Gold: Preparing For Another Global Lockdown

Fundamentals

Gold is trading at $1788.10, down about $2.90. We’ve seen a bit of choppiness this morning as we got some new economic numbers related to unemployment claims, which were higher than expected. They were at about 335,000 new claims. On Labor Day, 7.5 million Americans will lose their unemployment aid. This is happening in the face of another surging pandemic, which is spreading in Europe to the point where they are considering closing their borders to the US.

Courtesy: CBS News

We're heading toward what could be greater volatility in the markets as we move into the later part of this year. The stimulus and infrastructure package being negotiated in the US today is just another additional amount of stimulus which is beginning to more rapidly erode the value of the US dollar. We're heading toward what could be greater volatility in the markets as we move into the later part of this year. If we go into another lockdown in Europe, it's going to cause the supply chain for many goods significant problems. There’s a possibility that the global economy could be locked down again.

China closed their ports for a few weeks. They're reopening them, but it caused additional problems in global supply chains.

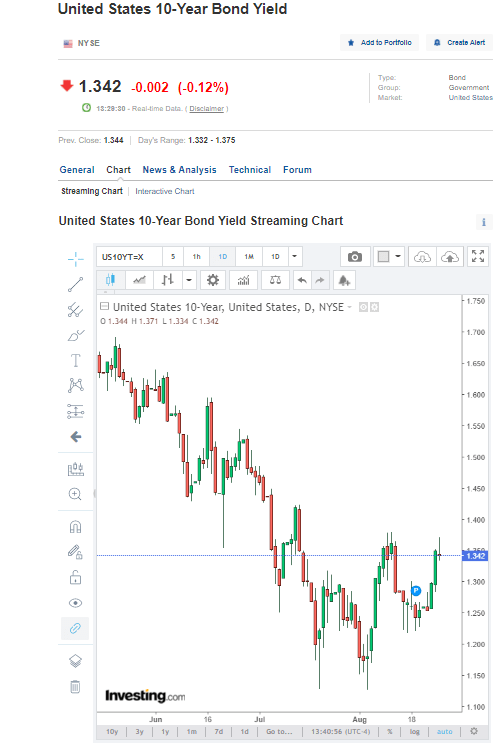

The Fed may not lean toward raising interest rates during such times. They may not even talk about raising them in this environment. If anything, interest rates may be pushed lower. It does not look like raising interest rates is in the cards for the foreseeable future.

Gold is undervalued compared to inflation rates right now, which are at about 5.5%. The 10 year Note is at 1.34. The spread is going to increase as the inflation factor becomes more dominant and permanent.

We're going to see a lot of money go into precious metals, especially money that is afraid of going into cryptocurrencies because they're new and far less regulated. Precious metals appear to be set to become part of the new monetary system. The new system needs to include gold unless everything is fiat currency and we plan to live in a fantasy world of fiat currencies and fiat values. Such a fantasyland is where we appear to be headed. More and more stimulus, even as purchasing power declines and our lifestyles are eroded more and more. Real estate, stocks, and various hard assets are rising in price not so much because they are worth more, but because the US dollar, in which they are priced, is losing value.

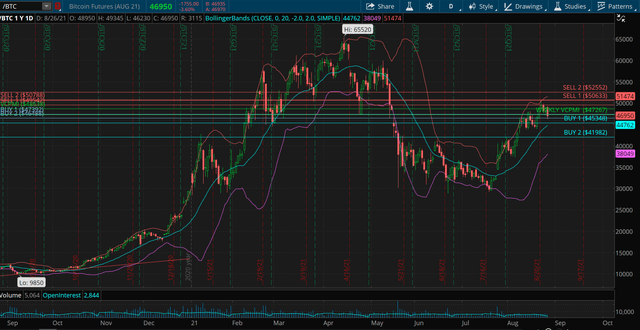

Bitcoin

Courtesy: TD Ameritrade

We trade Bitcoin, which is the leading instrument for digital currencies. It appears to be set to play a major part in the global monetary reset.

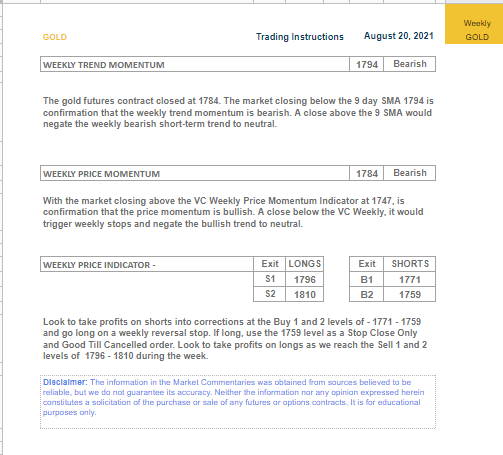

Gold

Courtesy: ema2trade.com

On Aug. 20, 2021, in our weekly gold report, based on our Variable Changing Price Momentum Indicator (VC PMI), we said that the weekly trend momentum of $1794 was bearish, as was the Variable Changing Price Momentum. However, the VC PMI weekly price indicator was bullish with a target of $1796. The market rose above $1796, meeting that target and reaching $1812.

We’ve been trading back down into this $1784 level, which has activated a bullish price momentum. The low was $1782.90 and the Buy 1 level coming into today was $1783. Now we have activated $1796 again and $1810 for this week as targets.

Disclosure: I/we have a beneficial long position in the shares of GDX either through stock ownership, options, or other derivatives.

To learn more about how the VC PMI works and receive ...

more

The price of gold (actual gold metal) varies in proportion to the LACK OF CONFIDENCE in the rest of the economy. And based on our federal reserve bankers, I would choose to have a lot of actual gold on hand these days. But I don't.

It appears that once again those chaps do not concern themselves with any folks except the financial sector stock traders and major shareholders.

It seems that the effect of inflation on the other 90% of the population does not matter much, if at all. At least not in their world. Perhaps this is the time for "an adjustment" in the membership of the Fed, or maybe even "a correction" of some sort. The reduction of the accelleration of inflation is not at all the same as halting the damage, or even backing off. How often do inflted food and housing prices deflate? I don't recall it happening at all, maybe I missed it?

The problem is that the wages of many never catch up to the rise in prices. And so many folks lack the means to conveniently boost their incomes to natch the inflation of prices.

Perhaps the effective income of all the fed actors shold be reduced in proportion to the value drop in our dollars from inflation. An interesting radical thought.