Gold Price Forecast: XAU/USD Sinks On Hawkish Bullard Comments

Hawkish Bullard Opens The Door To A 75 Basis Point Hike

St. Louis Fed President, Jim Bullard (one of the most hawkish members of the FOMC) put a number of markets on edge yesterday when he failed to rule out a 75 basis point hike. The status quo had thus far been a 50 basis point hike but Bullard’s reminiscent comments regarding the economic environment of the early 1990s see him potentially looking for a 75 basis point hike in May.

In addition, Bullard mentioned his preference for interest rates to rise to 3.5% by year-end, while the markets have thus far prices in around 2.5% to 2.75%. Bullard has thus far been successful in convincing his fellow FOMC members to raise their rate hike preferences in the wake of persistent inflation. He began calls for a 50 basis point hike in the March meeting, which the minutes revealed, would likely have gone ahead if not for the conflict in Ukraine.

Gold dropped sharply lower yesterday and has continued lower this morning as US treasury yields also rose in response to higher rate expectations.

Gold Key Technical Levels

On Monday, spot gold rose to a level that I have been tracking for a while, the 0.786 Fib of the August 2020 decline at 1990. A strong rejection, saw gold close much lower on the daily chart which set the tone for further selling. Such a rejection of higher prices was rather telling for subsequent price action.

1965 was irrelevant in halting declines but now surfaces as the nearest resistance level. 1940 is an area that had restricted upward momentum in the latter half of March and becomes the next level of support followed by the significant 1915 level – the level that has supported spot gold for multiple weeks

Gold Daily Chart

(Click on image to enlarge)

Source: TradingView, prepared by Richard Snow

Treasuries Respond To Hawkish Bullard Comments

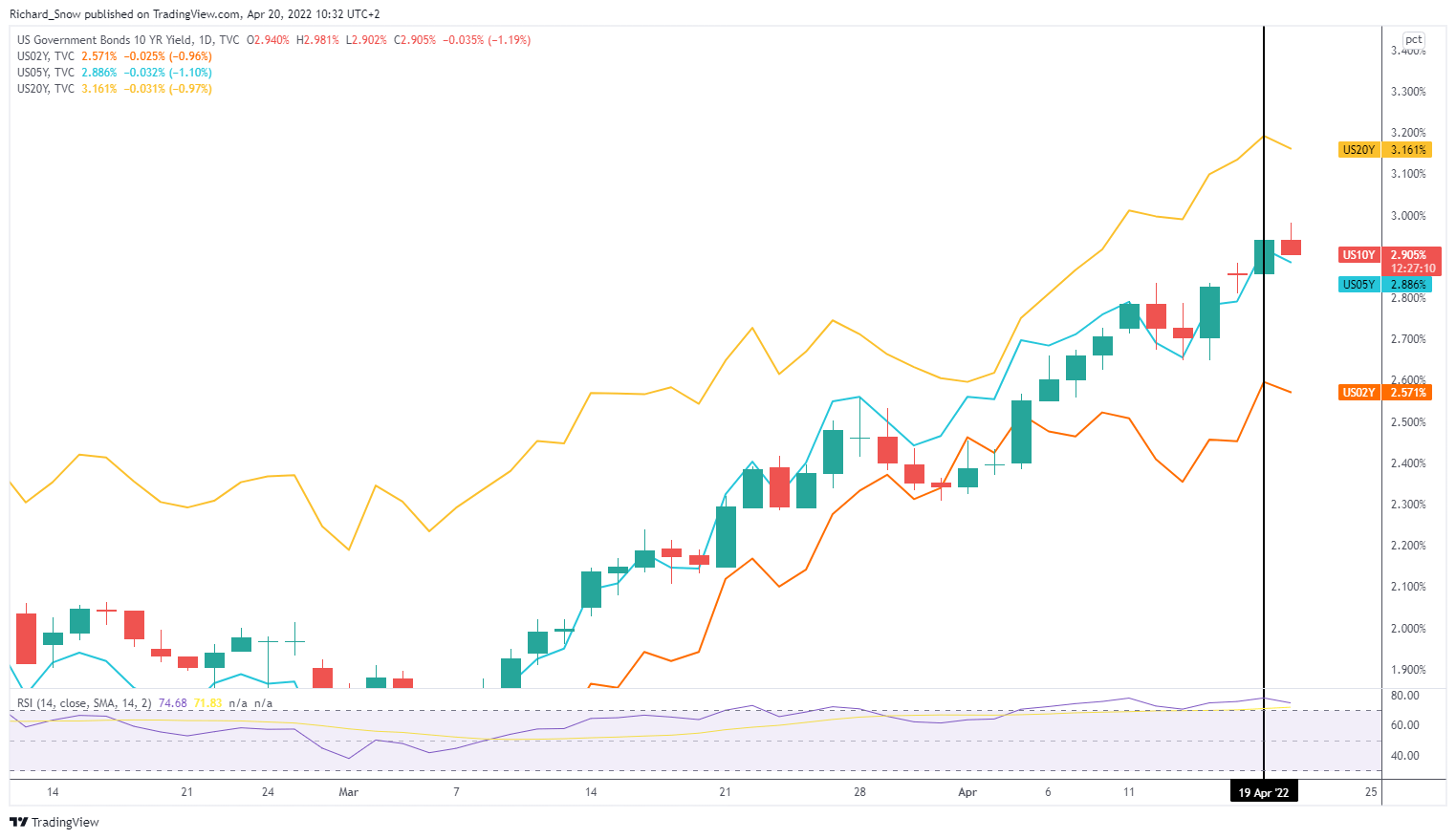

Treasury yields rose across the board on the back of Bullard’s remarks but have turned lower this morning. Rising treasury yields, and more specifically, rising real yields (nominal yields – inflation) tend to move in the opposite direction to gold prices. The relationship exists mainly because the opportunity cost of holding gold rises as alternative investment opportunities like treasuries and other fixed-income vehicles become more attractive as the global rate hiking cycle matures.

US Treasury Yields (2, 5, 10, and 20 years)

(Click on image to enlarge)

Source: TradingView, prepared by Richard Snow

Disclosure: See the full disclosure for DailyFX here.

I dont understand how a rate increase can be bearish for gold and bullish for the market.