum with a target of $26.43. As a day trade, the signal is neutral to bullish and suggests waiting for the market to reach $26.43 or even $26.63, which integrates the weekly numbers. At those levels, it is likely that sellers will come into the market and is likely to revert back to the mean.

Courtesy: TDAmeritrade

We do not recommend trading around the mean, since you are going to be stopped out a lot. It will be very choppy. Wait for the market to reach an extreme above or below the mean.

Disclosure: I am/we are long GDX.

To learn more about how the VC PMI works and receive weekly reports on the E-mini, gold, and silver, check us out on more