Gold Miners: It's Time To Buy

While the war worshippers of the world take turns waving “I love Poohtin!” and “I love Jackboot Joe!” pom poms (and wave them far from the front lines of the war), I’ll simply ask the sane gold bugs of the world:

The citizens of India, aka the “A Team”, are back on the buy!

(Click on image to enlarge)

Commercial bank traders tend to aggressively cover short positions and go long on the COMEX as Indians begin to buy… and a base pattern usually appears on the short-term charts when they do that.

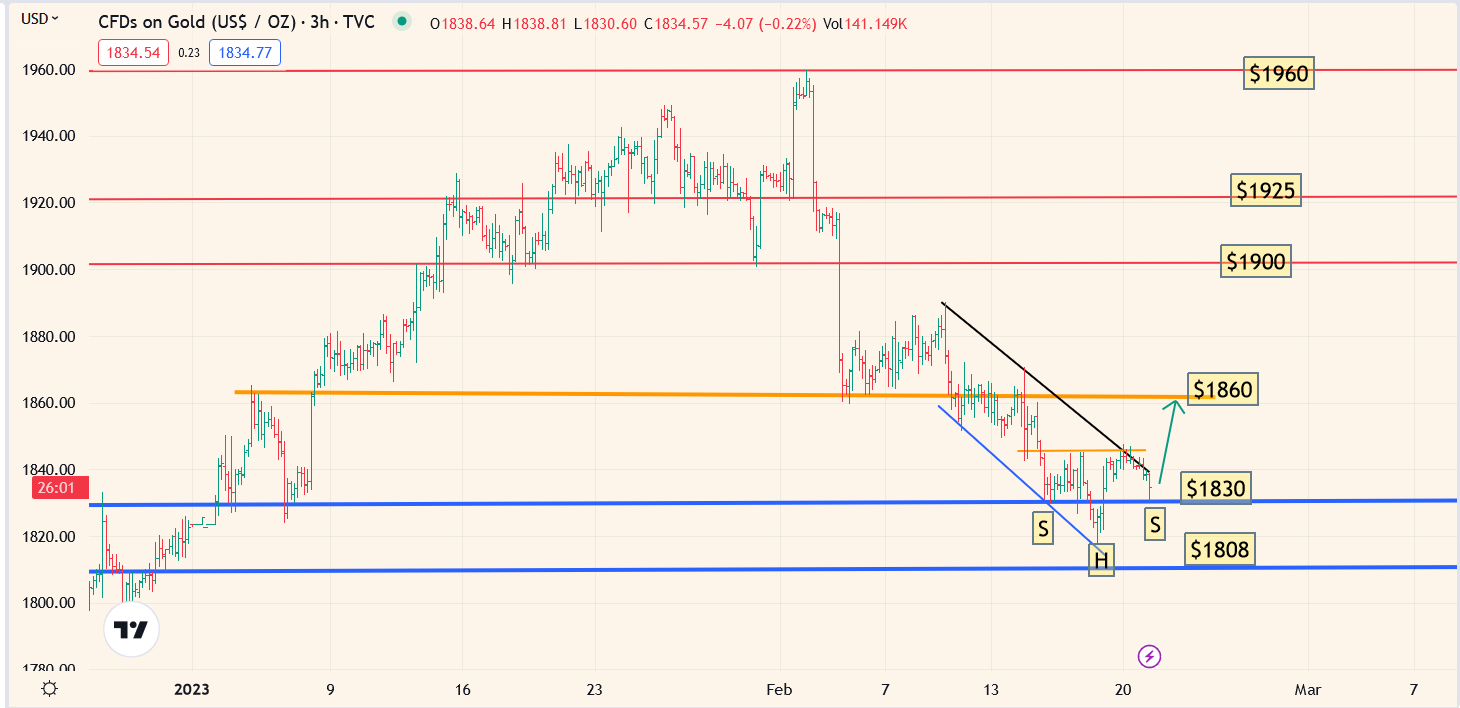

That’s the case now. An inverse H&S pattern is in play. It could “fail” and morph into a bigger pattern, but here’s the bottom line:

Traders can cover short positions and investors should be joining the Indian citizens with modest buy programs.

The banks are key players in the movement of gold into India, so it makes sense that they are COMEX contract buyers as their dealing volume rises.

(Click on image to enlarge)

long-term gold chart.

The RSI oscillator has moved closer to the 50 zone but Stochastics is still very high.

That’s why I suggest buying with a modest size rather than “backing up the trucks” to buy while trying to call some kind of “final low”.

Investors should be fully prepared to buy again at $1808 and $1780, with a focus on both bullion and the miners.

Clearly, the government of China is ramping up the use of alternative energy… energy that doesn’t need to be imported through a Western government gauntlet of “my way or the highway” sanctions.

It’s obvious that America’s favorite war-mongering draft dodger is President “Jackboot Joe”, and it’s equally obvious (from his actions toward the citizens of Russia) that he won’t hesitate to try to cut off the flow of oil to China’s citizens if he goes to war over Taiwan (while in his own backyard, he leaves the citizens of Cuba to rot under decades of sanctions).

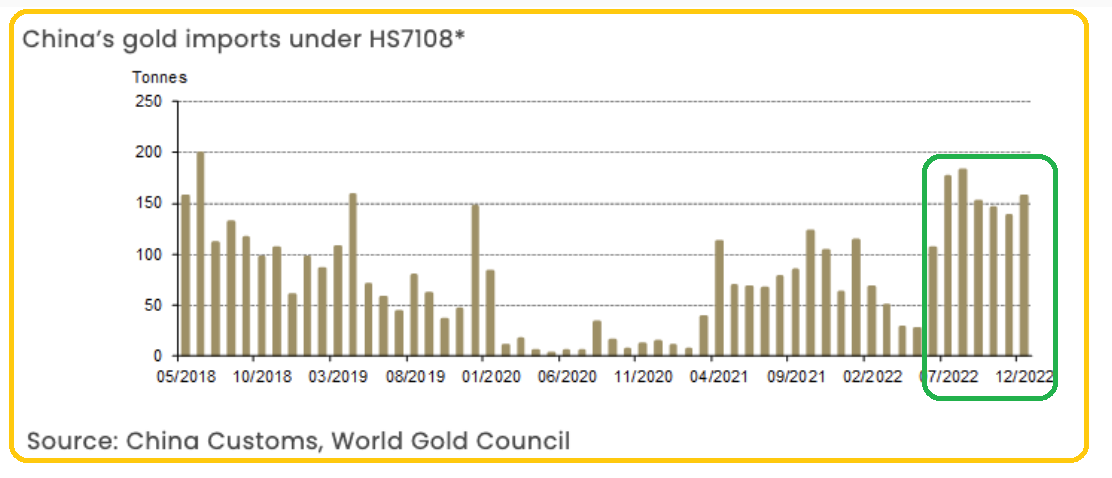

For the past six months, China’s gold imports have been coming in consistently at roughly 150 tons a month. Is this the new normal?

I’ll suggest that it is, and for additional insight into the matter:

(Click on image to enlarge)

American investors are taught (brainwashed?) to celebrate good economic and stock market times by selling their gold.

The opposite mindset exists in China and the country has two “Golden Week” holidays every year. I’ve predicted that by 2040 the Western “Gold pays no interest so sell it if rates rise!” mantra will go the way of the dodo bird. I’ve also predicted that China’s energy consumption will be almost all green by 2040 too.

For now, this huge base pattern on the Chinese stock market suggests the good times that began in November… and are set to accelerate.

(Click on image to enlarge)

fabulous FXI and gold chart.

The synergy is stunning. A range trade over the next few months is the most likely scenario for both markets, followed by a “barnburner” rally in the summer.

What about oil?

(Click on image to enlarge)

Investors should keep the buy and sell zones simple, and I do that here. Oil is in a key buy zone now.

Like gold, oil is likely to range trade for the next few months and it could reach my next buy zone at $65… before beginning the next stage of what is likely an Elliott “C wave” towards the $130 area highs.

The overvalued US stock market is doing “better than expected” mainly because the money managers have a crowd mentality that if they all buy together, the market won’t fall, and for now that mantra is working.

(Click on image to enlarge)

interest rate chart.

The money managers are fighting the Fed, and they’ve won a few rounds in the fight.

I’ll suggest that the Ides of March is a time that will bring concern that the anticipated rate cuts aren’t going to happen, and the crowd of buyers will get thinner.

What about the miners? I get some despondent emails from investors who sold bullion (or never bought it at all) and invested heavily in the miners after big rallies. They did it with a buy-and-hold approach to the market.

My mantra is that the miners are great investments, but only if the core position size is limited and most buying is done at support zones for gold. The good news: Gold has just arrived at one of those zones ($1830-$1780).

(Click on image to enlarge)

It’s unknown if GDX forms a huge double bottom pattern or begins a major move higher now. What is known is that the $27-$26 support zone is in perfect sync with gold at $1830 and $1808. It’s time to buy, with the expectation of locking in gains of 20% in 1-2 months (annualized 100%-200% gains). With Chinese demand solid, India on the buy, and key moving averages providing a floor of support at $1808-$1780, the time is now, to press the mining stock buy buttons with gusto!

More By This Author:

A Golden ValentineA Triple Whammy For Gold: What Now?

Gold Prices For Action $1880 And $1808